The Commodities Feed: US oil stocks swell

Your daily roundup of commodity news and ING views

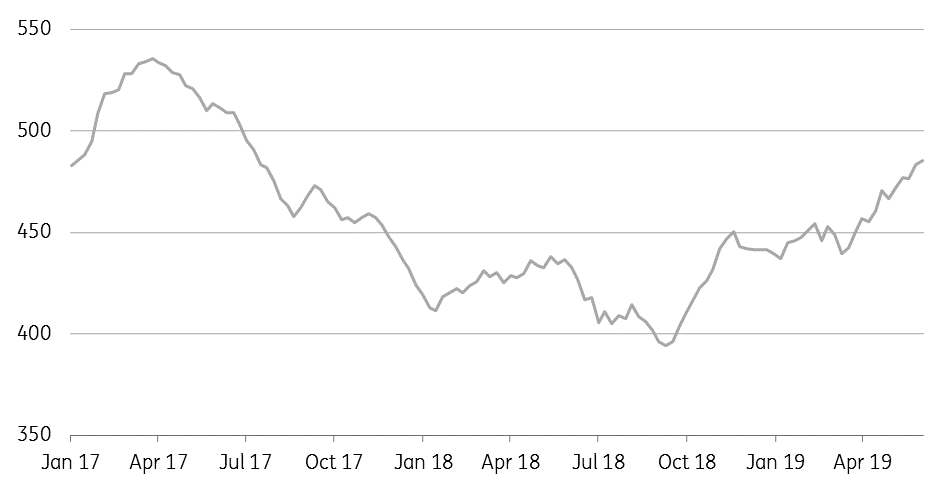

US crude oil inventories (MMbbls)

Energy

US oil numbers: The EIA yesterday reported a surprise crude oil build of 2.21MMbbls over the last week, which was quite different to the 1MMbbls drawdown the market was expecting, but still less than the 4.85MMbbls that the API reported the previous day. This has taken total US crude oil inventories to above 485MMbbls, which is the highest level since July 2017. Cushing inventories increased by 2.1Mmbbls over the week- taking stocks in the WTI delivery hub to almost 53MMbbls- levels last seen in December 2017. These large stock builds are weighing on prompt WTI spreads, with the Jul/Aug spread deep in carry- trading at a US$0.26/bbl discount this morning. This spread was trading around flat in early May.

The report was clearly bearish for the flat price, however the market is stronger this morning after reports of an incident involving tankers in the Gulf of Oman.

Looking ahead, we do still expect these crude builds to reverse, with the expectation that refinery run rates will pick up as we move through the summer. Over the last week, refinery utilisation rates increased by 1.4 percentage points to 93.2%- still some distance from the 97.2% achieved in late December.

US crude oil exports over the week averaged 3.12MMbbls/d, which is also the third consecutive week that oil exports have exceeded 3MMbbls/d. The general weakness that we have seen in the WTI/Brent spread is certainly helping to support these larger export volumes.

Market releases: The rest of this week will see a number of important market releases, starting with the OPEC monthly report today. The market will be watching closely to see how Saudi production performed over the month of May. The range of other estimates is roughly between 9.65MMbbls/d and a little over 10MMbbls/d for the month, which compares to 9.8MMbbls/d in April, but still well below the agreed production level of around 10.3MMbbls/d.

Then on Friday, the IEA will release its monthly oil market report, and the market will be looking closely to see if the agency makes any changes to its demand growth forecasts. In its last report, the agency revised lower its demand growth forecasts by 90Mbbls/d to 1.3MMbbls/d for 2019. This revision was concentrated in 1Q19, with little change to the agency’s outlook for the remainder of the year.

Metals

Zinc treatment charges: Spot treatment charges for zinc concentrate in China inched up further to US$275/t this week compared to US$265/t last week. Zinc smelting fees have increased nearly 67% since the start of the year, indicating an improvement in zinc concentrate supply. However oddly, these higher TCs have not translated into higher refined output, with Chinese refined zinc output down 7% year-on-year to 1.77mt over the first four months of 2019. But this is largely due to capacity cuts related to environmental restrictions and plant upgrades. With treatment charges rising, smelters will be keen to increase throughput rates as soon as possible, which should mean further refined supply over the second half of the year.

Chile copper strike: Workers at Codelco’s Chuquicamata mine are set to strike from Friday, after unions and Codelco failed to come to an agreement. The Chuquicamata mine produced 321kt of copper last year. This has the potential to tighten up the concentrate market further, depending on how long strike action lasts. Spot Chinese treatment charges have fallen for much of this year, suggesting that the concentrate market is already tightening.

Agriculture

Cocoa floor price: Top cocoa producers Ivory Coast and Ghana have agreed to set a floor price of US$2,600/t for the 2020/21 crop in an effort to bring additional and stable revenues for cocoa farmers in the respective countries. Floor prices are nearly 1% above current prices and nearly 12% above the YTD average price of US$2,313/t. Setting floor prices should be supportive to the cocoa market in short term; however, higher prices risks bringing further supply onto the market in the longer term.

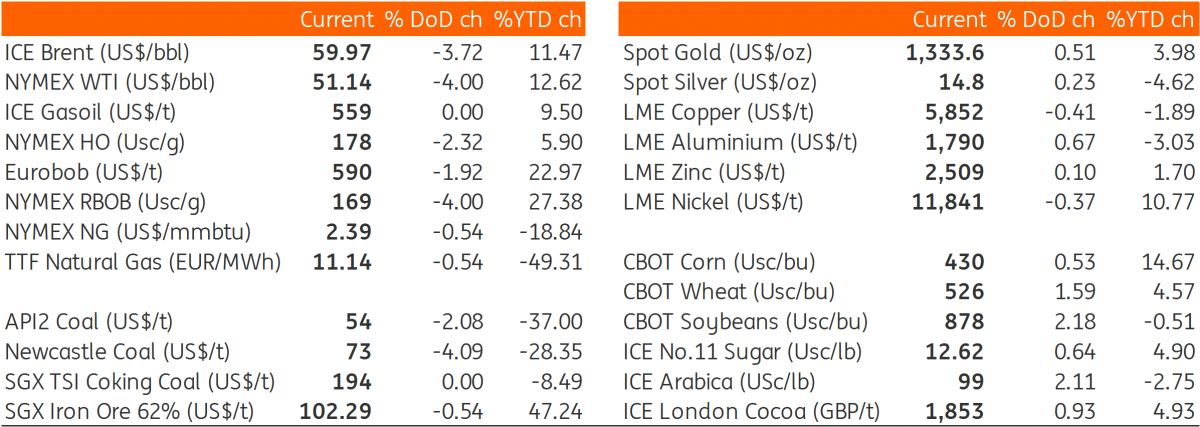

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap