Briefing Romania

Another busy day on the primary market

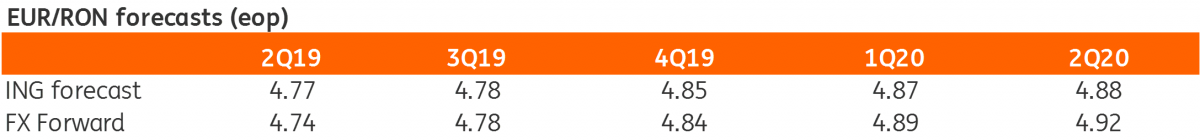

EUR/RON

The EUR/RON continued its mild upward trend yesterday, closing around 4.7250 on above average turnover. The trend fits our view, though we’d expect an even more gradual return to the 4.7500-4.7700 area.

Government bonds

The higher-than-expected CPI apparently failed to impress the market, as Romanian government bonds traded almost flat compared to the previous day. Today’s primary market activity should be more relevant though for assessing market reaction. The Ministry of Finance plans to sell RON300 million in Sep-2031 and RON300 million in Jun-2021 bonds.

The 2031 was allocated last month at 5.17%/5.25% average and maximum yields, quite a long tail, signalling a willingness from MinFin to issue at this part of the curve. Meanwhile, ROMGB’s rallied somewhat and we would expect the average yield for today’s auction to be just above 5.00%.

As for Jun-2021, we expect good demand from local ALM’s and maybe from some investors looking to rollover the upcoming redemption due on 24 June. An average yield around 3.60% should satisfy all parties involved.

Money market

Not much is going on in the money market these days. Carry stays around 2.50% while the longer end is very slowly inching lower in line with our expectations for a mild yield curve compression.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap