The Commodities Feed: US crude oil imports decline

Your daily roundup of commodity news and ING views

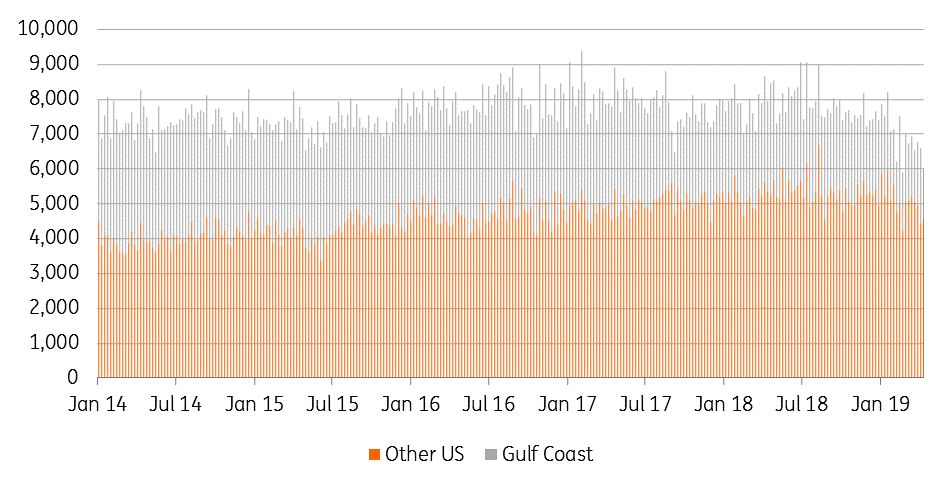

US crude oil imports fall- driven by Gulf Coast (Mbbls/d)

Energy

US crude oil inventories: The EIA reported yesterday that US crude oil inventories declined by 1.4MMbbls over the last week, which is the first weekly decline since mid-March. The drawdown was less than the 3.1MMbbls reported by the API the previous day, but still went against market expectations for a build of around 2.3MMbbls. The key driver behind the draw was the fall in weekly crude oil imports, which fell by 607Mbbls/d week-on-week to average 5.99MMbbls/d. This decline was driven by the Gulf Coast, and likely reflects the disruptions in shipping we have seen in Houston in recent weeks. Meanwhile on crude oil exports, there was little in the way of WoW changes, but moving forward, given the narrowing in the WTI/Brent spread, we could see US exports coming under pressure.

Meanwhile, another weekly gasoline drawdown has proved supportive for the RBOB gasoline crack. US gasoline inventories declined by 1.17MMbbls over the week, with the drawdown coming predominantly from PADD 1B, which includes NY Harbor. US gasoline inventories now stand at 228MMbbls, which is below the five-year average for this time of the year.

Metals

Data weighs on gold: Gold continues to come under pressure with the more constructive macro picture, following positive data out of China yesterday. Total known ETF gold holdings have fallen 486koz since the start of April, and more than 1.5mOz since late January to total 71.8mOz. The outlook for gold will largely be dictated by how trade talks evolve. The Wall Street Journal reports that the US and China are looking towards reaching a deal as soon as the end of May.

China nickel pig iron: Latest data from Grand Flow Resources shows that Chinese nickel pig iron output totalled 47,614 tonnes in March, up 11.7% month-on-month and 25% higher year-on-year. In fact, it is the strongest monthly production number going as far back as January 2017. Stronger margins have supported the growth in output. This stronger Chinese NPI output, along with expectations of growing production from Indonesia, should weigh somewhat on refined nickel prices.

Agriculture

Argentina crop estimates: The Buenos Aires Grain Exchange has left its estimates unchanged for the 2018/19 domestic soybean and corn crop, at 55mt and 46mt respectively. Harvesting is well underway, with over 34% of the soybean harvest complete, while a little more than 23% of the corn crop is harvested. Meanwhile, the Agricultural ministry has a more optimistic outlook for both crops, estimating in their April report that soybean output will total 55.9mt, whilst corn production will total 55mt this season.

Daily price update

Download

Download snap