The Commodities Feed: US crude oil draw expected

Your daily roundup of commodity news and ING views

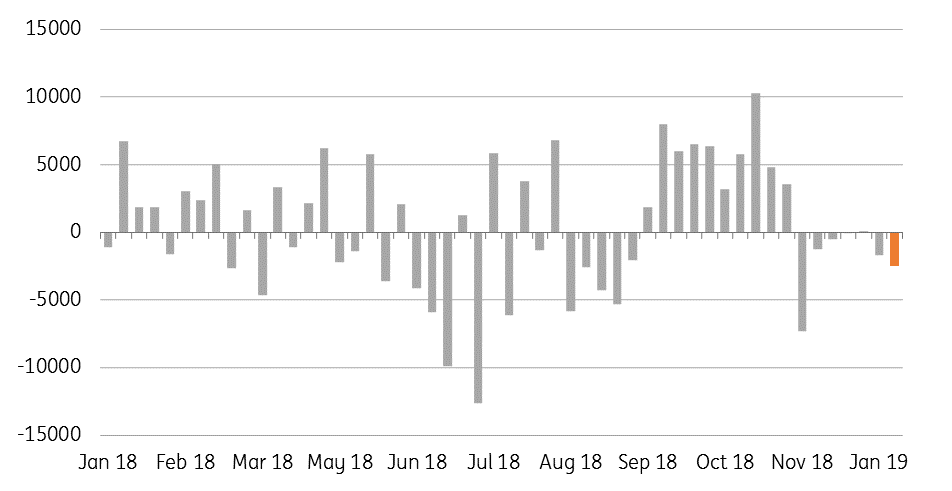

US crude oil inventories expected to have declined (Mbbls)

Energy

US crude oil inventories: The API is scheduled to release its weekly inventory report later today, and market expectations are that US crude oil inventories declined by 2.5MMbbls over the last week, according to a Bloomberg survey. Meanwhile, the market expects another week of product builds, with market estimates suggesting a 3MMbbls increase in gasoline inventories, and a 1.5MMbbls build in distillate fuel oil stocks. The more widely followed EIA weekly report will be released tomorrow. Finally, the EIA will also be releasing its latest Short Term Energy Outlook today, and the market will be watching closely if their output estimate of 12.1MMbbls/d for 2019 is revised lower, given the pressure on oil prices.

OPEC+ meeting: OPEC+ members have finally decided meeting dates in order to discuss the current output cut deal. The Joint Ministerial Monitoring Committee will meet in Baku on the 17-18 March, where the progress of the current deal will certainly be discussed. This will be followed by the official ministers meeting in Vienna on the 17-18 April. It is at this meeting where members will discuss whether there is a need to extend the current production cut deal beyond the initial 6 months agreed. By this stage, members will have a better idea of whether the US will grant further waivers to buyers of Iranian oil, although Brian Hook, from the US State Department, has said that the US will not be looking to grant any new waivers.

Metals

Alunorte refinery update: The president of Hydro Aluminum USA has said that the Alunorte alumina refinery in Brazil could return to full operations by the end of 1Q19, as the company continues to work with local authorities to resolve issues. The 6mtpa alumina refinery- the largest in the world- has been operating at half capacity since early 2018, and a return to normal operations would be welcome given the tightness in the alumina market. Alumina prices have already fallen 6.5% since the start of the year, on the back of US plans to lift sanctions on Rusal. This has seen the alumina/aluminium price ratio falling from 22.5% at the end of 2018 to 21.2% currently. A return to normal operations from Alunorte could put further pressure on the ratio.

Copper spreads weaken: The LME cash/3M spread eased further this week, falling to a five-month low of negative US$30/t yesterday. Soft Chinese economic data and weaker copper imports have weighed on both the flat price and spreads. However, exchange inventories remain low, whilst there continues to be a number of ongoing smelter disruptions, which should keep the refined market tight.

Agriculture

US grain inspections: Latest data from the USDA shows that 1.01mt of US corn was inspected for export over the last week, up from 502kt in the previous week, and significantly higher than the 624kt inspected in the same week last season. Meanwhile, soybean export inspections totalled 1.09mt over the week, up from 682kt in the previous week, but still down from 1.24mt in the same week last season. Over the week another 68kt was inspected for export to China.

Cocoa grinding numbers: The Malaysian Cocoa Board reported today that cocoa processing increased by almost 23% YoY to total 72,451 tonnes in 4Q18, which takes total grindings for 2018 to 249,661 tonnes, up more than 14% YoY. European grinding numbers will be released on Wednesday, followed by North American figures on Thursday.

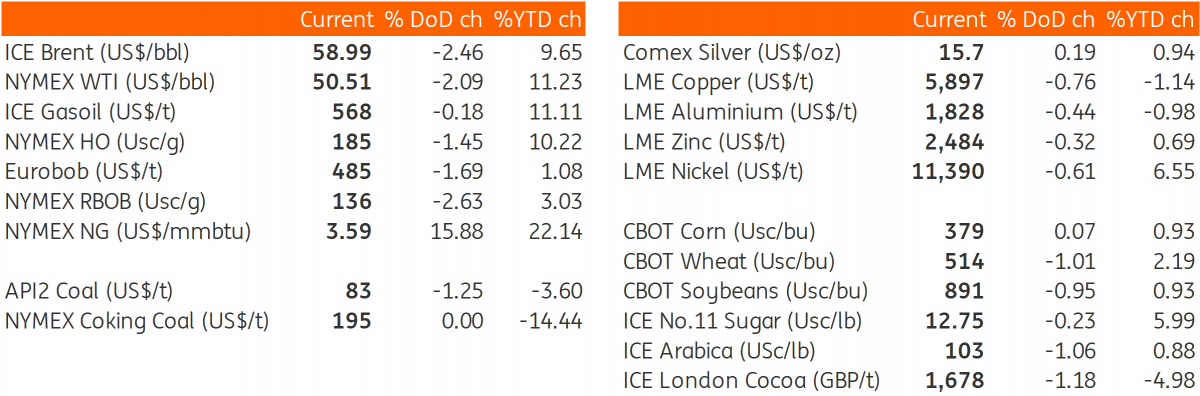

Daily price update

Download

Download snap