The Commodities Feed: Trump demands & Russian oil

Your daily roundup of commodity news and ING views

ICE Brent managed money position (000 lots)

Energy

Trump demands & Russian oil: Brent came under significant pressure on Friday, settling almost 3% lower on the day. This weakness came despite the shutting of the 1MMbbls/d Druzhba oil pipeline, which carries Russian crude into Europe, after high levels of organic chlorides were found. The market seems to have taken comfort in comments that oil flows along the pipeline will return to normal within two weeks, and that unaffected crude oil will reach Belarus by today.

Further downward pressure followed comments from President Trump who said, “I called up OPEC. You have got to bring them down”, referring to gasoline/oil prices. He followed this up with a tweet later on saying, “Spoke to Saudi Arabia and others about increasing oil flow. All are in agreement.”

We are of the view that Saudi Arabia will increase output as soon as May, something they were likely to do anyway in the lead up to summer. The Kingdom could increase output by 500Mbbls/d and still be in compliance with the OPEC+ deal for the month of May.

Oil speculative positioning: Latest market positioning data shows that speculators increased their net long in ICE Brent by 16,401 lots over the last reporting week, leaving them with a net long of 396,266 lots as of last Tuesday. The move was driven by fresh buying, with the gross long increasing by 16,431 lots. However, given the price action since last Tuesday, particularly on Friday, it is likely that a large part of the fresh longs were flushed out. Aggregate open interest between Tuesday and Thursday fell by around 27k lots, and when open interest data is released later today, we would expect it to show a further decline for Friday.

Metals

LME zinc backwardation: The LME zinc cash/3M spread increased to an intraday high of US$130/t, before settling in at US$120/t by the end of Friday. The spread has increased by nearly 56% so far this month, with the prompt physical market remaining tight. The deeper backwardation in the spread has supported the delivery of zinc into LME warehouses, which has increased from around 50kt in the first week of April to 80kt currently. However, stocks are still marginal when compared to an average of a little under 200kt in 2018, which should continue to offer support to zinc in the near term.

Speculative positioning: Speculators continue to sell gold, with the managed money net short position increasing by 18,359 lots last week, leaving specs with a net short of 22,328 lots as of 23 April 2019. Similarly, managed money net shorts in silver increased by 7,032 lots week-on-week to 17,870 lots, as an appreciating US dollar and improving economic sentiment reduces demand for low-yielding safe haven assets. For copper, speculators turned net sellers again last week, with a net short of 6,600 lots as of last Tuesday.

Agriculture

Grains remain under pressure: If speculative data is anything to go by, speculators are still hesitant about the US and China coming to any trade deal. Latest CFTC data shows that speculators increased their net short in CBOT soybeans by 38,166 lots to leave them with a record net short of 129,566 lots. It is a similar story for corn, with specs selling 14,686 lots to leave them with a net short of 322,215 lots, as of last Tuesday. These significant short positions leave these markets vulnerable to a short covering rally, especially as we move towards the summer, and all eyes will be on weather in the US.

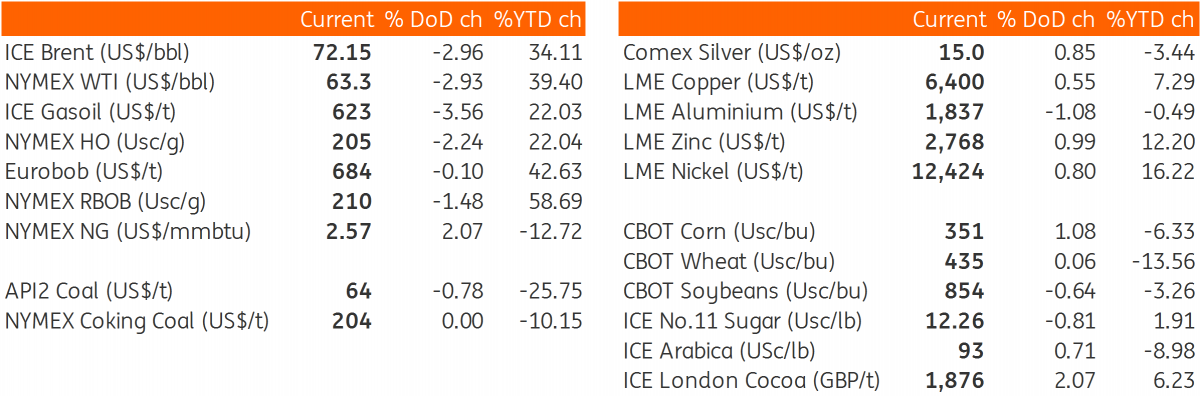

Daily price update

Download

Download snap