The Commodities Feed: The Saudis cut more

Your daily roundup of commodity news and ING views

Energy

The big news yesterday was the announcement that Saudi Arabia would cut output in June by an additional 1MMbbls/d, which would take output in the month to around 7.5MMbbls/d, the lowest levels seen in almost 20 years. The rationale behind the extra cut was to speed up the return to normality for oil markets. Although interestingly, the announcement follows a phone call between President Trump and the King of Saudi Arabia. The market reacted as one would expect, at least initially, with Brent rallying around 5%. However, as the market digested the news, this strength fizzled out, and the market settled lower for the day. The bears would say the fact that Saudi Arabia has to cut by an additional 1MMbbls/d, suggests that the demand is not there, with them unlikely to take such action if it was.

Following the announcement from Saudi Arabia, the UAE and Kuwait announced that they would also cut by an additional 100Mbbls/d and 80Mbbls/d respectively over June. We will need to see how individual compliance performs under the broader OPEC+ deal, because that would tell us if we are seeing real additional cuts from the OPEC+ group, or whether these recently announced cuts will just make up for poor performance from other producers. Iraq’s track record with compliance has been poor in recent years, and under the deal that started on 1 May, they need to cut output by 1MMbbls/d, something that many in the market believe they will not achieve.

Finally, there are plenty of data releases this week. Apart from the usual weekly reports, we are set to see the EIA release its Short Term Energy Outlook today, and it will be interesting to see what revisions they make to their US oil output forecasts, given the collapse in drilling activity and numerous production shut in announcements from US producers in recent weeks. Then on Wednesday, OPEC will release its monthly report, where the market will be interested in their latest thoughts on demand. Finally, on Thursday the IEA will release its monthly report, and once again the key focus will likely be on their demand expectations for the remainder of the year.

Metals

Base metals remain fairly well supported, with LME copper reaching an intraday high of US$5,370/t. Comments from China’s central bank, signalling further monetary stimulus, proved supportive, while data on money supply including new yuan loans was better than the market expected.

According to the latest supply data from SMM, China’s copper cathode production rose 6.5% YoY and 1.2% MoM to total 752kt in April, following the ramp up of new capacity and the resumption of operations at other smelters. The strong year-on-year growth is also due to a low base, with some smelters carrying out scheduled maintenance during the same period last year. Among all metals, LME lead remained the best performer, with prices rising almost 1.7% yesterday, supported by LME data which showed a sharp jump in cancelled warrants; rising by 14kt (highest since mid-June) to 17kt as of yesterday. Meanwhile, LME lead stocks remain almost flat at around 74kt, but the sudden rise in cancelled warrants may result in declining inventories in the coming days.

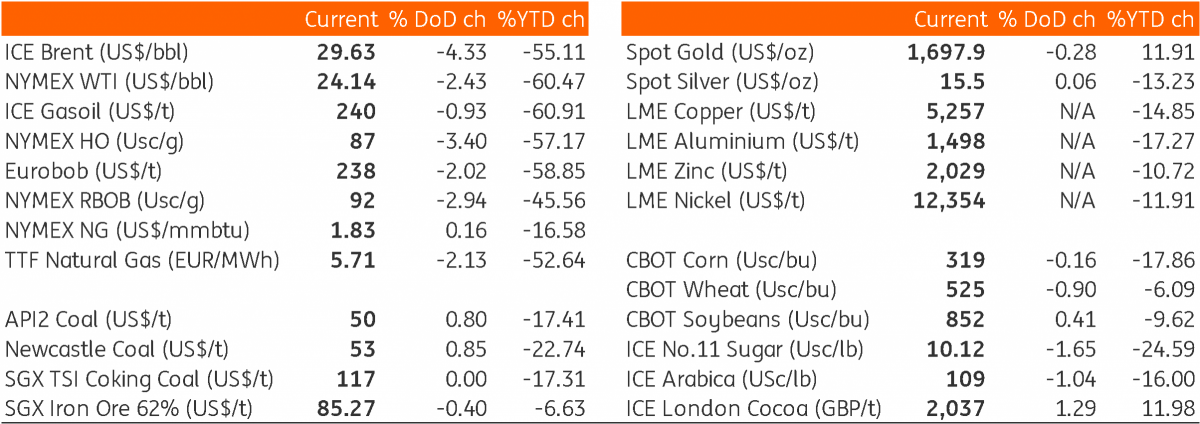

Daily price update

Download

Download snap