The Commodities Feed: That’s all folks

Your daily roundup of commodity news and ING views

Energy

De-escalation mode appears to be the theme for now, with both Iran and the US showing some restraint after the latest developments. This is clearly reflected in the oil market, with ICE Brent settling 4.15% lower yesterday, and seeing the market trade in a pretty large intraday range of US$6.81/bbl - a range that we last saw following attacks on Saudi oil facilities back in September. Assuming that we do not see a re-escalation between the US and Iran, we would expect oil prices to trade back in the US$60-65/bbl range in coming weeks.

The fundamental outlook for the oil market is not constructive, with expectations that the market will return to surplus over 1H20. And as we move closer to March, the market will get increasingly nervous about whether OPEC+ will extend its output cut deal through until the end of June. Concerns over demand also continue to linger. And while a phase-one trade deal may bring some relief, if we look at refinery margins, they remain under pressure, suggesting demand is not great at the moment. Finally, positioning is key. Speculators have bought the market on the back of trade optimism and more recently on Iranian/US tension. This has left speculators holding their largest net long in ICE Brent since October 2018, leaving room for some hefty liquidations - a risk which only grows if details of the phase-one trade deal between the US and China disappoint (the deal is scheduled to be signed on the 15th January).

Yesterday’s EIA report also did little to support sentiment, with US crude oil inventories surprisingly increasing by 1.16MMbbls over the week, compared to market expectations for a 3.25MMbbls drawdown. This was very different from the 5.95MMbbls decline that the API reported the previous day. There were a number of factors behind the surprise build. Firstly, refinery utilisation rates fell by 1.5 percentage points over the week, secondly, crude oil exports declined by 1.4MMbbls/d WoW- although admittedly this was from a record high base of almost 4.5MMbbls/d in the previous week, and finally, crude oil imports increased by 378Mbbls/d over the week.

Despite lower refinery run rates over the week, the EIA also reported significant builds of 9.14MMbbls and 5.33MMbbls in gasoline and distillate fuel oil respectively. Demand really appears to be what is weighing on the products market, with gasoline demand falling by 828Mbbls/d over the week, taking it to levels last seen back in early 2017. These numbers will do little to support refinery margins, which continue to come under pressure. Seasonally, we generally see US gasoline stocks trending higher through until late January/mid-February, which means that gasoline cracks are likely to remain fairly weak until at least then.

Metals

Gold also gave back a lot of the gains it made in recent days, with investors taking comfort from the fact that it appears that the worst of the tension between the US and Iran is behind us. This has seen gold slump more than 3.5% from yesterday’s intraday highs, leaving it to flirt with the US$1,550/oz level once again. Meanwhile, for palladium, there really does seem to be no stopping its advance, the precious metal would have benefitted from the flight to safety in recent days, but bullish fundamentals mean that it has not witnessed the same selloff as the rest of the complex more recently. In fact, it has instead broken above US$2,100/oz for the first time.

Turning to base metals, LME zinc rallied 2.43% yesterday, taking total gains to over 9% since early December, with inventories in LME warehouses declining to 50.2kt, which is a fraction of the 5-year average level and enough to cover just 1.3 days of global demand. Meanwhile, inventories in the China market also remain very low, despite expectations that the market is entering a seasonal lull. The much-anticipated stockbuild in the market has been somewhat disappointing, despite the fact that production has been robust since last year. This strong output has been largely incentivised by higher smelting margins. Treatment charges for imported concentrate were around US$310/t at the end of December, compared to around US$180/t at the start of 2019. Latest data from the Shanghai Metals Market shows that Chinese zinc production increased 20% YoY (+1.2% MoM) to 537kt in December, with some smelters restarting production after completing maintenance.

Agriculture

Moving onto grain markets, and they have largely ignored developments in the Middle East over recent days. Instead, attention is focussed on tomorrow’s WASDE release from the USDA. Expectations are for little change from the December WASDE. The biggest revisions are expected for US corn, where a Bloomberg survey shows that market participants expect corn output to be revised down by almost 160m bushels, which would also mean a revision lower in US ending stocks for 2019/20. The other big news that grain markets are awaiting is the signing of the phase-one trade deal next week between the US and China, and whether this leads to a significant increase in purchases of US agri products from Chinese buyers.

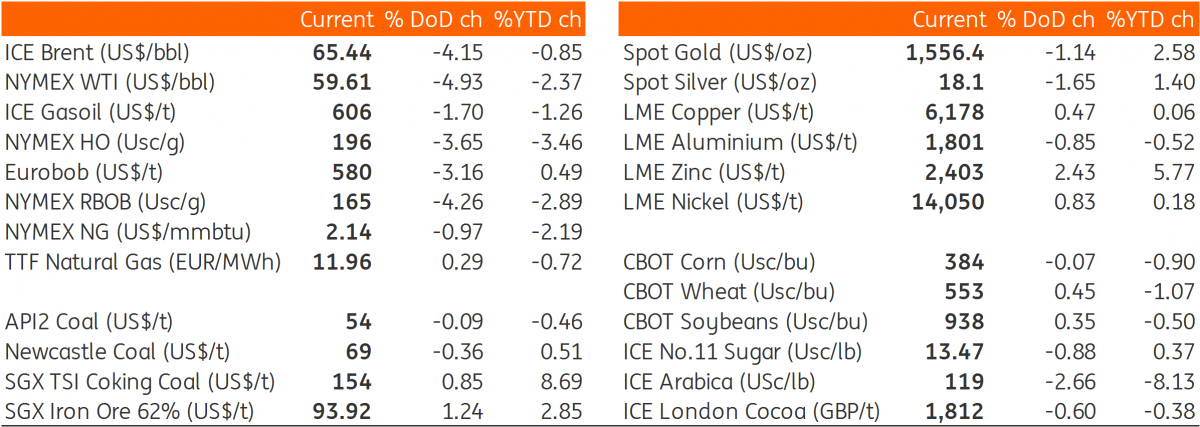

Daily price update