The Commodities Feed: Surprise US oil draw

Your daily roundup of commodity news and ING views

Energy

US crude oil inventories fall: The oil market rallied higher yesterday, with ICE Brent settling back above US$61/bbl. The key driver was the EIA surprising the market by reporting that commercial US crude oil inventories declined by 1.7MMbbls over the last week, compared to a expectations for a build of around 3MMbbls, and was also very different from the 4.45MMbbls build the API reported the previous day. However what was even more constructive, was the fact that total US inventories (crude and product) declined by 10.02MMbbls over the week.

The crude draw was largely driven by an increase in refinery run rates, with crude oil inputs over the week increasing by 429Mbbls/d, whilst crude oil exports also increased by 435Mbbls/d to 3.68MMbbls/d- the second highest weekly number on record. On the product side, despite a pick-up in refinery activity, big draws were still seen, and the key driver here was stronger demand.

Overall the report was clearly bullish, however as we have seen with the oil market in recent months, the macro environment has been one of the key drivers for price, and so the potential for the bullishness of this report to wear off. We are already seeing so in early trading this morning.

Metals

Copper market update: Chilean miner, Codelco has said that some of its shipments may be delayed as a result of the ongoing protests and strikes in the country. At least two mines and a smelter have seen operations impacted due to the protests. The unrest in Chile continues to provide support to the copper prices, with LME copper holding up above US$5,800/t.

Meanwhile, in its latest forecasts, ICSG revised its supply deficit estimates, and now expects a deeper supply shortfall of 320kt in 2019 following higher supply disruptions, this compares to its previous forecast in May of 190kt. However, for 2020 the group forecasts a surplus of 280kt, with supply recovering from temporary shutdowns and new projects.

Global mine production after rising by 2.5% in 2018, is estimated to decline marginally by 0.5% in 2019, however, it is expected to grow by 2% in 2020. Refined production is estimated to remain flat in 2019, and forecast to rise by 4% in 2020, with capacity expansions in China and improved supply from ex-China as well. Looking at global copper consumption, global demand is expected to remain largely flat in 2019 (+0.3%), impacted by the global economic slowdown, although demand is expected to pick-up in 2020, and is estimated to rise by 1.7%.

Nickel mine closure: LME nickel prices continued to move higher this morning, with prices now back above US$16,700/t, following the temporary shutdown of operations at a nickel mine in Papua New Guinea. Metallurgical Corporation of China, Ramu nickel-cobalt project situated in northeast Papua New Guinea was ordered to close yesterday due to a pollution investigation according to reports. Ramu produced 35.35kt of nickel in 2018.

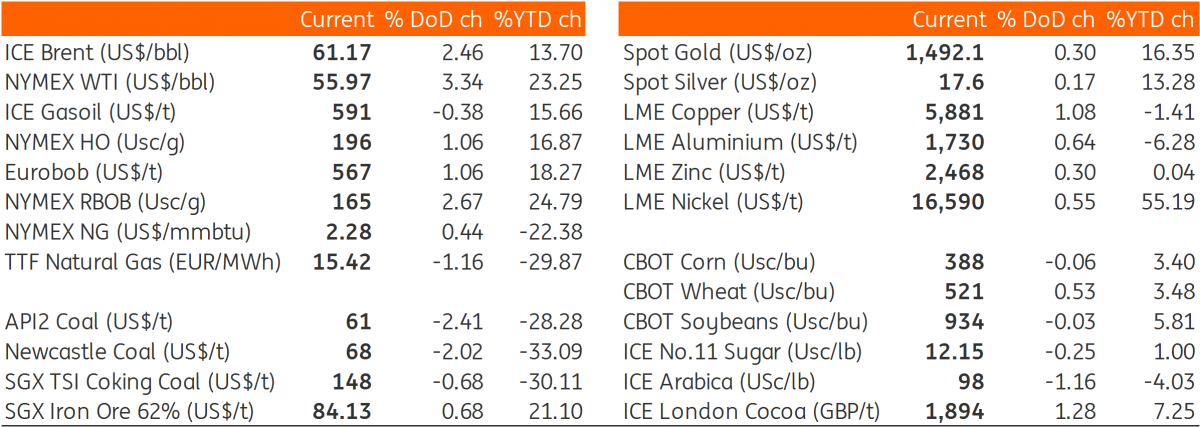

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap