The Commodities Feed: Specs continue to add to oil long

Your daily roundup of commodity news and ING views

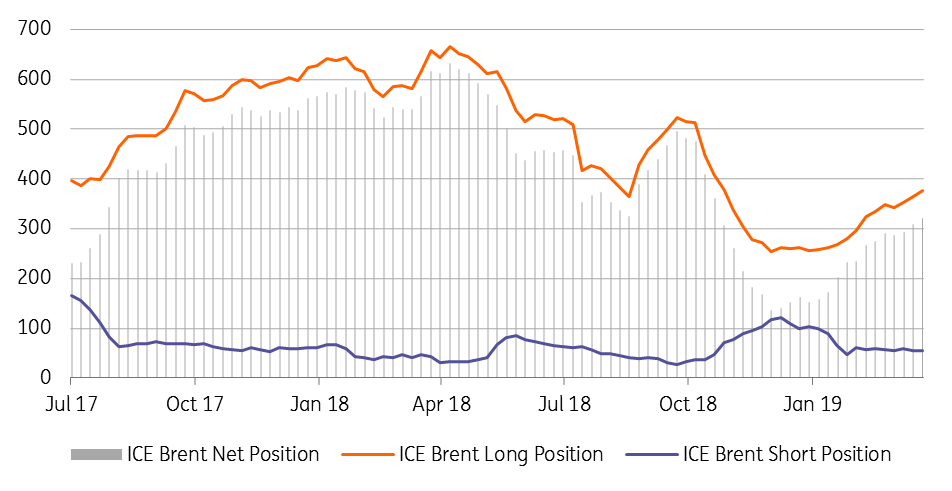

Limited short covering to come from specs in ICE Brent (000 lots)

Energy

Oil speculative positioning: Latest exchange data shows that speculators increased their net long in ICE Brent by 13,429 lots over the last reporting week, leaving them with a net long of 322,035 lots as of last Tuesday. The bulk of this buying were fresh longs, rather than short covering. In fact, moving forward the risk of a short covering rally is fairly limited given that speculators hold a gross short of just 54,090 lots.

Meanwhile, CFTC data shows that speculators increased their net long in NYMEX WTI by 25,888 lots over the week, leaving them with a net long of 238,205 lots. Similar to Brent, the bulk of this buying came from fresh buying.

US production and rigs: Numbers releases by Baker Hughes on Friday showed that the US oil rig count declined by eight over the week to total 816. Since mid-November, the number of active oil rigs in the US has declined by 72, and this is largely a result of the price weakness seen over Q4. Meanwhile, Friday also saw the EIA release monthly US production numbers for January, which showed that US oil output over the month fell by 90Mbbls/d to average 11.87MMbbls/d. This is the first decline in US output since May.

Metals

Further iron ore disruptions: Rio Tinto has declared force majeure on some of its iron ore supplies after its Cape Lambert shipping terminal reported damages following last week’s cyclone. The miner expects around 14mt of iron ore supply to be lost due to the disruption. Rio Tinto was expected to increase output over 2019 to try to offset some of the losses from Vale in Brazil. However, latest developments push the global seaborne market even further into deficit for 2019.

China data surprises: China’s manufacturing PMI for March came in at 50.5, much better than market expectations of below 50, and indicates the positive effects of stimulus on industrial and manufacturing activity. The stronger than expected numbers have proved supportive for the base metals complex this morning. Meanwhile, trade talks seem to continue moving in the right direction, and over the weekend China decided it would once again suspend retaliatory tariffs on US vehicles and parts.

Agriculture

US 2019 plantings: The USDA released its Prospective Plantings report on Friday, which gave the agency’s estimates for 2019 US plantings. Expectations are that planted corn area in 2019 will increase by 4% to total 92.8m acres. Meanwhile soybean area is expected to fall by 5% to total 84.6m acres This expected shift from soybean to corn plantings is largely a result of China’s retaliatory tariffs on US soybeans, which has seen China take a step back as a significant buyer of US beans, and as a result we have seen a large build in stock in the US. These estimates did weigh on CBOT corn prices on Friday.

US grain stocks: On Friday the USDA also released its Grain Stocks report, which showed that US corn stocks as of the 1st March stood at 8.6b bushels, down 3% from the 1st March 2018. However, unsurprisingly US soybean stocks on the 1st March stood at 2.72b bushels, up 29% YoY. This increase reflects the lack of Chinese buying. Finally, total wheat stocks stood at 1.59b bushels on the 1st March, up 6% YoY.

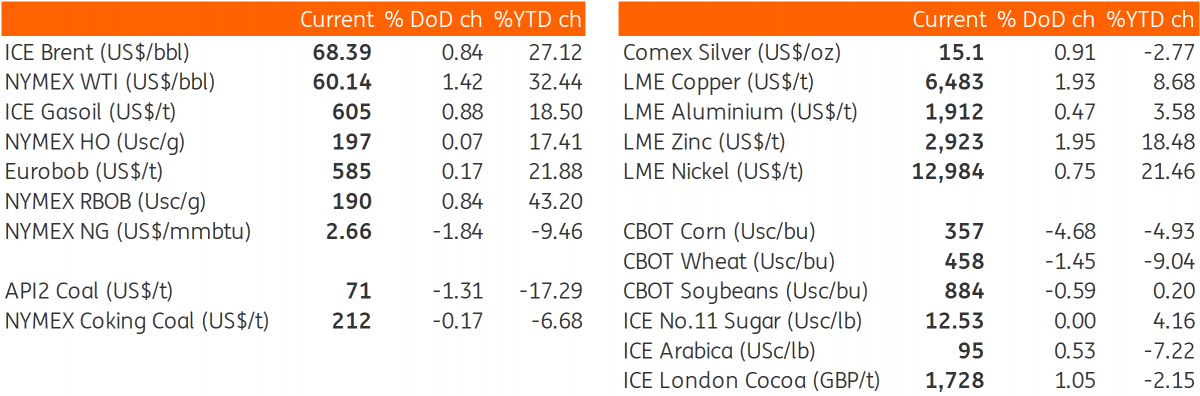

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap