Briefing Romania

EUR/RON close to historical highs again

EUR/RON

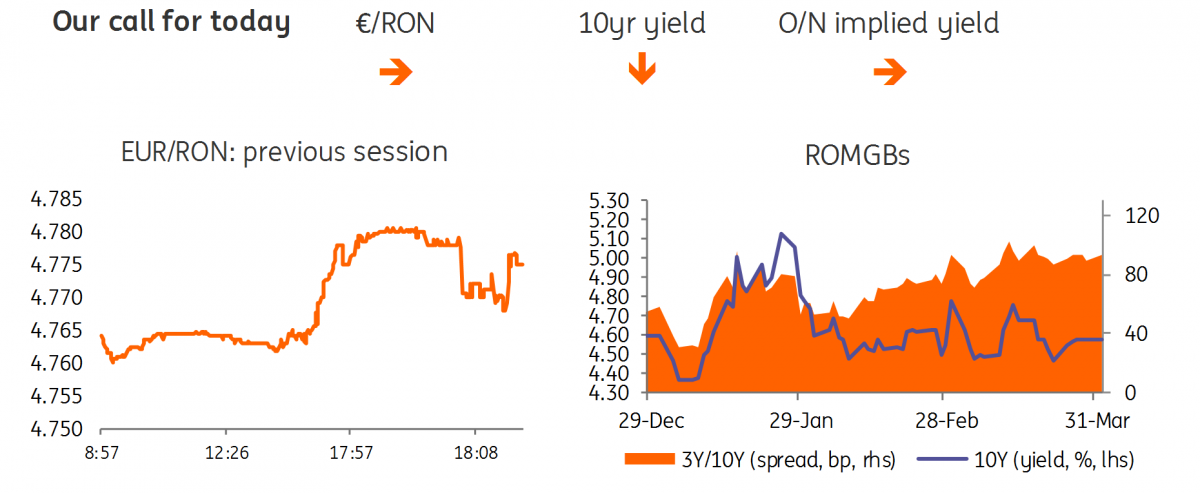

After testing above 4.7600 for a few days already, the EUR/RON moved higher on Friday and traded above 4.7700 on quite a heavy turnover. Unless official offer to curb the trend again, we see a 4.7650-4.7800 trading range for today, with an upside bias.

Government bonds

The April auction calendar has been released without causing any market waves. The Ministry of Finance aims to sell RON 3.2 billion this month, with the first auction taking place today 1 April, for RON 500 million in June 2023. The tenor traditionally attracted a broad range of investors and despite trading close to historical lows we still see decent demand for it. We expect an average allocation below 4.10%.

Money Market

Cash rates continued to inch higher and returned above 4.00% on Friday. The end-of-quarter effect could have played its part while official offers in the FX market might have given a direction as well. As previously mentioned, we expect tight cash conditions for the current reserve period.

The week ahead

In the US, scheduled reports for this week include retail sales, the ISM business surveys and the March employment report. We expect to see some respectable US economic figures, which should help to ease fears of a marked slowdown in activity. In Germany, the industrial production data for February will show whether the downward trend of the entire manufacturing sector will continue or could be brought to a halt. Elsewhere, the European Central Bank will release the minutes of its March policy meeting. Watch out for any signs on how to alleviate some of the negative rate pressure on banks.

We expect no key rate change from the National Bank of Romania this week. CPI has recently surprised on the upside but the central bank will need more time to assess the changes to the bank levy and spillovers from weaker eurozone data. The NBR is likely to continue to use liquidity management, and eventually, FX interventions, to deter the depreciation of the Romanian leu - at least for a while.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap