The Commodities Feed: Saudi OSP increases

Your daily roundup of commodity news and ING views

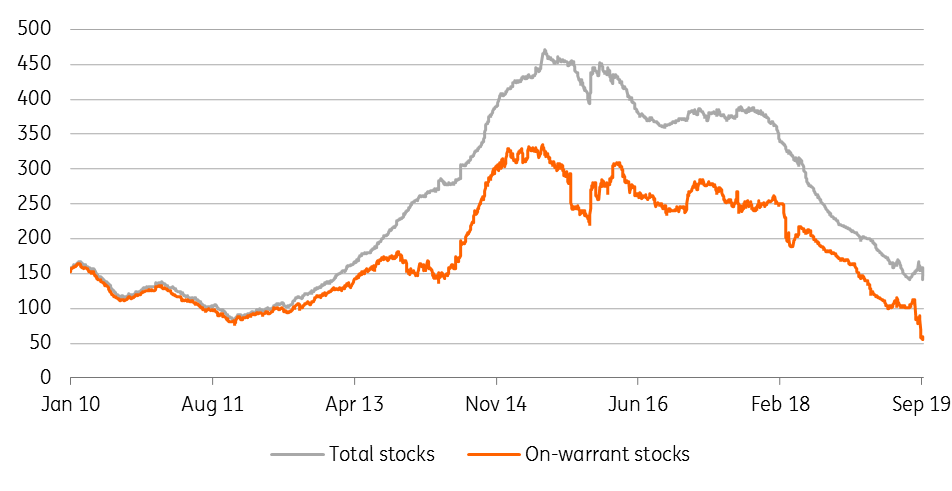

LME Nickel inventories (k tonnes)

Energy

Saudi official selling price: Saudi Aramco increased its official selling price for Arab Light to Asia in November by US$0.70/bbl to a premium of US$3/bbl over the Oman/Dubai benchmark, which takes the OSP to the highest level seen since January 2014. The increase in the OSP shouldn’t come as too much of a surprise, particularly following the Saudi attacks in mid-September. This is the second consecutive month where we have seen an increase in the OSP to Asia, and is reflective of the tightening crude market. However, this tightening is clearly not reflected in the flat price, with ICE Brent under continued pressure, trading below US$58/bbl, given the poorer macro data we have seen this week.

European refined product inventories: The latest data from Insights Global shows that refined product inventories in the ARA region declined by 352kt over the last week to total 5.63mt. Draws were seen across all products, although fuel oil saw the biggest decline, with stocks falling by 183kt. In the aftermath of the Saudi attacks, we did see increased European flows of gasoline to the Middle East, while middle distillates supplies from the Middle East to Europe have also slumped, which has proved supportive for gasoil cracks.

Metals

LME nickel stocks: The run on nickel stocks at LME warehouses continues with nearly 17kt of stocks withdrawn since start of the month. LME inventory levels fell to a five-year low of 140.9kt yesterday, with on-warrant stocks falling to a decade low of 55kt on 1 October 2019. The upcoming ban on Indonesian nickel ore exports has created a rush to withdraw metal from LME warehouses and secure supply. Asian inventories have led the decline, with stocks falling from around 120kt in mid-September to 71kt currently. The LME nickel cash/3M spread made a fresh high of US$214/t on Tuesday and remains at around US$150/t currently.

Indian gold imports: Media reports suggest that India’s gold imports fell 86% year-on-year (down 9% month-on-month) to 13.5 tonnes in September, due to higher gold prices and increased import duties. September imports are the lowest in nearly three years, and reflect the poor demand for physical gold at these elevated prices. A slowdown in economic growth have further weighed on gold demand in the country, with year-to-date imports down 12% YoY to total 521 tonnes over the first nine months of 2019. Physical gold demand is at odds with investor demand, where we continue to see increased interest as a safe haven.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap