Briefing Romania

Key rate on hold at 2.50%

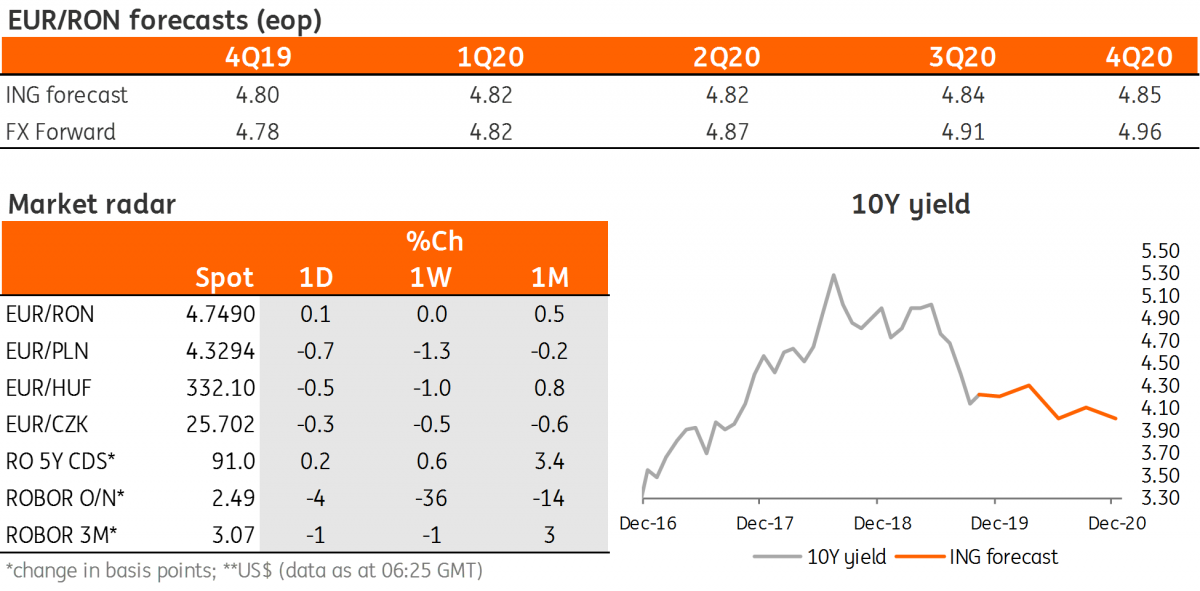

EUR/RON

The EUR/RON traded in the same 4.7450-4.7500 range yesterday on average turnover. The press briefing following the NBR Board meeting didn’t bring much news. While disavowing the leu’s depreciation as a solution for correcting the external imbalances, Governor Mugur Isarescu reiterated that any appreciation will be discouraged as well. Hence, stability should be the name of the game for some time. More on this topic here.

Government bonds

Romanian government bonds enjoyed a better day and embarked on a slight bull flattening move, with long term yields down by 2-3 basis points. One of the reasons was the poor US data (details here) which has increased market expectations for rate cuts. Back to the local front, the RON500 million Apr-2026 auction came in pretty well with a bid-to-cover of 2.5x, upsized allocation to RON702 million and an average yield of 4.02%. As the external data continues to come in on the weak side, it’s likely that the relatively high ROMGBs yields will continue to prevail over internal vulnerabilities and trigger more buying interest.

Money market

Carry remains stable slightly below 2.50%. The reference to “strict liquidity control” has been maintained in the NBR’s press release.

The budget execution data released yesterday shows that the fiscal deficit for the January-August 2019 stands at -2.13% of GDP from -1.76% at end-July, way above last year’s -1.54% of GDP after the same period. To make things worse, the August data does not yet include the 15% increase in pensions, which will show up in September. Incomes are 11.9% higher than in 2018 but expenses accelerated by 14.8%.

We believe that staying within -3.0% of GDP is still possible mainly by not fulfilling the investment plans. Linking the upcoming budget execution with the local money market, we could see a material slowdown in public spending in the last few months of this year. This will overlap an already decreasing liquidity surplus and we believe that towards the end of the year we could even see a liquidity deficit in the system. While in the last few months the NBR’s open market operations have become more predictable and managed to increase the relevance of the key rate, we are slightly wary on how things will shape up once the central bank becomes a net creditor of the system.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap