The Commodities Feed: Saudi fiscal breakeven edges higher

Your daily roundup of commodity news and ING views

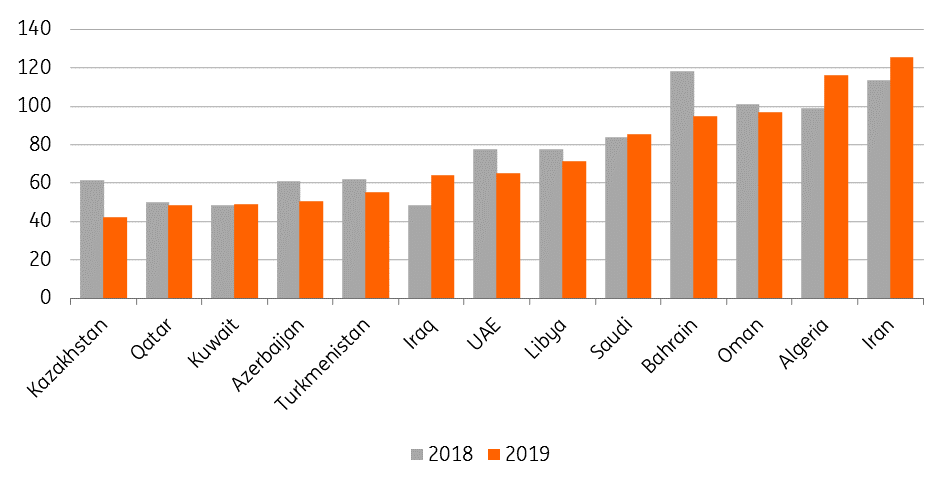

Fiscal breakeven oil prices (US$/bbl)

Energy

Crude oil inventories: The API is scheduled to release its weekly inventory report later today, and the market is expecting that US crude oil inventories increased by around 1.5MMbbls over the last week. According to EIA data US crude oil inventories have increased by 20.9MMbbls since the start of this year, to stand at 460.6MMbbls, leaving stocks just above the 5 year average. Recent stock builds have put pressure on the front month WTI time spread, with it slipping back into contango, having traded into backwardation earlier in the month. How this spread develops moving forward will depend on how quickly we see a pick-up in refinery utilisation rates- we have seen a slow return of refineries from maintenance season.

Meanwhile ahead of the API the market is expecting drawdowns of 1.25MMbbls and 750Mbbls in gasoline and distillate fuel oil respectively. Further draws in gasoline will likely continue to support gasoline cracks, with US gasoline inventories continuing to fall further below the 5 year average.

Fiscal Breakeven oil levels: The IMF yesterday released its latest estimates on fiscal breakeven levels for a number of oil producers in the Middle East and Central Asia. The general takeaway is that a number of countries have a fiscal breakeven oil price above current market levels. The IMF estimates that Saudi Arabia needs a price of a little over US$85/bbl to balance its budget, while Iran needs above US$125/bbl. The UAE and Iraq are estimated to have a fiscal breakeven level of around US$65/bbl.

Metals

Chinese iron ore inventory: Chinese ports saw iron ore inventories fall by 4mt over the last week, with a total of 12.9mt of stocks being withdrawn over the past three weeks. Current iron ore stocks stand at 136mt- the lowest levels since October 2017, reflecting the supply disruptions from both Brazil and Australia as demand picks up.

Meanwhile latest PMI data out of China came in below market expectations, with the manufacturing PMI coming in at 50.1 for April, down from 50.5 in March. However this reading still points towards an expansion in manufacturing activity in the country.

Agriculture

US crop progress: The USDA’s latest crop progress report shows that farmers have planted 15% of corn, which is up from 6% last week, and unchanged YoY. However quite some distance below the 5 year average of 27% for this stage in the year. Meanwhile soybean plantings are 3% complete, which is up from 1% last week, and slightly down from the 5% seen at the same stage last year. Turning to winter wheat, and the crop remains in good condition with 64% of the crop rated good to excellent, this compares to 62% last week, and just 33% at the same stage last year.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap