The Commodities Feed: OPEC+ deal uncertainty

Your daily roundup of commodity news and ING views

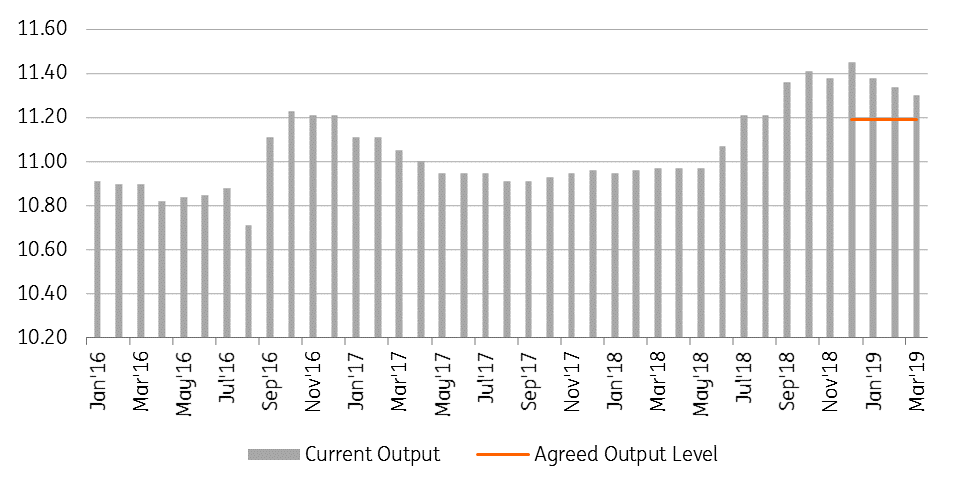

Russian oil output falling short of agreed cuts (MMbbls/d)

Energy

EIA outlook: The EIA released its monthly Short Term Energy Outlook yesterday, which showed that they revised higher the US oil output estimates for both 2019 and 2020 by 100Mbbls/d. The EIA is now expecting US production to average 12.4MMbbls/d this year, and 13.1MMbbls/d in 2020. This revision higher comes despite the decline in the US oil rig count- which has fallen from 888 in November to 831 currently. To add to this, recent EIA data showed that US production over January fell month-on-month for the first time since May.

The API also reported yesterday that US crude oil inventories increased by 4.09MMbbls over the last week, which is higher than market expectations for a 2.5MMbbls build. The API also reported much bigger drawdowns in product than expected, with gasoline inventories falling by 7.08MMbbls and distillate fuel oil stocks declining by 2.4MMbbls. The more widely followed EIA report will be released later today.

Looking ahead, OPEC is scheduled to release its monthly oil market report today, which will be followed by the IEA oil market report tomorrow.

Russia uncertainty: Russia is still not willing to commit to an extension to the current production deal which is set to expire at the end of June. President Putin said that it is too soon to decide on whether the deal needs to be extended, but did say that current oil prices are very comfortable for Russia. The President also said that “We are not supporters of uncontrollable price rises”. We continue to believe that whilst the global balance sheet does not need to see cuts extended through to the end of the year, failing to continue with output cuts will likely hit sentiment.

Metals

China automobile sales: New passenger vehicle sales in China fell 12% year-on-year to 1.78m units in March, according to China Passenger Car Association- the 10th consecutive month of declines as a slowing economy and trade war worries dent consumer sentiment. Slowing sales are likely to be a drag on metal prices, and in fact, the more recent pressure that we have seen on palladium prices has been partly blamed on disappointing Chinese vehicle sales.

Meanwhile, the IMF yesterday revised lower its 2019 global GDP growth forecast from 3.5% to 3.3% on higher economic and policy uncertainty. While the US and China have been making progress with trade, risks remain skewed to the downside until an agreement is reached.

Agriculture

WASDE report: The USDA released its April WASDE report yesterday, which saw the agency revise higher its expectations of US wheat ending stocks for the 18/19 season from 1.05b bushels to 1.09b bushels, with a slight revision lower in both domestic use and exports. Global ending stock estimates for wheat have been revised from 270.53mt to 275.61mt.

The US corn balance is also set to end the season with higher stocks, with the USDA revising higher its ending stocks estimate from 1.84b bushels to 2.04b bushels, which is also the result of expectations of lower exports and domestic use. Lower domestic use in the US also helped to push expectations for global ending stocks up from 308.53mt to 314.01mt.

For soybeans, expectations for US ending stocks have been revised slightly lower from 900m bushels to 895m bushels, while the global soybean balance saw little change, with ending stocks expected to remain around 107mt.

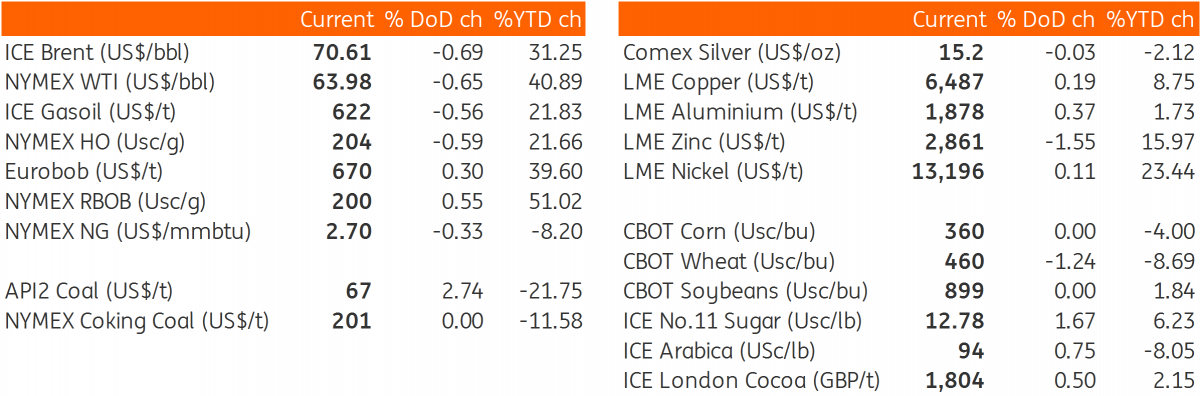

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap