Briefing Romania

CPI bounces back to 4.0% March

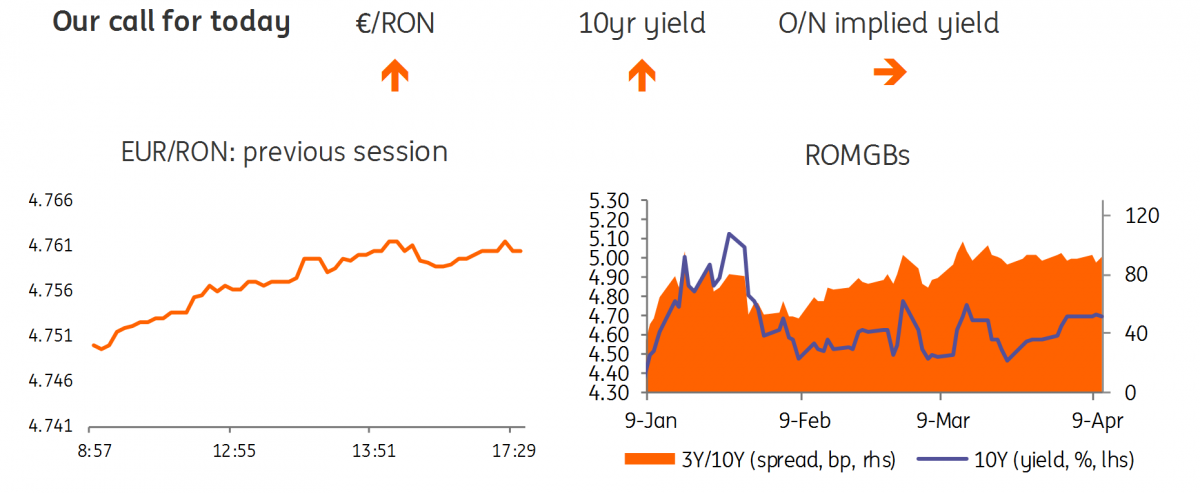

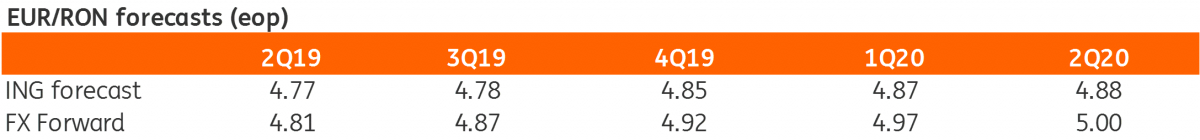

EUR/RON

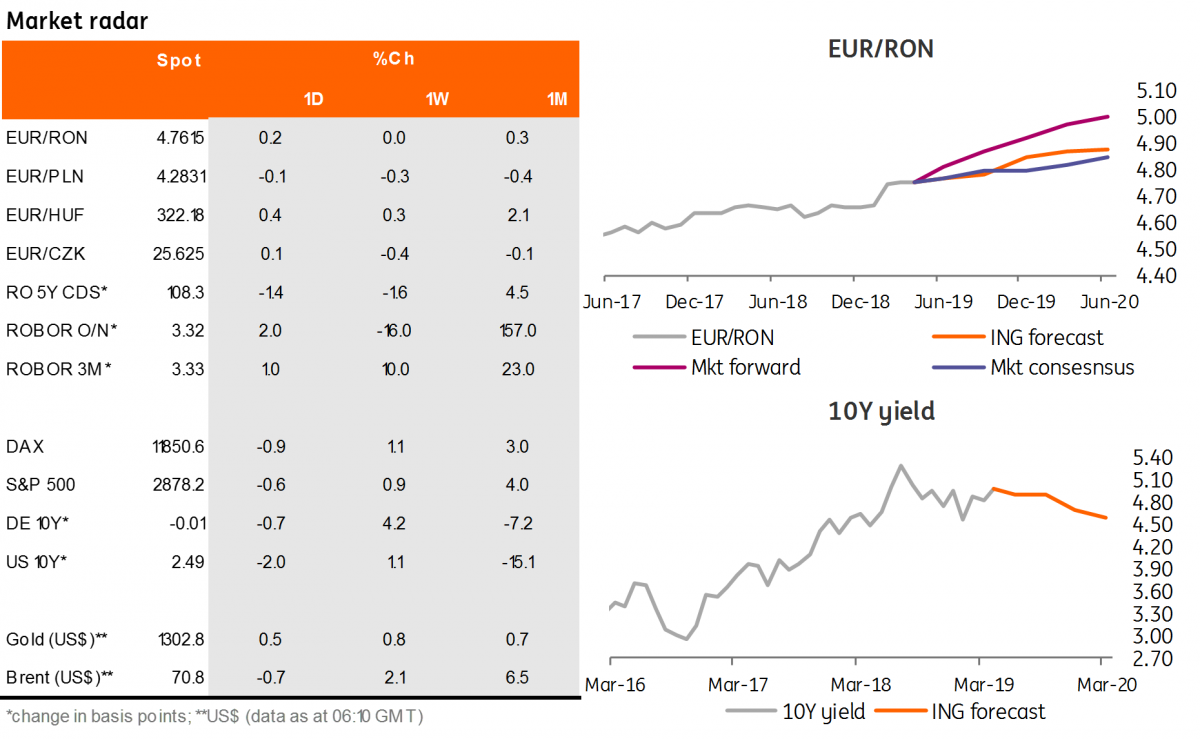

The slightly lower cash rates and very weak trade balance data translated pretty quickly into upward pressure on the EUR/RON. The pair marched higher throughout yesterday’s trading session, from 4.7500 to 4.7600 where it closed. With the downside potential quite limited (the pair couldn’t break sustainably below 4.7500) the market might want to test the upside again. Yesterday’s National Bank of Romania minutes revealed “serious reasons for concern ” due to the current account deficit and its “coverage by autonomous capital inflows”. Hence, some Board members saw that “an increase in pressures on the exchange rate was very likely”. Today, we see a 4.7600-4.7700 range with the NBR likely to cap the upside. In the absence of the NBR, we could get to 4.8000 pretty quickly.

Government bonds

Romanian government bonds were better offered yesterday on higher CPI numbers in neighbouring Hungary and hawkish NBR minutes afterwards. Today’s above-consensus CPI for Romania (4.0% in March versus 3.9% Bloomberg consensus and ING call) comes in the same vein. Hence, we expect the mild correction in ROMGB’s yields to continue today.

Money market

Cash rates are on a bit of a roller coaster again, spiking above the NBR credit facility of 3.50%. 3M moved around 30 basis points higher to 4.45%, while 1Y inched about 10bps higher to the 4.05% mid implied rate.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap