The Commodities Feed: OPEC agrees to a deal

Your daily roundup of commodities news and ING views

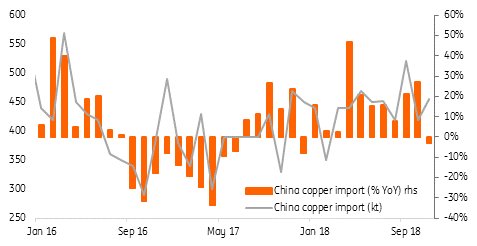

China refined copper imports

Energy

OPEC cuts: After an eventful few days last week, OPEC+ finally agreed to cut output by 1.2MMbbls/d from October levels for a period of six months, with the deal set to be reviewed in April, which is conveniently when waivers for buyers of Iranian oil expire. OPEC has agreed to reduce output by 800Mbbls/d, whilst non-OPEC members of the deal have agreed to reduce output by 400Mbbls/d. Iran, Libya and Venezuela are exempt from cuts. This deal, along with previously announced production cuts from Canada, should mean that the global oil market is largely balanced over the first half of 2019. In the lead up to the meeting, President Trump made it clear that he did not want the group to reduce output, however, as of yet, he has not made any comment on the cuts.

Libyan oil disruption: Libya’s National Oil Corporation has declared force majeure after production at the Sharara oil field was suspended due to safety concerns, with protests at the oil field. The shutdown will result in a loss of 315Mbbls/d of production from the field, whilst an additional 73Mbbls/d will be lost from the El Feel field, which is dependent on Sharara for its electricity needs. Libya produced 1.11MMbbls/d in October, up from an average of 892Mbbls/d over 3Q18.

Metals

China metals trade: China’s imports of refined copper fell 3% year-on-year to 456kt in November 2018, which appears to be the first sign that trade tensions between China and the US are having an impact on Chinese copper demand. Copper ore and concentrate imports were also down 4.5% YoY to total 1.7mt over the month. Meanwhile, iron ore imports into the country declined by 8.7% YoY to 86.3mt, with winter cuts and weaker steel mill margins weighing on demand for raw materials.

Chinese metal inventories: SHFE saw another week of inventory withdrawals, with copper stocks falling 7,163 tonnes over the last week, while over the past month inventories have declined by 18,355 tonnes. The tightness in the spot market does appear to be improving though, with physical premiums in the spot market falling from a peak of US$120/t at the start of 4Q18 to US$67.5/t currently. Aluminium stocks were down 17,863 tonnes week-on-week and 67,541 tonnes month-on-month; nickel and tin stocks also declined last week while zinc inventories were largely flat.

Agriculture

China soybean imports: China’s imports of soybean slowed further over the month of November, with shipments totalling 5.38mt over the month, down 22% MoM, and 38% lower YoY. This reduction is clearly a result of tariffs on US soybeans. We are entering a stage where Chinese buyers usually switch from South American soybeans to US soybeans, with peak US supply. However with tariffs, buyers are refraining from making purchases from the US. Although following trade talks between China and the US at the G-20 summit, China is reportedly set to announce this month that it will resume purchases of US soybeans, with these imports expected to make their way into state reserves.

Daily price update

Download

Download snap