The Commodities Feed: Oil under pressure

Your daily roundup of commodity news and ING views

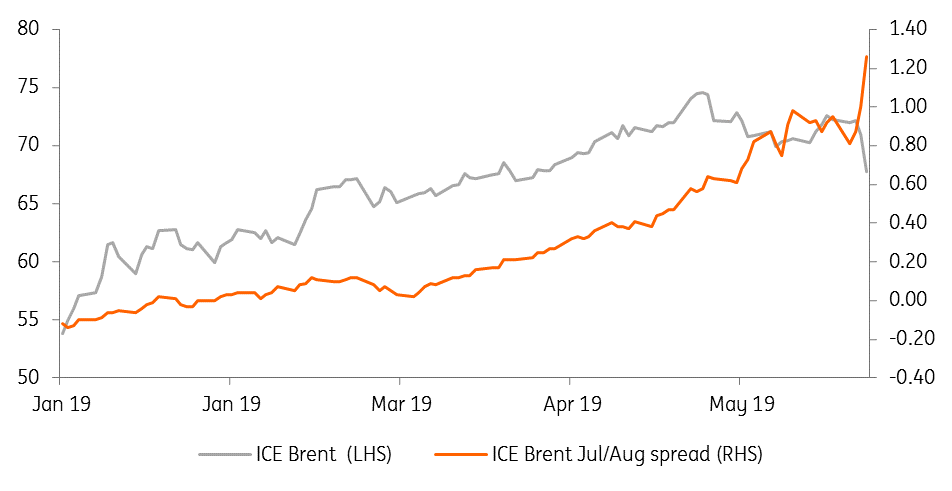

ICE Brent flat price vs. Jul/Aug spread (US$/bbl)

Energy

Oil under pressure: Both ICE Brent and NYMEX WTI came under significant pressure yesterday, with Brent down more than 4.5%. Broader macro concerns appear to be the driver behind the sell-off, although breaking through key technical levels brought further selling. Despite the large sell-off in flat price, prompt ICE Brent time spreads strengthened further, highlighting the tightness in the prompt market. Further weakness from current levels may force OPEC+ to act and extend its current output cut deal into the second half of 2019. However if this turns out to be the case, we believe that the market is sending the wrong signal to OPEC+, with the global oil balance set to tighten further as we move into 3Q.

If we want to look for a bearish fundamental driver in the oil market we have to look at the US, where we continue to see unusually large crude oil builds as we move into the summer. This has been driven by a prolonged refinery maintenance season, along with some unplanned refinery outages. Moving forward though, as these run rates edge higher, we would expect these more unusual builds to come to an end.

Metals

Chinese imports: Latest customs data shows that China’s coking coal imports increased 59.4% year-on-year to 7.4mt in April, while year-to-date imports are up 41.5% YoY to total 23.8mt. Stronger steel production on the back of improved margins has been supportive for raw materials demand in the country.

For base metals, copper scrap imports were up around 70% month-on-month to 170kt in April (but down 5.5% YoY) as traders stockpiled ahead of further restrictions on scrap imports from July. China’s alumina exports recovered marginally from 4kt in March to 19kt in April, however the country remained a net importer over the month. We would expect China to remain a net importer in the coming months following the shutting of some alumina refining capacity in Shanxi province amid environmental inspections.

Agriculture

US farmer aid: The US administration yesterday announced a $16 billion aid package for US farmers in order to offset the impact of the ongoing trade war. The package will include direct payments of $14.5 billion to farmers, which will be split into three tranches, with the first set to begin in late July/early August, according to the USDA. A decision will then be made at a later stage on whether the second and third tranches are needed. Obviously if China and the US do come to a trade deal later in the year, the government will be unlikely to proceed with the remaining tranches. The USDA also stated that “those per acre payments are not dependent on which of those crops are planted in 2019, and therefore will not distort planting decisions.”

Daily price update

Download

Download snap