The Commodities Feed: Oil positioning risk?

Your daily roundup of commodity news and ING views

ICE Brent managed money position (000 lots)

Energy

Crude oil speculative positioning: Latest exchange data shows that speculators increased their net long in ICE Brent by 15,934 lots over the last reporting week, to leave them with a net long of 308,606 lots. The move was largely driven by fresh longs, rather than short covering. The gross long position stands at 363,349 lots as of last Tuesday, the largest position since late October. A large gross long is a key downside risk for the market, especially with growing concerns over the economy, which is not helped by the inverted yield curve.

Meanwhile latest CFTC data shows that speculators increased their net long in NYMEX WTI by 54,669 lots over the last reporting week, leaving them with a net long of 212,317 lots as of last Tuesday. Similar to Brent, the bulk of this increase was driven by fresh longs.

Chinese crude oil imports: Chinese crude oil imports over February increased by 2% MoM to average 10.27MMbbls/d, while on a YoY basis imports increased by almost 22%. China increased its share of Venezuelan and Iranian imports over the month, with them increasing 17% and 22% MoM respectively. US sanctions on both countries have seen them increasingly target the Chinese market in order to find homes for their oil.

Metals

China metals trade: Alumina exports from China plunged 98% MoM to just 3.4kt in February, as global alumina prices softened. Exports peaked at 460kt in October 2018 when supply concerns from Brazil and Australia sent alumina prices soaring. However without Chinese export supply, and assuming the Alunorte refinery does not return to full operations any time soon, the ex-China alumina market will still be fairly tight over the course of this year, which should be fairly supportive for global alumina prices. Among other metals trade, copper scrap imports fell 67% MoM to 60kt as Beijing tightens control over the inflow of scrap into the country on environmental concerns.

Twin cyclones in Australia: Twin cyclones Trevor and Veronica hit Australia over the weekend, impacting both mining and energy operations in North and Western Australia. BHP Billiton and Rio Tinto halted some activities at their Pilbara iron ore operations, while Glencore stopped mining activity at its McArthur River zinc mine. Other companies, including South32 and Fortescue also reported disruptions to mining operations. In Pilbara, the ports of Ashburton, Dampier and Port Hedland have been shut since Friday, and remain closed, disrupting iron ore exports from these ports.

Agriculture

Chinese soybean imports: Latest data from Chinese customs shows that Chinese buyers made a big return to US soybeans over the month of February, importing 907,754 tonnes over the month, compared to just 135,772 tonnes in January. This increased buying comes at a time when both China and the US are trying to work towards a trade deal, which would see recently imposed tariffs removed. Whilst imports have seen a significant increase MoM, Chinese imports from the US are still significantly lower than levels seen previously - in February 2018 China imported 3.34mt of US soybeans.

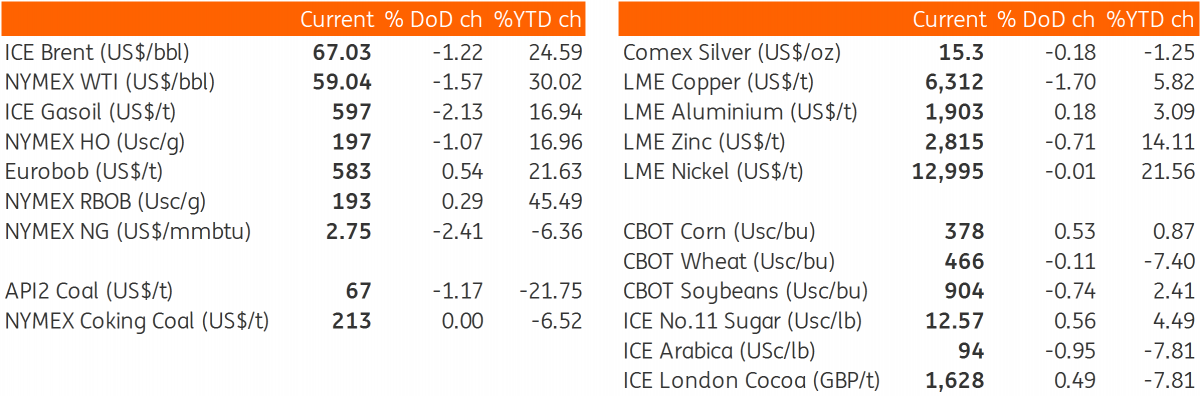

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap