The Commodities Feed: No respite for oil

Your daily roundup of commodity news and ING views

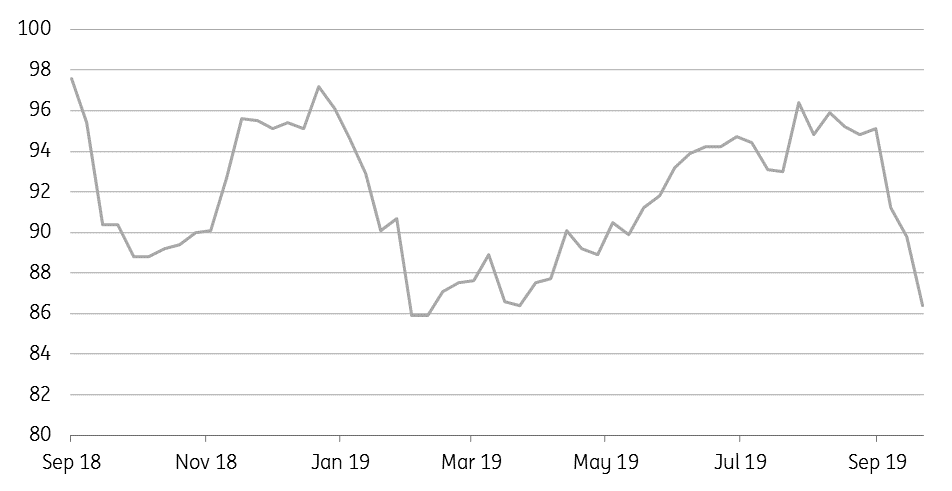

US refinery utilisation rate (%)

Energy

No respite for oil: The oil market continues to grind lower, with ICE Brent now trading well below US$58/bbl- which is 4.5% below where the market was trading prior to the Saudi attack. Negative macro data this week, with the US ISM manufacturing report falling to a 10-year low, has not helped.

Timespreads also continue to trend lower, with the Brent Dec/Jan spread having fallen from a backwardation of US$1.13/bbl at the time of the attack, to just US$0.62/bbl currently- which is more aligned with levels it was trading at prior to the attack.

Meanwhile, yesterday’s downward pressure was largely a result of EIA numbers, which reported that US crude oil inventories increased by 3.1MMbbls over the last week, very different from the 5.9MMbbls draw that the API reported the previous day. A key factor behind the build was the decline that we saw in refinery utilisation rates, which fell by 3.4 percentage points to 86.4% for the week- levels last seen back in late March. This saw crude oil inputs for refineries fall by 496Mbbls/d over the week. On the product side, gasoline and distillate fuel oil inventories fell by 228Mbbls and 2.42MMbbls, respectively.

European gas inventories: The new gas year started this week, and in the EU we will be going into the heating season with inventories at a five-year high at least. The build in stocks has been driven by strong LNG inflows for much of the year. Although in recent months these inflows have slowed down considerably, with the arb in Asia once again more attractive. With lower LNG volumes coming into Europe, along with stronger heating demand, we expect European gas prices to be fairly well supported moving forward.

Metals

China zinc treatment charges: SMM data shows that treatment charges for imported zinc concentrate into China have increased from US$240/t in September to US$280/t currently on increasing demand for smelting capacity in the country. Zinc smelters were reported to be operating at a utilisation rate of 82.1% in August, the highest operating rates since November 2017 due to improved supply of mined ore and the strength in treatment charges. China’s refined zinc production recovered to more than a one-year high of 528kt in August, and higher treatment charges suggest that production will remain strong for the rest of the year.

Gold recovery: Gold prices have recovered back towards the US$1,500/oz mark, on the back of weaker economic data from the US and the increasing probability of another Fed rate cut. The ISM manufacturing PMI in the US dropped to 47.8 in September, its lowest level in a decade as the trade war continues to keep manufacturers cautious while the ADP employment report was also softer than expectations. An economic slowdown remains a major concern for investors, who continue to seek safety in gold with total ETF holdings increasing to 81.3mOz (+0.4mOz week-on-week).

Agriculture

Chinese soybean purchases: China is reported to be purchasing further US soybeans ahead of trade talks, after Beijing provided a further quota of around 2mt of tariff-free imports earlier in the week. Previously, China approved around 2-3mt of tariff-free soybean imports from the US in late September. Soybean prices have found further support from the US stocks report earlier in the week, which showed US soybean stocks to be at 913mn bushels as of 1 September 2019, compared to the market expectations of around 981mn bushels.

Meanwhile, Brazilian exports of soybeans to China dropped 13% YoY to 3.6mt in September, with year-to-date exports down 16% year-on-year to total 46mt. This saw total soybean exports from Brazil fall by 2% YoY in September to 4.4mt, while YTD shipments are down 12% YoY to total 60.8mt. Cash values for Brazilian soybeans have also weakened considerably over August and September, with values falling from US$1.50/bu to US$0.89/bu currently- recent Chinese purchases of US soybeans have not been constructive for Brazilian values.

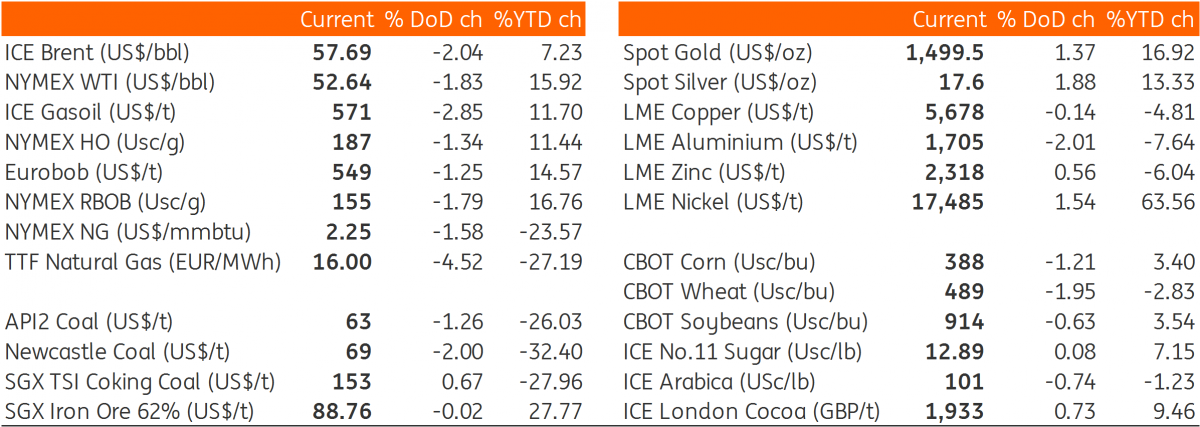

Daily price update

Download

Download snap