The Commodities Feed: Market largely ignores Trump tweet

Your daily roundup of commodity news and ING views

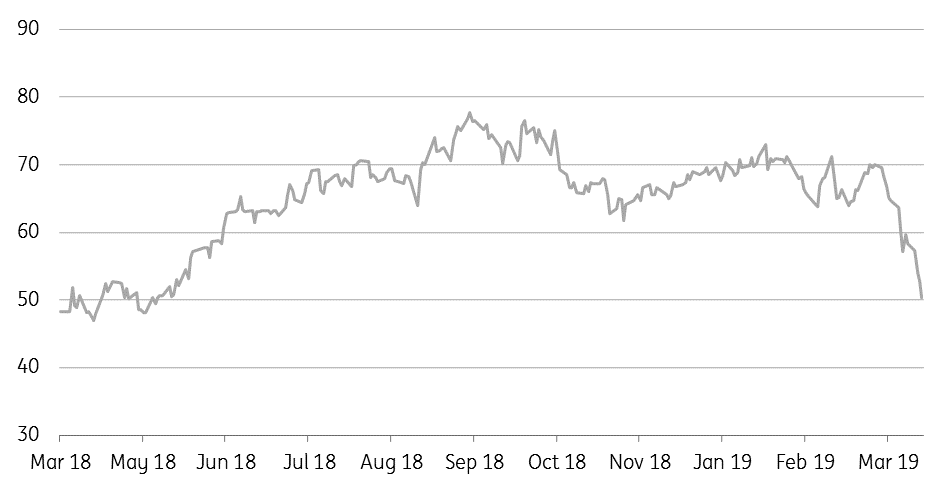

May'19 white sugar premium comes under pressure (US$/t)

Energy

Trump tweets again: The US President once again took to twitter yesterday to show his displeasure towards OPEC+ production cuts. President Trump said that it is “very important that OPEC increase the flow of Oil” and the “price of Oil getting too high.” While the market had an immediate reaction to this tweet, both WTI and Brent settled close to flat on the day.

We continue to hold the view that OPEC+ will largely ignore these calls from the US President, and will remain committed to returning the market to balance. The Saudis have over- complied with the deal, and it would have all been in vain if they were to throw in the towel now. Furthermore, the Saudis are unlikely to forget last year, where they increased output in the lead up to US sanctions on Iran, only for the US to provide waivers to a number of buyers of Iranian oil.

Refined product inventories: The latest data from PJK International shows that refined product inventories in the ARA region increased by 245kt over the last week to total 5.58mt. Gasoil saw the largest increase, with stocks increasing by 150kt over the week, bringing stocks closer towards the five-year average. March has seen an increase of product flows from both the Middle East and the Americas. In fact, flows from the Middle East are on course to reach their highest level since May.

Meanwhile, gasoline inventories in the ARA region declined by 37kt over the week to total 1.03mt, leaving inventories in the region below the five-year average. March has seen a rebound in gasoline flows from Europe into the Americas, with exports over the month set to hit their highest level since at least August. Despite a tightening in gasoline stocks, gasoline cracks have come under pressure in recent days, and this seems to suggest expectations of increased supply following refinery turnarounds.

Agriculture

EU sugar exports: The latest data from the European Commission shows that the EU has exported 953kt of sugar so far in the 2018/19 season, this compares to around 1.87mt at the same stage last year. This shouldn’t come as too much of a surprise given the smaller harvest the EU has seen this season, and this is a trend that is likely to continue into the 2019/20 season with 2019 plantings expected to fall year-on-year. While lower white sugar exports from the EU should be fairly supportive for the whites premium, the May whites premium continues to edge towards US$50/t, but this weakness appears to reflect concerns that the Indian harvest this season might, in fact, turn out to be larger than many were anticipating.

US 2019 plantings: The USDA is set to release its prospective plantings report later today. The market will be watching closely to see what the USDA has to say in terms of area shifting from soybeans to competing crops, in light of the ongoing trade war, and the build-up of US soybean inventories, with Chinese buyers having shunned US soybeans for much of the season. That said, however, there are media reports that Chinese buyers have bought around 1.4mt of US soybeans in recent days for July/August shipment.

Metals

Vale iron ore sales: Vale’s iron ore sales could fall as much as 20% this year with the company having closed mining capacity of around 93mt following the dam accident in January. Vale now expects 2019 sales to be around 307mt, down from their previous estimate of 382mt but largely unchanged from the 309mt in 2018. The spot market is likely to feel the tightness over the course of the year, as producers prioritise contractual obligations.

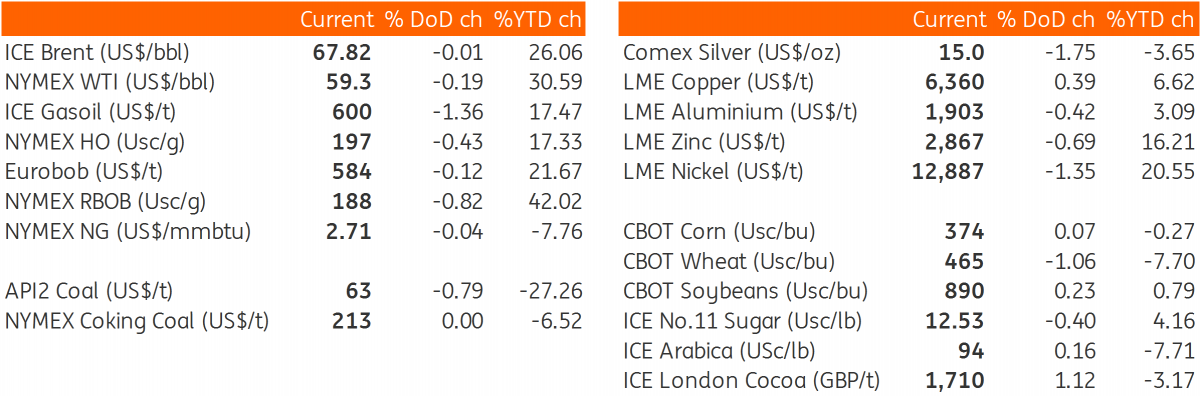

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap