The Commodities Feed: LNG prices rally

Your daily roundup of commodity news and ING views

Energy

While the oil market has remained rather dull lately, the Asian LNG market has seen quite a bit more excitement, with prices having rallied significantly over the last week, and with the market now trading back above US$4/MMBtu. There have been reports of a slight pickup in demand, however this does not justify the rally we have seen. Instead we are seeing some supply concerns out of Australia. The restart of Gorgon’s train 2 has been pushed back to September, rather than July, with maintenance work taking longer than expected. Meanwhile safety regulators have also ordered the inspection of trains 1 and 3, and it’s not yet fully known how these inspections will impact operations. Each of the three trains at Gorgon have a nameplate capacity of 5.2mtpa. It is questionable how sustainable the strength in the Asian market is, with stronger prices likely to lead to stronger spot inflows into the region once again.

Back to oil, and yesterday the EIA released its monthly Drilling Productivity Report, in which they forecast that US shale oil production will fall by 19MMbbls/d month-on-month in September to 7.56MMbbls/d. The number of drilled but uncompleted wells (DUCs) increased by 30 over July to total 7,685. In July, we continued to see a slowdown in drilling, and obviously in well completions, too. In the months ahead, given the lack of drilling activity, we would expect the industry to draw down DUC inventory in order to try to maintain output around current levels.

Finally, the API will release weekly inventory numbers later today. Expectations are that US crude oil inventories fell by around 2.85MMbbls over the last week. If we do see a drawdown, and if this is also confirmed by the EIA tomorrow, it will be the fourth consecutive week of declines in US crude oil inventories. As for products, expectations are that we will see draws of 1.2MMbbls and 1.3MMbbls in gasoline and distillate fuel oil, respectively.

Metals

Base metals have been well supported following China’s recent move to boost liquidity. The People’s Bank of China added CNY700B (US$101 billion) of one-year funding through the medium-term lending facility yesterday in an effort to help the economy recover from the Covid-19 pandemic. LME copper prices have continued to strengthen, heading towards the US$6,500/t mark. Falling LME inventories have also been supportive for the metal, with them falling by over 50% in the past three months, and reaching the lowest levels since 2008. Yesterday, stocks fell by 3.2kt, taking total inventories to just 110kt.

Agriculture

The weekly crop progress report from the USDA showed that corn and soybean crop conditions in the US weakened slightly over the week due to bad weather, especially in the Midwest region. The agency estimates 69% of the US corn crop to be in good-to-excellent condition, compared to 71% last week; but still significantly higher than the 56% seen last year. Meanwhile, 72% of the soybean crop was rated to be in good-to-excellent condition, marginally down from 74% last week, but up from 53% last year. In Iowa, where storms were severe, the share of the crop in good-to-excellent condition dropped from 69% to 59% for corn and from 70% to 62% for soybean.

Data from the National Oilseed Processors Association (NOPA) shows that soybean crushing in the US increased 2.8% year-on-year (+3.3% MoM) to 172.8m bushels in July, and was also above the little more than 170m bushels the market was expecting.

Finally, the latest estimates from the Ukrainian government see the wheat crop totalling 26.5mt this season, down 6.4% YoY, while total grains output for the country is estimated at 72.1mt, which would be 4% lower YoY. The government has also set its wheat export target at 17.5mt for the 2020/21 season, which compares to exports of around 20.5mt last season.

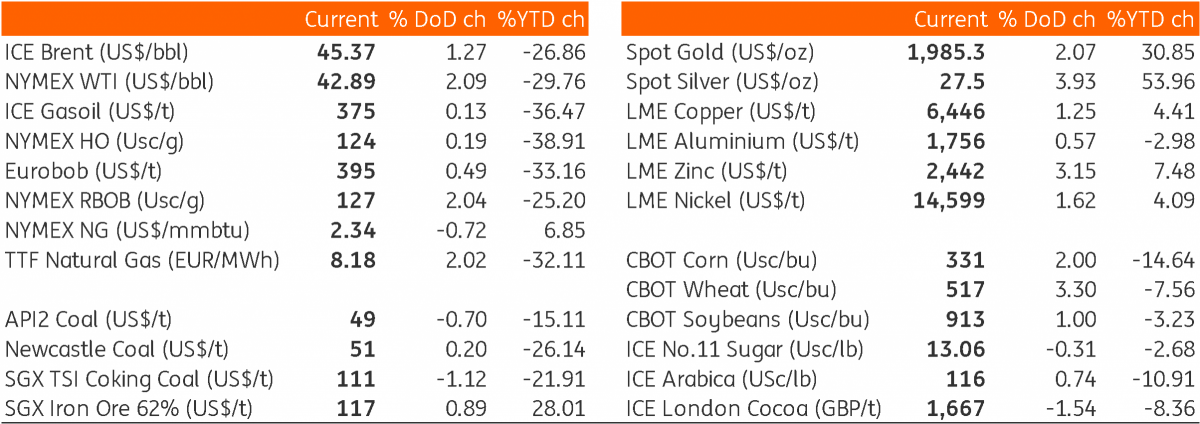

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap