Indonesia: July trade balance moves into substantial surplus, all eyes on BI decision

Imports contract more than anticipated, pointing to slowing economic momentum ahead

| $3.26bn |

July trade balance |

| Higher than expected | |

Trade numbers continue to point to sluggish economic growth

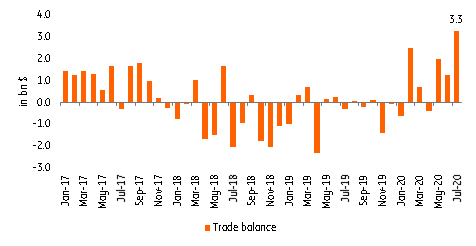

Indonesia’s July trade numbers showed both exports and imports in contraction, highlighting the struggles faced by the global economy due to the pandemic. Exports recorded a 9.9% drop, dragged lower by the more than 50% crash in oil and gas exports while non-oil exports posted a less severe drop of 5.9%. Meanwhile, imports contracted far more than anticipated, falling sharply by 32.5% (versus -19.4% consensus), suggesting that potential output may be stifled, complicating matters for a quick economic rebound. All in all, the trade balance swung into a substantial surplus of $3.26 billion due to the drop off in imports matched by a less severe contraction in exports.

Indonesia trade balance

IDR fails to take notice, weighed down ahead of BI decision

Despite the positive external sector development, the Indonesian rupiah failed to react and remained pressured ahead of the Bank Indonesia policy meeting on Wednesday. We expect Bank Indonesia (BI) to keep policy rates unchanged given the recent depreciation bias for IDR with investors turning anxious over the 2021 budget and on the prospect of another round of “burden sharing” between the central bank and the national government. BI Governor Perry Warjiyo has placed emphasis on currency stability and we expect it to have priority at this policy meeting over the need to provide additional monetary stimulus after 2Q GDP fell 5.3%. BI will likely refrain from additional rate cuts and wait for more stability for the IDR before easing again.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap