The Commodities Feed: Libya oil disruptions

Your daily roundup of commodity news and ING views

Energy

Oil has had a strong start to the day, with ICE Brent touching US$66/bbl in early morning trading, following reports that forces loyal to Commander Haftar in Libya blocked oil exports, as fighting in the country continues. The blockade has seen the National Oil Corporation (NOC) declare force majeure, and warn that production could fall to just 72Mbbls/d in the coming days once storage tanks are full. Prior to the blockade, Libya was producing around 1.2MMbbls/d. A prolonged disruption from Libya would be enough to swing the global oil market from surplus to deficit in 1Q20. While, if a disruption of this magnitude was to last through until 2Q20, it would be enough to bring the global market to balance over the second quarter. Disruptions for the market do not stop there. In Iraq, OPEC’s second-largest producer, the 70Mbbls/d Al Ahdab oilfield was forced to shut, with security guards blocking access to the oilfield, as they seek permanent employment contracts. Meanwhile, there are reports that the 50Mbbls/d Badra oilfield is at risk of having to shut today as well.

Looking at the Commitment of Traders report, there was little change in speculative positioning in ICE Brent over the last reporting week. However NYMEX WTI saw significant liquidation, with speculators selling 62,636 lots over the reporting week, to leave them with a net long of 225,794 lots as of the 14th January. Meanwhile looking at Henry Hub natural gas, speculators continued to increase their net short over the last reporting period, selling 19,528 lots, leaving them with a net short of 269,944 lots - a record net short. However, this position is likely to be even larger at the moment, with Henry Hub coming under renewed pressure more recently, which has seen prices fall below US$2/MMBtu. This weakness is really reflective of the state of the global gas market, where all regions have an abundant supply. In the US natural gas inventories stand at 3.04Tcf, which is 494Bcf above levels seen at the same stage last year, and 149Bcf above the 5-year average. Meanwhile, forecasts for warmer than usual weather in the US have done little to offer support to the US market.

Finally looking at the week ahead, and in terms of data releases, it will be fairly quiet for the oil market. Today the US is off for Martin Luther King Jr Day, and as a result, the usual US releases will be delayed by a day. API inventory numbers will be published on Wednesday, while the EIA weekly report will come out on Thursday.

Metals

Last week's phase-one deal signing saw copper consolidating towards the US$6,300/ tonne level, while GDP data from China on Friday, along with better than expected industrial output and retail sales numbers provided further support. Meanwhile, inventories for LME metals continue to decline, and aluminium inventories saw their largest weekly decline since 1995. Despite this, spreads for the metals remain in contango, with the exception of zinc, where the cash/3M spread is trading at US$19.75 backwardation.

Turning to Ferrous metals, iron ore producer, Rio Tinto released its quarterly numbers on Friday, which showed total shipments stood at 74mt in 4Q19 - largely flat when compared to the previous quarter. Although total shipments for 2019 were down 2.4% YoY, they were still in line with guidance of 276-284mt for the year. The company also revised higher its previous 2020 shipment guidance by 5% to 285-296mt (+3% YoY). Looking ahead to this week, we will see quarterly results from both BHP and Anglo American. Meanwhile, latest inventory data from Steelhome shows that Chinese weekly iron ore port inventories declined by just 550kt, to stand at 127mt as of 17 January. We might see much lower outflows in stocks over the next week due to slowing demand as we move close to the Lunar New Year holidays. Meanwhile, the latest data from NBS shows that China’s monthly crude steel production increased by 5% MoM and 12% YoY to stand at 84.27mt in December. This took full-year 2019 steel production to 996mt, up 8.3% YoY.

Agriculture

Given the recent rally we have seen in sugar, it is no surprise that the latest CFTC data show that speculators boosted their net long in No.11 raw sugar by 64,006 lots over the last reporting week, leaving them with a net long of 77,076 lots - the largest net long speculators have held in sugar since Q4 2018. The latest production data out of India will likely continue to underpin the market, with cumulative output this season through until 15 January, totalling 10.89mt, down 26% YoY. Meanwhile, looking at Indonesia, sugar refiners in the country are still awaiting import licenses for raw sugar which were meant to be issued in December. The local industry group has said that 9 of the 11 refineries in the country may have to suspend operations by the end of this month if there is a further delay in issuing import licenses. The longer it takes the government to issue permits, the more of an impact it would have on raw sugar demand in the near term, with Indonesia the largest raw sugar importer in the world.

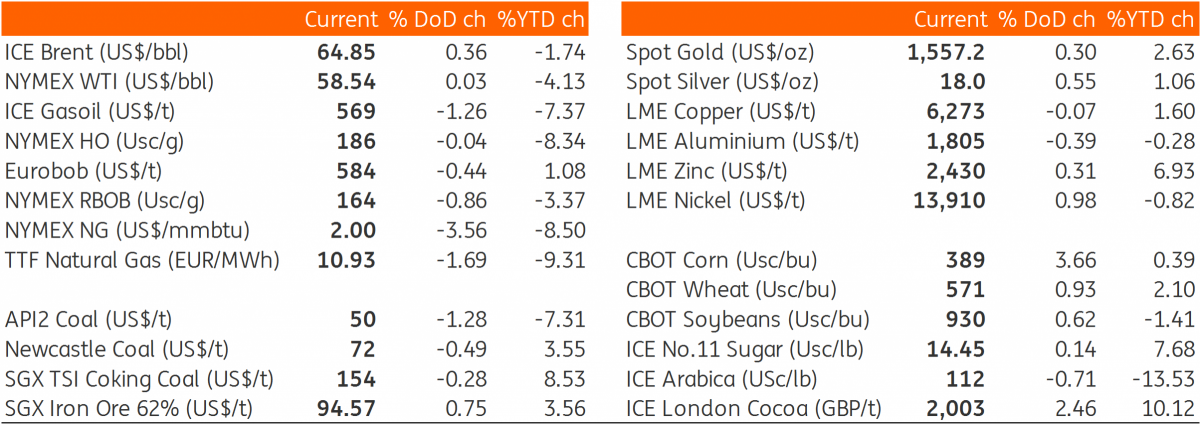

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap