The Commodities Feed: US gasoline imports soar

Your daily roundup of commodity news and ING views

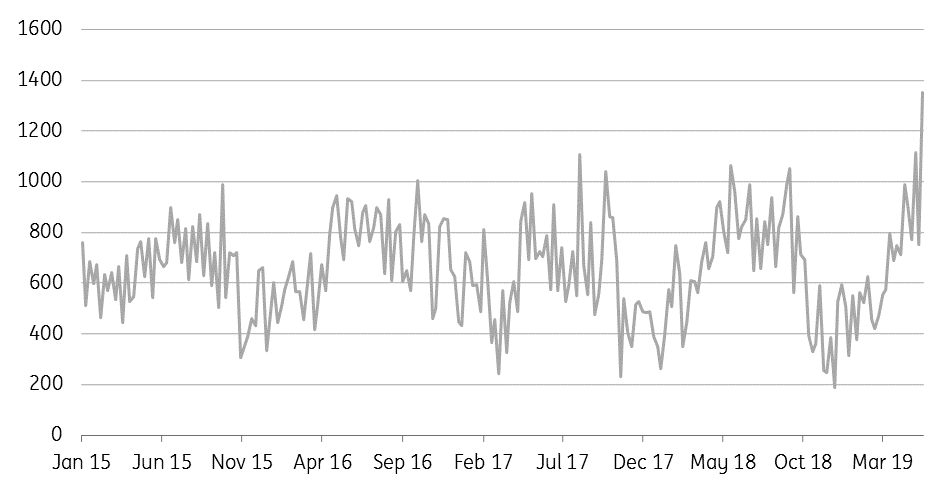

US weekly gasoline imports soar (Mbbls/d)

Energy

US crude oil inventories: The EIA reported yesterday that US crude oil inventories increased by 4.74MMbbls over the last, more than the 2.4MMbbls increase the API reported, and very different from the 1.7MMbbls drawdown the market was expecting. Cushing inventories increased by 1.27MMbbls over the week, taking stocks at the WTI delivery hub to 49.1MMbbls- levels last seen in late 2017. These builds should continue to keep the pressure on the WTI/Brent spread.

Low refinery run rates remain the key to these crude oil builds, and over the last week run rates fell below 90% once again. Despite lower refinery throughput, gasoline inventories increased by 3.72MMbbls. This build was a result of strong imports, with gasoline imports increasing by 598Mbbls/d over the week to total 1.35MMbbls/d- the largest weekly number seen since May 2011. These strong inflows of gasoline continue to be the key behind the gasoline inventory drawdown that we have seen in Europe for much of the year, and are also the key supportive factor for European gasoline cracks.

Metals

LME Nickel spreads: LME nickel spreads have been tightening this month, as LME inventories continue to decline. The June/July spread swung into backwardation last week, reaching a high of $50/t, and now trades at around $32/t. LME nickel inventories have fallen by more than 42kt so far this year, leaving inventories at around 165kt- the lowest level seen since 2013. On-warrant stocks suggest an even tighter market, standing at just 101kt. Similarly, SHFE nickel stocks stand at a five-year low of 8.8kt as of 16 May 2019, with 6.5kt of stocks withdrawn since the end of 2018.

Albras aluminium output: Following the lifting of production embargoes at Hydro’s Alunorte alumina refinery in Brazil, the Albras aluminium smelter is set to return to full capacity as well. The smelter, which has a capacity of 460ktpa, has been operating at 50% capacity since April 2019. Hydro expects the Albras smelter to be operating at full capacity over the 2H19.

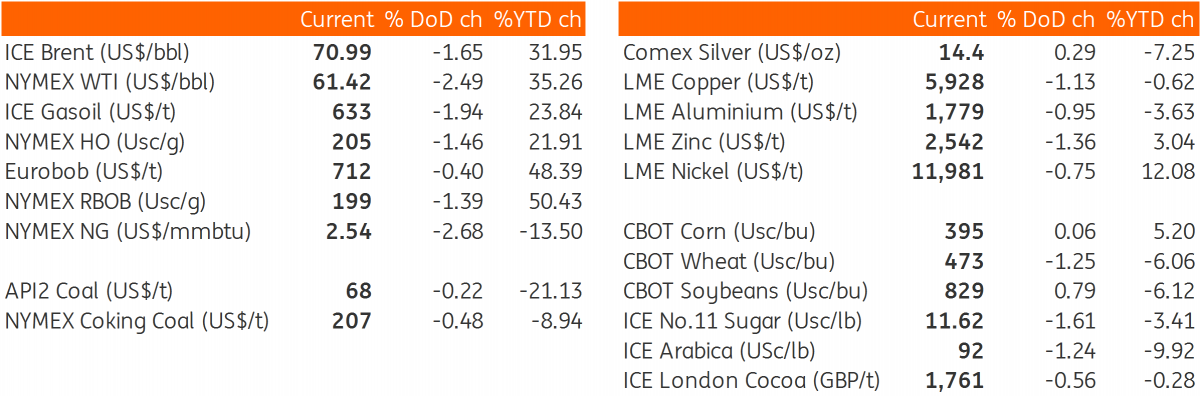

Daily price update

Download

Download snap