The Commodities Feed: Further spread strength

Your daily roundup of commodity news and ING views

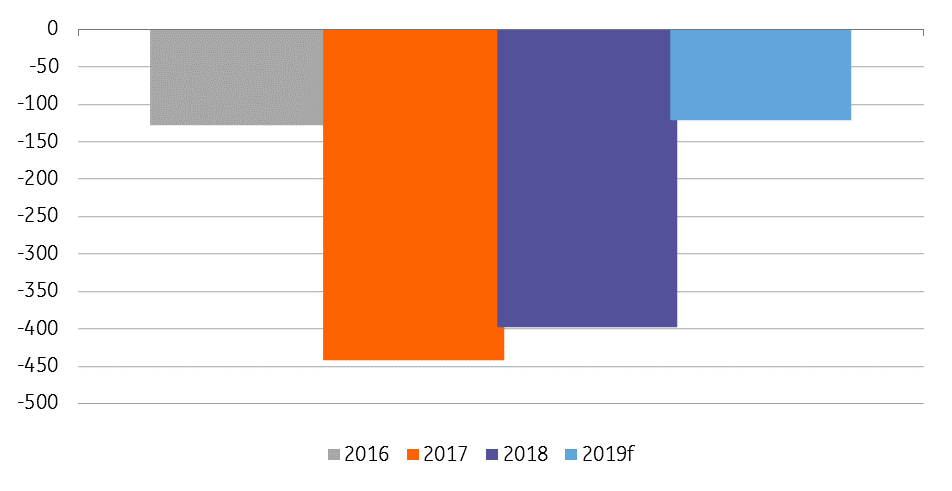

Global refined zinc supply/demand balance (k tonnes)

Energy

Deeper into backwardation: ICE Brent prompt spreads continue to move deeper into backwardation, with the Jul/Aug spread trading to as high as US$0.93/bbl, up from US$0.75/bbl on Wednesday. While trade war concerns have weighed largely on the flat price this week, the spreads clearly point towards a tight market. Meanwhile, following the increase in the Saudi’s official selling price to all regions except the US for June, the Iraqis increased their official selling price for Basrah Light into Asia by US$0.60/bbl to US$1.60/bbl over Oman/Dubai for June shipments.

Refined product inventories: Latest data from PJK International shows that refined product inventories in the ARA region fell by 308kt over the last week to total 5.37mt. The drawdown in stocks was led by gasoline, with inventories declining by 184kt to total 847kt. Gasoline flows from Europe to the Americas have been strong, with US gasoline inventories continuing to trend lower as we move into the summer months. The prolonged refinery maintenance season in the US has clearly been bullish for gasoline cracks, and we expect these cracks to remain well supported, given where US gasoline inventories stand.

Metals

US tariffs come into effect: The US tariff hike on US$200 billion of Chinese goods came into effect this morning and with this hopes for a quick resolution also faded. Discussions between China and the US were held yesterday, and are set to continue today. China has said that it will be forced to retaliate, although measures are yet to be announced. The deterioration in trade talks has been supportive for gold prices, although oddly ETF holdings in gold have continued to trend lower over the course of this week.

Zinc supply/demand balance: In its latest forecasts, the ILZSG estimates that the global zinc market will be in deficit by 121kt over 2019, smaller than the 398kt deficit seen in 2018. Mine supply is expected to increase by more than 6%, with increases coming largely from Australia, China and South Africa. Refined zinc output is estimated to increase by 3.6% year-on-year to 13.65mt, while demand is expected to rise modestly by 0.6% YoY to 13.77mt.

Agriculture

WASDE release: The USDA will be releasing its monthly WASDE later today, and the report will also include the agency’s first estimates for the 2019/20 season. For US wheat, despite a lower area for 2019, market expectations are that production for 2019/20 will increase from 1.88b bushels to a little over 1.9b bushels, given the great condition of the crop. Unsurprisingly, the market is expecting US corn output to increase from 14.42b bushels to 14.84b bushels on the back of farmers switching area from soybeans to corn. Looking at the global balance, market expectations are that for soybeans and wheat we will see an increase in ending stocks for 2019/20, whilst corn ending stocks are expected to edge lower, despite the area increase in the US.

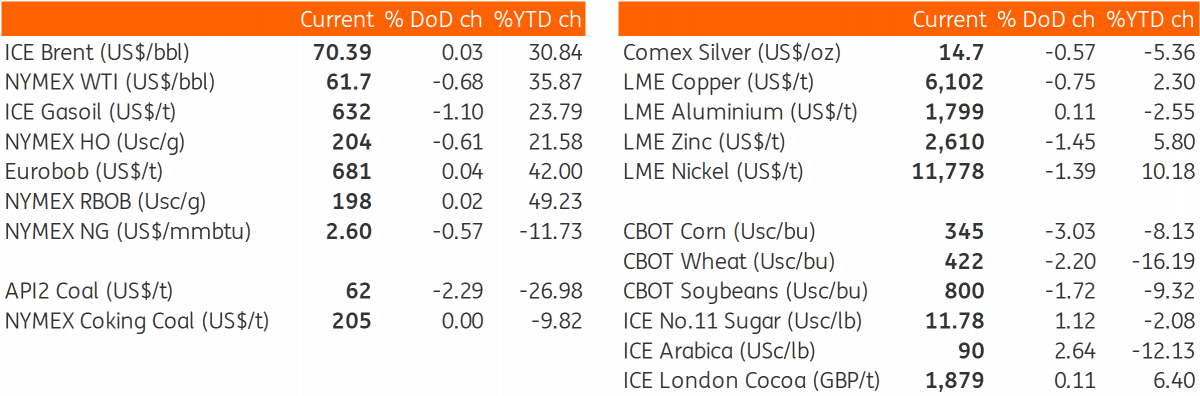

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap