The Commodities Feed: Downward pressure resumes

Your daily roundup of commodities news and ING views

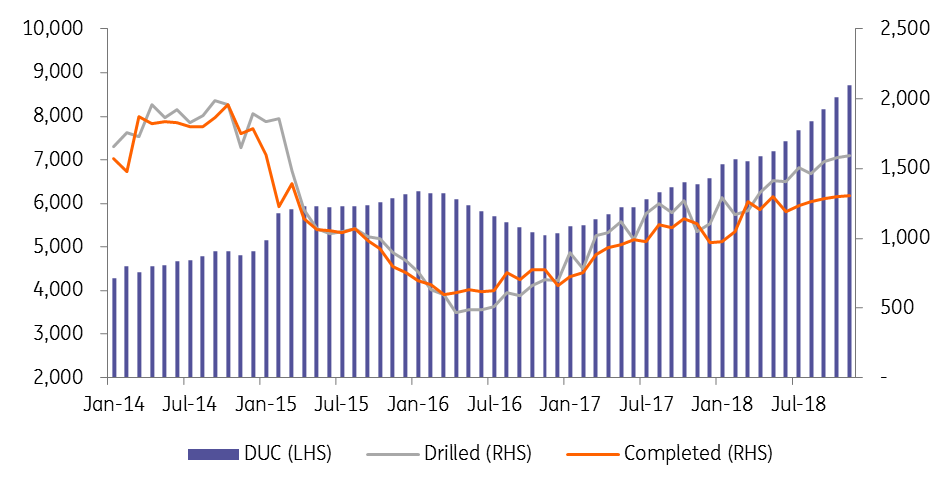

Drilled but uncompleted wells in the US continue to rise

Energy

Oil under pressure: The oil market has come under renewed pressure with WTI settling below US$50/bbl yesterday, while Brent settled below US$60/bbl. A large part of the move is due to a broader market sell-off, with both US and Asian equity markets coming under pressure. Meanwhile specifically for the oil market there are no clear signs yet of the market tightening, with this likely to only happen when OPEC+ cuts come into force on the 1 January. Meanwhile later today the API will release its weekly inventory numbers, and if their number is aligned with market expectations for a 3.25MMbbls draw, this could offer some immediate support to the market.

US oil drilling: In their latest Drilling Productivity Report, the EIA estimates that US shale oil production will rise by 134Mbbls/d to 8.17MMbbls/d in January. They also revised higher their estimate from last month for December 2018 production from 7.94MMbbls/d to 8.03MMbbls/d. Meanwhile the number of drilled but uncompleted (DUCs) wells increased by 287 over the month, to total 8,723 by the end of November. While the build-up in DUCs in recent months has been driven more by constraints rather than unattractive prices, the latter could become more of a driver if the current weak price environment lingers on for much longer.

Metals

China copper output: Chinese refined copper output increased 4.3% MoM (-2.3% YoY) to 768kt in November 2018, with YTD output up 1% YoY to 8.17mt. In order to support refined copper production, copper concentrate imports increased 17% YoY to 18.3mt over the first 11 months of 2018, as copper scrap availability fell due to restrictions imposed on scrap imports. China’s copper scrap imports declined 33% YoY to 2.2mt over the first 11 months of 2018. There will be further downward pressure on scrap imports in 2019, with a full ban on category 7 scrap imports coming into force.

Precious metal ETF holdings: ETF investors bought nearly 0.9mOz of gold over the past two weeks, with them now holding 69.6mOz of gold, the largest since late July. Stressed financial markets and concerns that the US Federal Reserve are becoming slightly more dovish has increased demand for the metal. On the other hand, investors continue to sell silver, with 6mOz of ETF holdings liquidated since the start of the month; total known ETF holdings of silver now stand at a six month low of 523.5mOz. Palladium continues to see ETFs being sold and physical metal leased onto the market, with holdings falling by 19.3kOz of ETF being sold since the start of the month.

Agriculture

Second round of aid for US farmers: The USDA announced yesterday that they will be making available the second and final round of payments to US farmers affected by retaliatory trade tariffs on US agricultural products. Farmers will be able to receive Market Facilitation Program payments for the second half of 2018 production. This second round of payments would bring total direct payments to almost US$9.6b.

US export inspections: Latest data from the USDA shows that 975kt of soybeans were inspected over the last week for export, this compares to 927kt the week before, and is significantly lower than the 1.8mt inspected in the same week last year. In terms of destination, there was no volume inspected for China. Meanwhile 885kt of corn was inspected for export over the week, up from 876kt in the previous week, and somewhat higher than the 637kt seen in the same week last season.

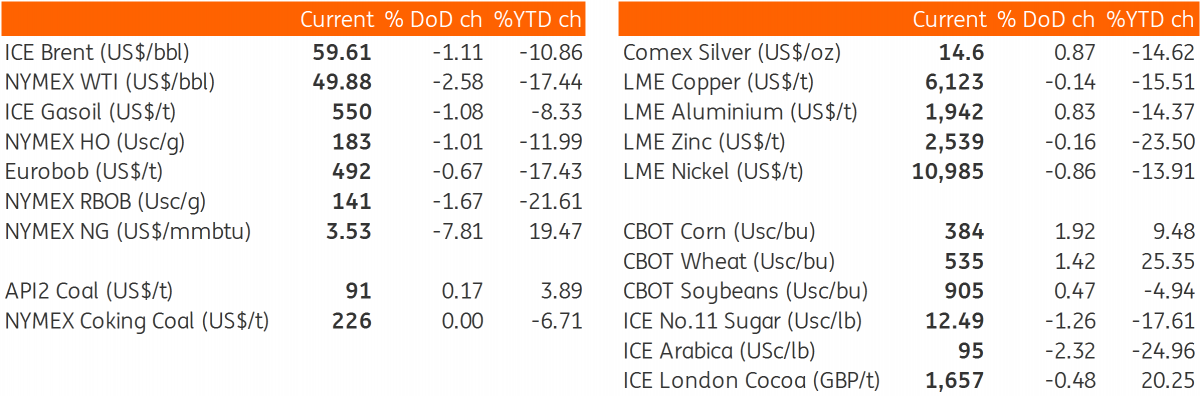

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap