Briefing Romania

Waiting for the 2019 budget draft

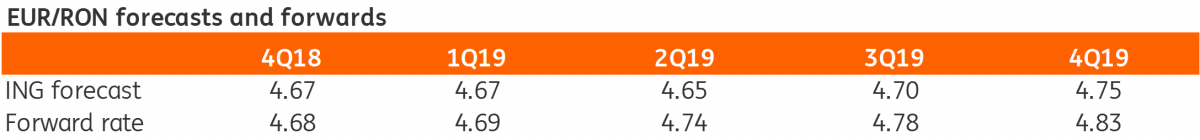

EUR/RON

EUR/RON closed the day near the opening level after following a downside trend for most of the trading session. The market seems to be in holiday mood already, but some news on the political front could still impact the leu. We expect the government to present the general budget draft for 2019 in the coming days - something which could bring something for the market to chew.

Government bonds

A somewhat volatile session for ROMGBs yesterday. The market mood turned less positive and the curve shifted 4-5 basis points higher. The October 2021 auction didn’t go that well mainly due to the poor demand with bid-to-cover ratio at 0.65x. Yield-wise it came out slightly above expectations but still within the bid-offer spread, at 3.79/3.80% average and maximum. RON289 million have been allocated versus the 600 million target.

Money Market

Some shy paying interest in the back-end of the money market curve pushed implied yields c.8 basis points higher. The 1M-1Y curve is all within some 60 basis points now, which looks more in line compared to this year’s average. This could change again on the back of the usual heightened volatility into the year-end.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap