The Commodities Feed: Cushing inventories decline

Your daily roundup of commodity news and ING views

Energy

Oil markets rallied yesterday, with WTI strengthening by almost 6.8%, managing to settle above US$25/bbl, and dragging ICE Brent higher with it. Along with this flat price strength, time spreads have also rallied significantly, with the prompt WTI spread now trading at a contango of just US$0.51/bbl - levels last seen back in March, whilst the prompt Brent spread is trading at a contango of around US$0.86/bbl. Concerns over hitting storage capacity have eased, as we see demand gradually recovering, along with supply cuts hitting the market. While the API reported yesterday that US crude oil inventories increased by 7.58MMbbls, they also showed that inventories at Cushing, the WTI delivery hub, declined by 2.26MMbbls, which if confirmed by the EIA later today, would be the first inventory drawdown at Cushing since February.

Sticking with WTI, and looking at open interest for contracts on the board, it is the Dec-20 contract which holds the largest open interest, rather than the Jul-20 contract, which is the soon-to-be front-month contract. A large part of this positioning further down the board is a reflection of oil funds rolling positions into further dated contracts, partly due to the steep contango seen recently at the front end of the forward curve. For example, the US Oil Fund, which in the past held its position at the front end of the curve, now holds the bulk of its position in the Dec-20 contract. Since a number of funds have made these changes, the contango at the front end of the curve has narrowed significantly.

Finally, in its latest "Short Term Energy Outlook", the EIA revised lower its forecast for US crude oil production this year by 70Mbbls/d to average 11.69MMbbls/d, which would be down 540Mbbls/d YoY. For 2021, the EIA is forecasting that output will fall by a further 790Mbbls/d YoY.

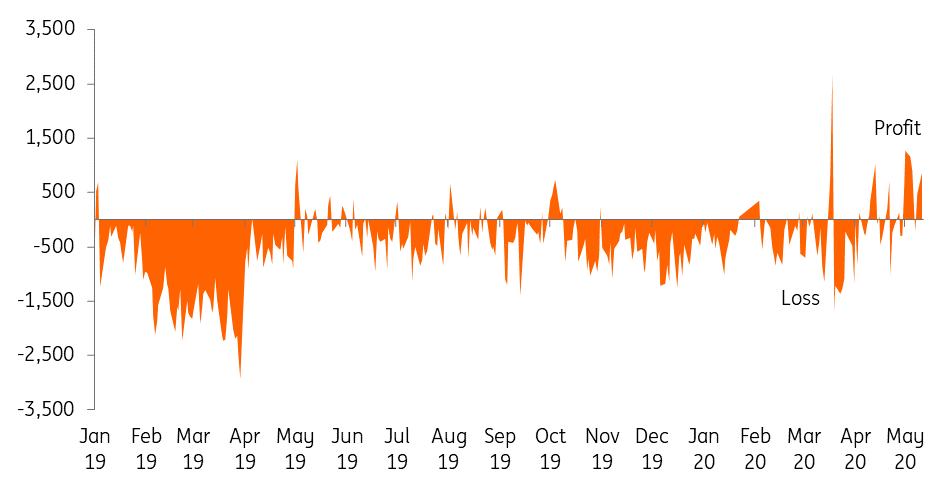

Chinese copper physical arbitrage profit/loss (CNY/t)

Metals

LME copper remains fairly well supported, with some support coming from the Chinese market. Given the opening in the China import arbitrage recently, the Yangshan premium has surged to the highest levels seen since late 2018. The premium on warehouse warrants has touched as high as US$115/t, while the premium on the bill of lading has surpassed US$100/t, suggesting an increased appetite for imported copper. This increased appetite for imports is the likely driver behind the recent drawdown in LME copper inventories, which has mostly occurred in Asian based warehouses. Although in the Chinese domestic market, the physical premium has flipped to a discount, implying the short term tightness may have eased. However, the nearby SHFE copper spread remains in deep backwardation, in contrast to the contango seen in the LME copper market.

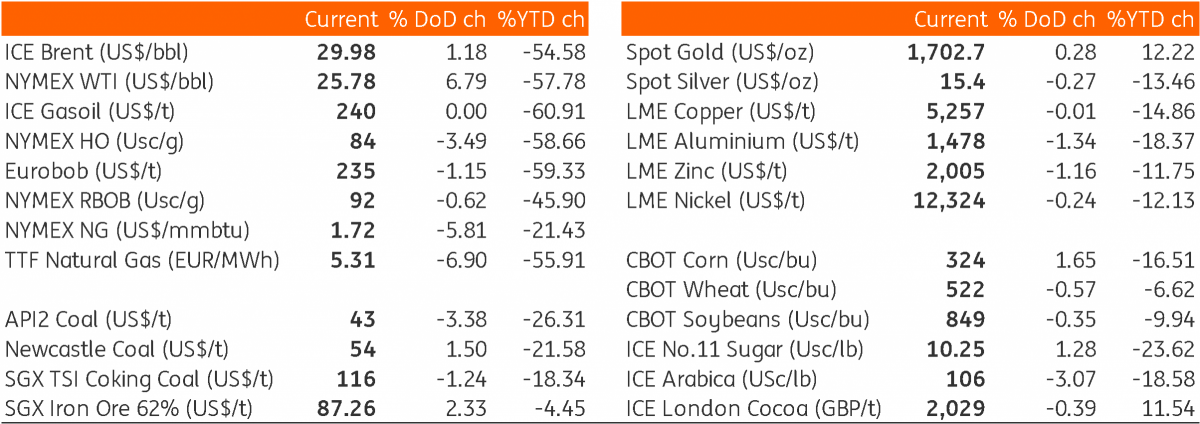

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap