The Commodities Feed: Crude cools as geopolitical tensions ease

Your daily roundup of commodity news and ING views

Energy

ICE Brent settled below $65/bbl on Friday and has been trading flat this morning as geopolitical tensions in the Middle East continue to cool down. Over the weekend, Iran admitted to having shot down the Ukrainian plane unintentionally, which helped shift the focus away from the US/Iran conflict for now. Exchange data shows that managed money was very bullish on oil prices last week, with speculative net longs increasing to 425,763 lots (+15,233 lots week-on-week) as of 7 January, the largest net long position since October 2018. But it appears that some of these longs have now been liquidated, as geopolitical tensions subside.

Meanwhile, the spread between WTI and Western Canada Select widened to $24/bbl on Friday, the widest level since November 2018, as Canadian production recovered while disruptions at transit routes (including a rail strike in late 2019 and a temporary outage at a Keystone pipeline) reduced offtake and resulted in inventory build-up in Canada. It is yet to be seen whether the current higher discount could lead to production curtailments in Alberta as seen in 2018.

Turning to US oil production and Baker Hughes data shows that active oil rigs in the US dropped by 11 last week with the total number of active oil rigs falling to 659 as of 10 January. The rigs are at the lowest level since March 2017, reflecting the slowdown in exploration activity in the US, as oil prices continue to trade in a tight range of $60-70/bbl. However, the US still has plenty of Drilled-but-Uncompleted wells, counted at 7,574 as of the end of November 2019, and completions of these would keep production growth healthy.

Metals

The LME metals complex recovered last week as geopolitical tensions eased while macro expectations continue to look promising in the near term. While the US's new sanctions on Iranian metal exports initially boosted the market, we think Iran's supply in the global picture is fundamentally rather small. This week, the market could be more focused on the 'phase one' trade deal, which is supposed to be signed on Wednesday.

- LME copper has been trading firmer, breaking $6,200/t as LME copper inventories dropped by around 12kt over the past week to total 133kt, the lowest level since March 2019 on tight supply.

- LME zinc strengthened by 3.1% on falling LME inventories and optimism over Chinese demand once the trade deal is signed.

- LME nickel also gained more than 3% over the past week on tight supplies from Indonesia (as the ore export ban has been implemented) and increasing demand from the electric vehicle-battery sector. Beijing recently hinted that it will not cut down on NEV subsidies this year, which will be supportive for NEV sales in 2020. Looking ahead to the current week, China will release preliminary trade data tomorrow and macro-economic data (including GDP, industrial production and retail sales) on Friday, which will be watched closely for clues on domestic demand for metals.

LME aluminium has seen increased orders to withdraw metals from LME warehouses with the cancelled warrants for LME aluminium increasing to 614kt as of Friday, compared to 562kt a week ago and as low as 94kt on 16 December. The aluminium forward curve continues to trade in deep contango (a premium of $111/t for 15M contract over the cash prices) which makes financing deals more attractive, especially in the current low-interest-rate environment, and more of the metal could end up being locked into financing deals.

Agriculture

The USDA’s monthly WASDE report was fairly neutral for the market, with crop production estimates revised marginally higher as lower acreage largely offset the higher yields. For corn, the USDA estimates US production to be around 13,692m bushels in 2019/20 against its earlier estimates of 13,661m bushels while for soybeans, production estimates were revised up marginally from 3,550m bushels to 3,558m bushels. Globally, corn ending stocks estimates were revised down from 300.6mt to 297.8mt on expectations of stronger demand than initially estimated.

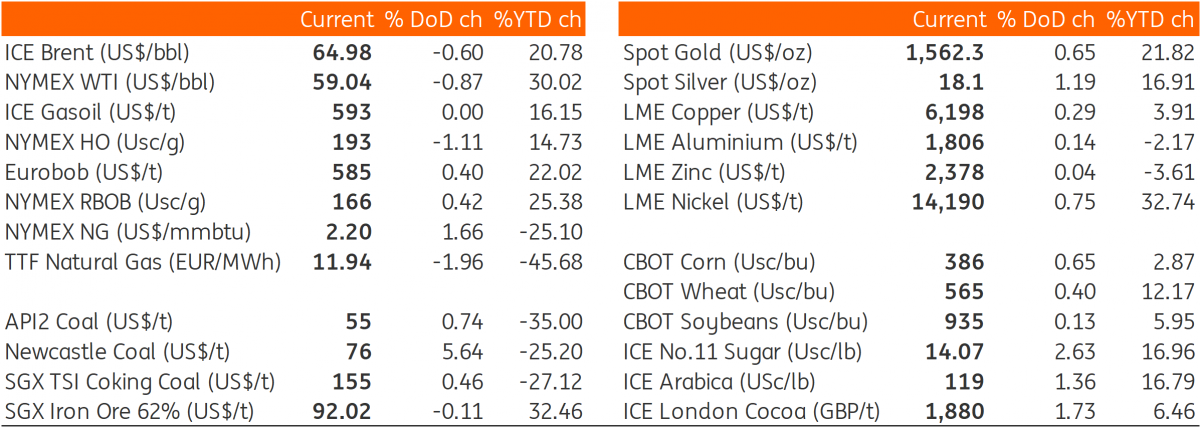

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap