Russia: higher FX interventions warrant caution over RUB

The increase in the Bank of Russia's FX purchases to an 18-month-high of $5.9bn in January amid import-driven contraction in the current account surplus could increase RUB vulnerability to volatile capital flows. A negative market surprise could trigger profit-taking after the 2019 rally. We continue to expect USDRUB to return to a 62-64 range in 1Q20.

| 310 bn |

Minfin FX purchases for January 2020 in RUBUp from RUB196bn in December 2019 |

| Higher than expected | |

FX interventions up to 18-month high in January 2020...

The Russian government is increasing monthly FX interventions in January 2020, against a backdrop of a strong oil price environment combined with possible increases in physical volumes of oil production and exports.

The Minfin has announced it will spend RUB310bn (equivalent to USD5.1bn at the current exchange rate) for FX purchases between 15 January and 6 February, much more than the RUB220bn we were expecting and the consensus figure of RUB230-240bn. This amount comes from the RUB245bn in extra fuel revenues in the budget that's expected in January and from the RUB65bn upward revision in extra fuel revenues for December last year - both coming mostly from the Brent price rising to the $65-70/bbl range in the second half of December and the beginning on January. Combined with the August-December 2018 backlog, when the central bank put market purchases on hold, the total amount of FX to be purchased on the market will be approximately $5.9bn in January, up from $4.1bn the previous month.

The amount of monthly FX purchases in January 2020 will be the highest in USD terms since June 2018, when the Bank of Russia purchased $6.0bn in an environment of oil prices fluctuating around $75/bbl. According to our estimates, if the oil price remains unchanged at the current level of $65/bbl in 2020, also very close to the 2019 average, the amount of market FX purchases will increase from $51bn in 2019 to around $60bn in 2020. That sum might be reduced by up to $6bn if the Finance Ministry follows through on the plan to invest around RUB300bn from the already accumulated National Wealth Fund in local currency.

Monthly FX purchases by Russian Finance Ministry/Central Bank

...sterilizing up to 65% of expected current account surplus in 1Q20 and 100% in 2020

The key question for the RUB exchange rate linked to increased FX purchases is whether Russia's current account is big enough to finance the mandatory interventions. Our answer for 1Q20 is positive, thanks to seasonality. We do note that the relative strength of Russia's current account is declining due to accelerating imports amid stagnating non-oil exports. With the 4Q19 balance of payments due to be released on 17 January, preliminary monthly data points to a likely acceleration in import growth to the 10-15% YoY range in 4Q19, after flat 9M19 performance - reflecting a pick up in investment activity and a reaction to prevous ruble strength. Should this trend be confirmed and continue in 1Q20, it will lead to the current account surplus shrinking from $34bn in 1Q19 ($11bn per month) to $25bn ($8bn per month) in 1Q20, despite a similar oil price environment.

This means FX purchases will sterilize up to 65% of the current account surplus in 1Q20 vs. 40% in 1Q19 - and will likely exceed the seasonally weak current account surplus in 2-3Q20. This surplus will face additional pressure from outgoing dicidend payments attributable to Russian corporates' non-resident shareholders. For full 2020, under an unchanged oil price scenario up to 100% of the current account suplus could be sterilized through FX purchases vs. around 70% in 2019 - highlighting the gradual increase in exchange rate vulnerability to capital flows.

We see USDRUB back in 62-64 range in 1Q20, see more risks further into 2020

A combination of shrinking current account surplus and stable or growing FX interventions is eroding fundamental support for the ruble exchange rate and is increasing its vulnerability to capital flows. These are subject to multiple risks, including possible mood swings on the global markets and Russia-specific challenges related to limited downside to the key rate, increased supply of state local debt, continuing accumulation of international assets by local households and corporates, and persisting risk of sanctions rhetoric re-emerging towards year-end due to the US electoral cycle.

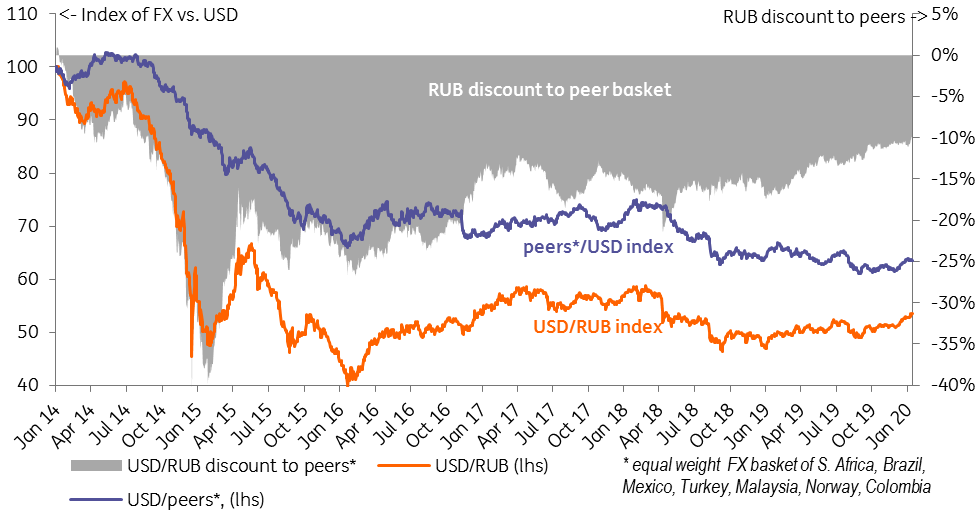

As a result, while we acknowledge the favorable market environment for the RUB exchange rate for the coming couple of weeks, we believe that in the medium to longer-term any negative surpise to expectations may become a trigger for profit taking after a very successful 2019. RUB gained 12% vs USD over the course of 2019, outperforming its EM and commodity peers, and reducing its country-specific discount from 17% to 10%, the narrowest gap since August 2014.

We see USDRUB returning to the 62.0-64.0 range towards the end of 1Q20 and see risks of further depreciation throughout the year as a base case. Factors that could prove our forecast from being overly pessimistic include continued EM risk appetite (USD weakness) throughout 2019, any sharp increase in oil prices, any improvement in rating agencies' take on Russia, a decline in sanction risks, and sustainable underperformance of CPI relative to expectations.

USDRUB performance vs. EM/Commodity peers

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap