The Commodities Feed: China soybean purchases

Your daily roundup of commodity news and ING views

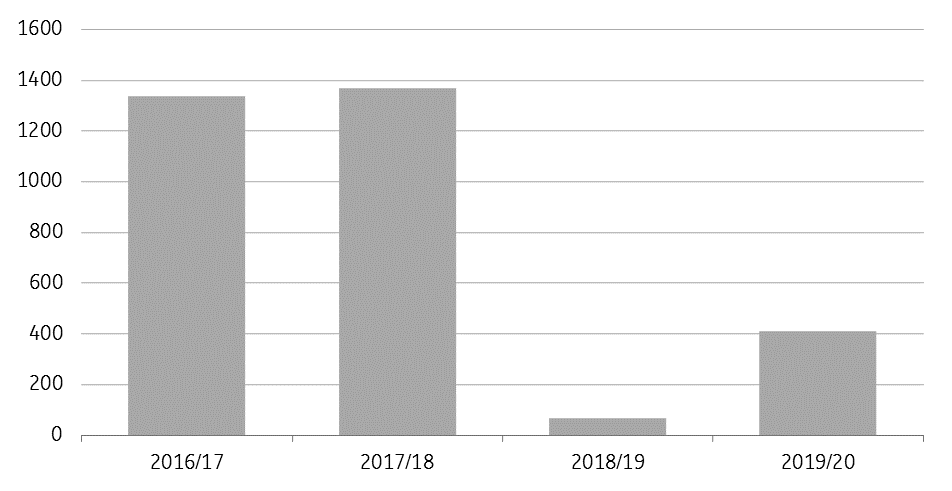

Cumulative US soybean export sales to China- first 2 weeks of marketing year (k tonnes)

Energy

US oil inventories & gasoline cracks: The API is scheduled to release its weekly inventory report later today, and according to a Bloomberg survey, expectations are for a 600Mbbls drawdown. However, there have been a number of refinery disruptions over the last week as a result of Tropical Storm Imelda which hit Texas. Reduced run rates, as a result, could, in fact, see inventory numbers surprise this week. These disruptions have continued to offer support to the RBOB crack, which has strengthened from US$8/bbl at the start of the month to US$10.72/bbl currently.

Strength has also been seen in European gasoline cracks in recent weeks, and this appears to be on the back of stronger flows of gasoline to the Middle East following the Saudi attacks. Reuters reports that over 400kt of gasoline has been booked over the past week for loading between the 21 and 26 September. At least for now though, gasoline inventories in the ARA region remain more than comfortable, with them sitting above the five-year high.

Metals

LME nickel stocks: Cancelled warrants for LME nickel stocks increased by 16,008 tonnes yesterday, pushing up total stocks earmarked for withdrawal to a year high of 87,462 tonnes. Combined with the inventory drawdown over the past few weeks after Indonesia announced bringing forward the export ore ban, LME nickel on-warrant inventory has now dropped to at least a decade low of 69,492 tonnes as on 23 September. The squeeze on physical stocks has pushed the LME nickel cash/3M spread to US$205/t on 20 September, although it has softened to US$125/t since then, but still remains significantly high compared to historical averages.

Copper market balance: Monthly data from the ICSG shows that the global deficit for copper widened to 220kt over the first six months of 2019 after copper supply fell short of demand by 21kt in June. Global copper production dropped 1.1% YoY to 11.74mt over the first half of the year, while demand fell 0.7% YoY to 11.96mt. Lower output from Chile, India, and Zambia has weighed on the copper market balance. However, despite the widening supply gap, LME copper stocks have increased by around 152kt for the year to date.

Agriculture

China buys US soybeans: Reuters reports that Chinese importers have purchased about 600kt of US soybeans for Oct-Dec shipment, which follows trade talks in Washington last week, and just ahead of further talks next month.

Bloomberg also reports that China has provided importers with new tariff waivers to purchase between 2-3mt of US soybeans. The news has not seen a significant move higher in CBOT soybeans, with the market still trading below the US$9/bu mark. Cumulative export sales for the current marketing year, up until the 12 September stand at 410kt, which compares to around 1.4mt for the same period in the 2017/18 marketing year, and just 67kt in the 2018/19 marketing year. Further purchases moving forward could put pressure on Brazilian cash values, which have already fallen from a recent peak of around US$1.50/bu in August to US$0.90/bu currently.

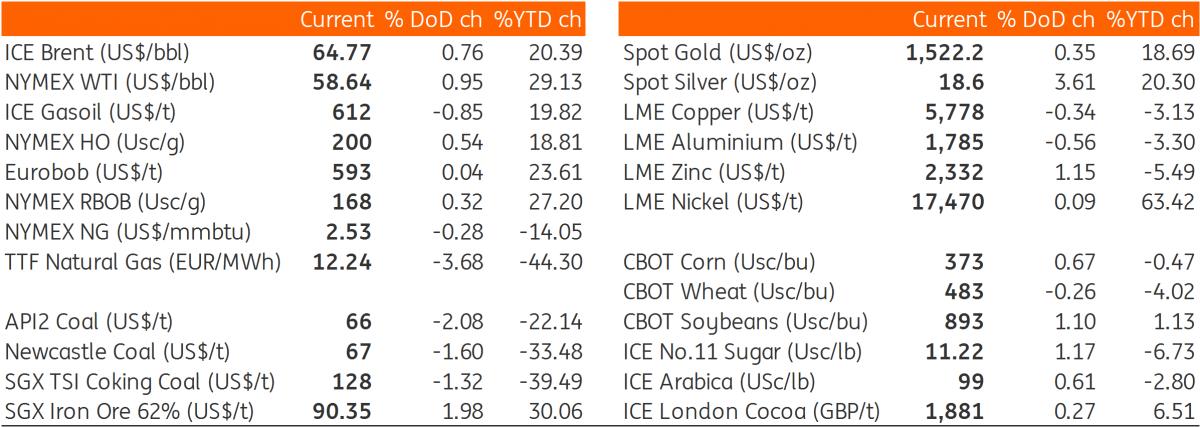

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap