Briefing Romania

Relatively weak June-2024 auction

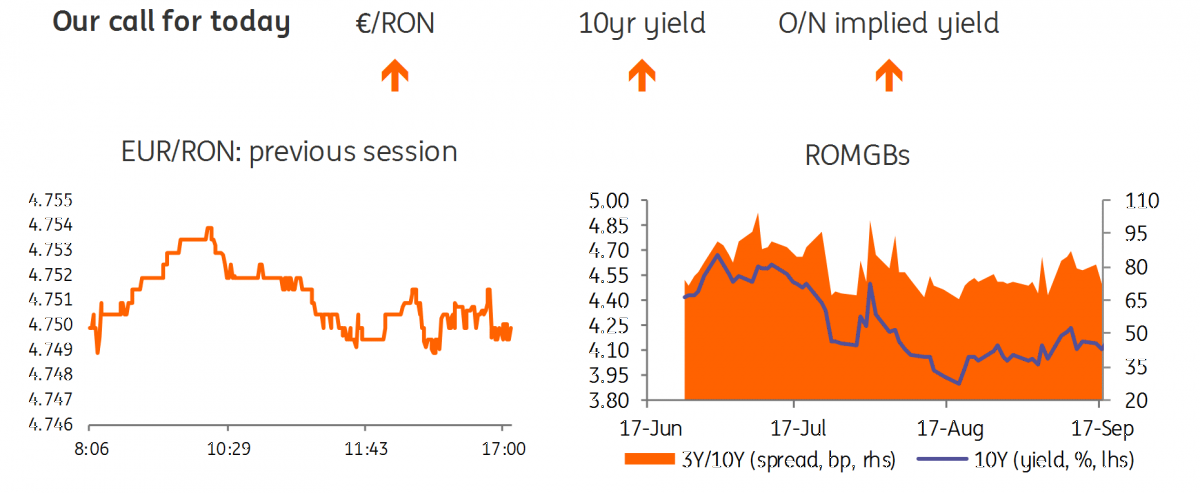

EUR/RON

As expected, the Romanian leu remained stable around 4.7500 yesterday, after moving higher in the previous session. The spike higher in turnover and relatively clustered trading around 4.7500 level is indicative of official offers to smooth volatility. We expect the upside pressure to persist today and the pair to inch towards the 4.7550 level. The acceptable daily volatility should be reflected in the official fixing.

Government bonds

Confidence looks shaky on the fixed income market these days. The yield curve shifted two to three basis points higher yesterday, but the main event was the relatively weak ROB600 million June-2024 bond auction. Total demand stood at RON806 million while the average and maximum yields came slightly higher than the secondary market levels, at 3.91% and 3.95%, respectively.

Money market

With FX under pressure, cash rates have started to inch higher, with one-week to one-year tenors trading above 3.00%. We believe that carry will follow the uptrend. The NBR drained RON3.42 billion in its one week deposit auction.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap