The Commodities Feed: API reports large oil drawdown

Your daily roundup of commodity news and ING views

Alumina prices weaken

Energy

US crude oil inventories: The API reported yesterday that US crude oil inventories declined by 6.13MMbbls over the last week, much larger than market expectations for a draw of 2.7MMbbls according to a Bloomberg survey. This draw along with signs of constructive trade talks between China and the US has been supportive for crude oil prices, with WTI now trading back above US$50/bbl. However the less constructive data from the API report were the refined product builds, with gasoline inventories increasing by 5.5MMbbls and distillate fuel oil stocks swelling by 10.2MMbbls. The EIA is scheduled to release their weekly report later today.

Metals

Alumina prices soften: Alumina prices have weakened by around 5% since the start of the year, whilst LME aluminium has traded largely traded flat-to-positive. This has seen the alumina-to-aluminium price ratio drop to 21% currently compared to 22.5% at the end of 2018 and an average of 22.4% for the whole of 2018. Historically, this ratio is still high, leaving further room for further downside. Although in order to see further weakness in the alumina market, we would likely need to see the Alunorte refinery return to full operation. Meanwhile turning to aluminium, whilst US sanctions against Rusal are set to be lifted, the Democrats have raised concerns over the lifting of sanctions.

Agriculture

Brazil soybean crop condition: According to Deral, Brazil’s rural economy agency, the condition of the soybean crop in Parana state has deteriorated. 58% of the crop is in good condition, down from 96% back on the 10th December. Meanwhile around 12% of the crop is in bad condition compared to 0% last month. Dry weather conditions have raised concerns over the Brazilian soybean crop, and expectations are that the crop will come in below the almost 120mt produced in the 2017/18 season.

China grains demand: China’s National Grain and Oils Information Center (CNGOIC) has revised lower its demand forecasts for corn as a result of African swine fever. The CNGOIC estimates that domestic corn consumption will total 190mt this season, 5mt lower than their previous forecast, but still higher than the 185mt consumed last season. Meanwhile the Center has revised higher soybean import demand, with China resuming purchases of US soybeans. They now expect imports to total 87mt, up 3mt from their previous forecast, but still down from 94mt imported in the previous season.

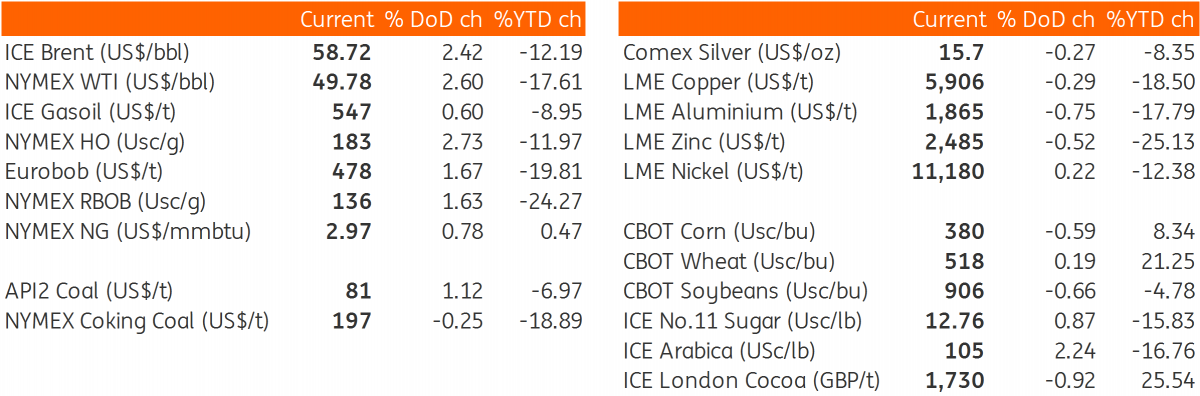

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap