Briefing Romania

No surprise from the NBR Board meeting

EUR/RON

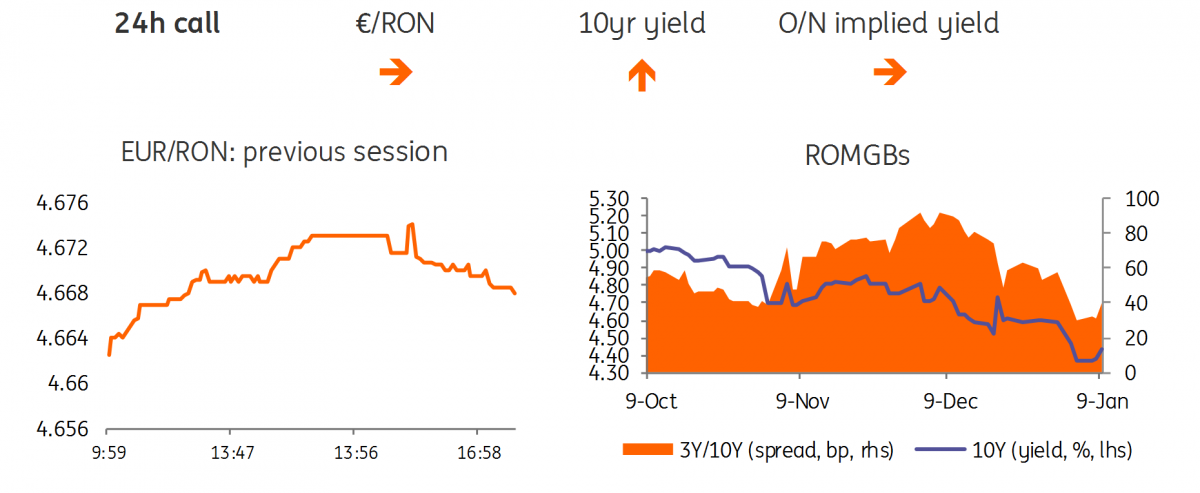

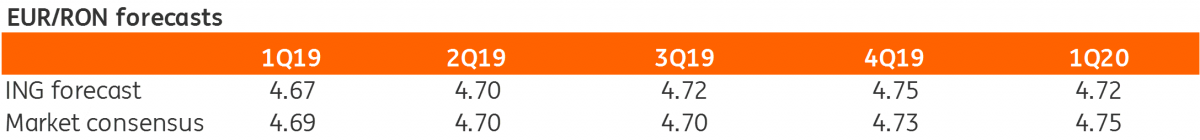

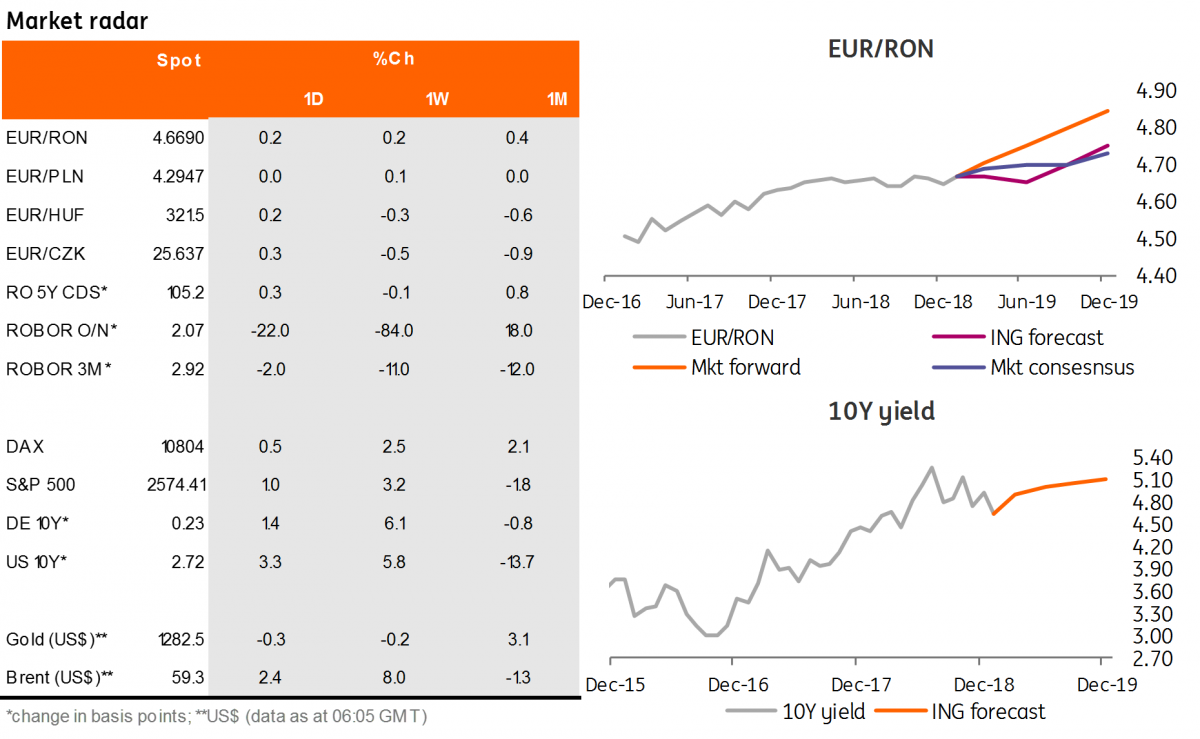

The EUR/RON tested the upside for most of yesterday’s trading session, closing just below 4.6700. NBR Governor Mugur Isarescu avoided any statements regarding the exchange rate in the press briefing following the Board meeting. However, with the central bank apparently less concerned about the inflation outlook at least in the short term, we expect a shift higher in the comfort range for the EUR/RON. Timing remains a tough call though.

Government bonds

The steepening of the ROMGB curve continued and accelerated into yesterday’s trading session. The front to mid-part of the yield curve dropped by five to as much as 20 basis points. Apparently the market is pricing accommodative liquidity conditions for an extended period. With the NBR seemingly not overly concerned about the inflation outlook, a key rate hike this year becomes less likely and should occur only in-sync with the ECB.

Money Market

In the money market the liquidity surplus is keeping cash rates below 2.00%. For now, mild upside pressure on the EUR/RON doesn’t seem to raise any eyebrows at the NBR. However, should the pressure intensify, we wouldn’t bet on the same attitude prevailing. Otherwise, Governor Isarescu did not address a potential cut in the minimum reserve requirements at yesterday’s press briefing. However, there were comments regarding the downside trend in Robor rates, noting that current levels are in line with the general trend of inflation and thus suggesting that the central bank is comfortable with current developments.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap