The Commodities Feed

Your daily roundup of commodities news and ING views

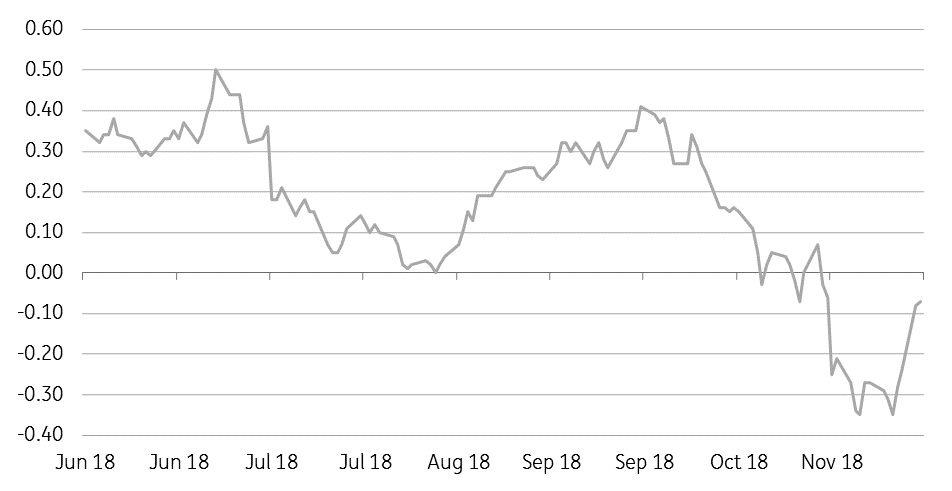

ICE Brent Jan/Feb spread strengthens on Buzzard outage (US$/bbl)

Energy

Saudi production edges higher: According to Bloomberg, oil output in Saudi Arabia has increased to as much as 11.2MMbbls/d from around 10.8MMbbls/d earlier in the month, and this is reportedly in response to stronger demand. Meanwhile, the ICE Brent Jan/Feb spread strengthened significantly yesterday, moving from a $0.24/bbl discount to settle at a discount of just $0.08/bbl. The strength in the spread is a result of the continued Buzzard oil field outage in the North Sea.

US crude oil inventories: The API is scheduled to release weekly inventory numbers later today, and expectations are that US crude oil inventories decreased by 1MMbbls over the last week, according to a Bloomberg survey. Refinery run rates should be edging higher once again following seasonal maintenance. If the EIA confirms a drawdown in crude oil inventories tomorrow, it would be the first draw since mid-September.

Metals

Iron ore plummets: Chinese iron ore prices fell 5-7% yesterday, with steel mill margins coming under pressure. This has meant that iron ore prices have declined by around 10% so far this month. Slower economic growth and uncertainty around trade have been bearish for sentiment more recently. Looking ahead, Chinese manufacturing PMI numbers are scheduled to be released on Friday, which the market will be watching closely.

Copper TC/RC charges: While some Chinese smelters have agreed TC/RCs for 2019 at $80.8/t and ¢8.08/lb earlier this month (down 2% year-on-year), Platts is reporting that many smelters have been resisting the reduction and instead opting to wait before finalising 2019 term volumes. Higher spot TC/RC at $90.5/t and ¢9.05/lb has meant that smelters have been focused on spot purchases, rather than fixing 2019 volumes.

Agriculture

US export inspections: The latest data from the USDA shows that 1.12mt of corn was inspected over the last week for export, which compares to just 846kt in the previous week. Soybean inspections totalled 1.11mt over the week, compared to 1.07mt in the previous week. There were no inspections for soybeans destined to China over the week, however, a total of 119,747 tonnes of soybean was set to be shipped to Argentina.

Sugar speculative positioning: The latest data from the CFTC shows that speculators reduced their net long in No.11 sugar further over the last reporting week. Speculators sold 24,612 lots over the week to leave them with a net long of just 10,730 lots. Moving forward, we should see more Indian sugar becoming available for the world market, as the harvest gets further underway. This means that in the short term, we could see additional pressure on sugar prices.

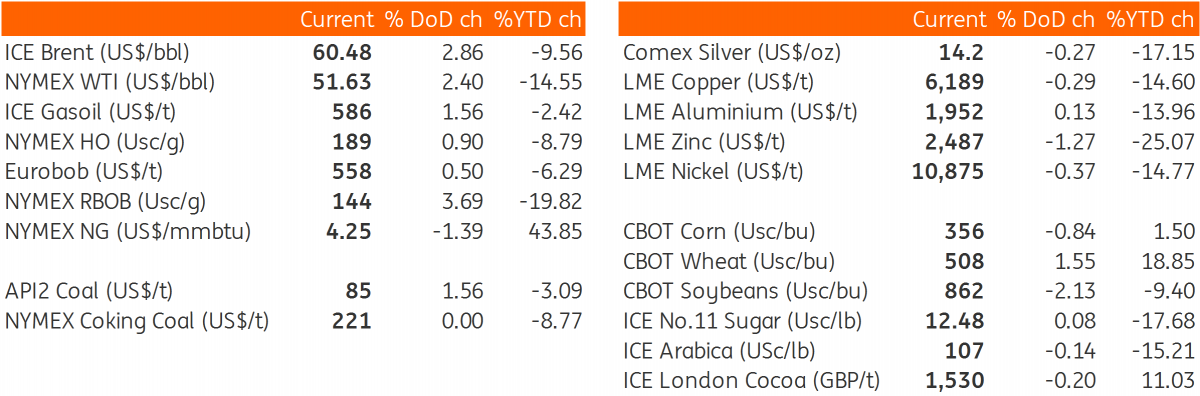

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap