Briefing Romania

Improved liquidity picture

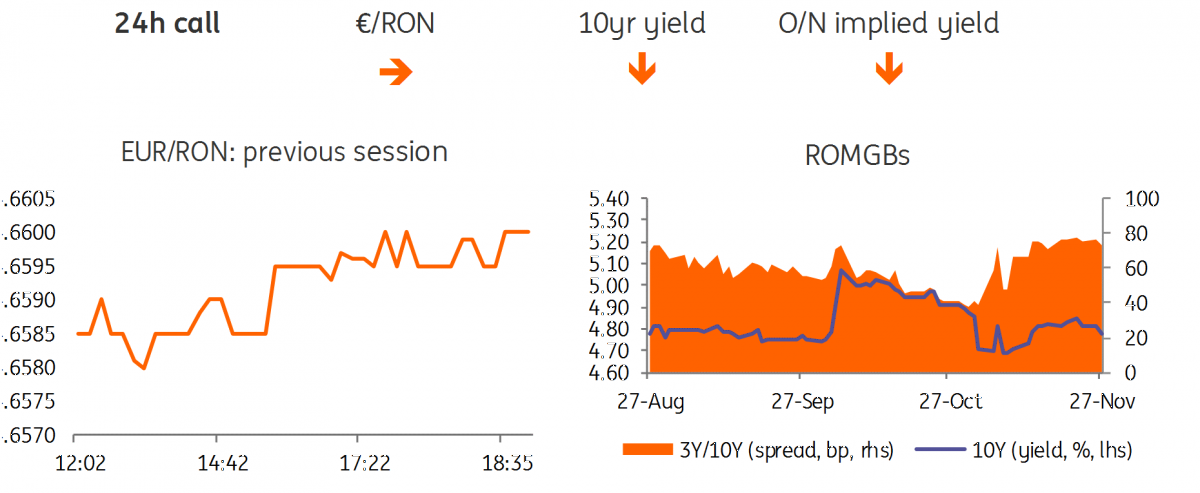

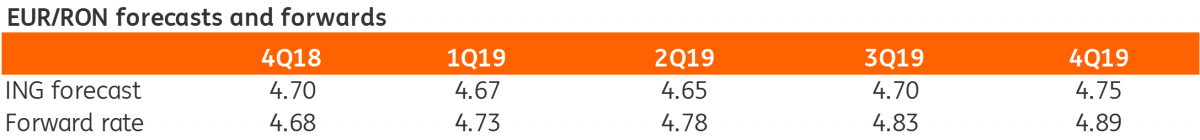

EUR/RON

While still maintaining some upward bias after the central bank's repo auction, the EUR/RON traded in a narrow 30 pips, closing the day at the 4.6600 mark. As the liquidity injection starts to filter through, the slow upward trend could continue into the current reserve period.

Government bonds

We had an overall positive day for Romanian government bonds. The February 2029 auction (new 10-year benchmark) came out quite strong - in line with our expectations. The bid-to-cover stood at 1.8x with the average and maximum yields at 5.01% and 5.04% making it difficult for the Ministry of Finance to upsize more than the accepted RON 622 million versus the RON 600 million initial targets. The 1-year T-bills auction result was less overwhelming but still decent, at 1.6x bid-to-cover and a somewhat long tail with average yield at 3.32% and maximum 3.38%. Otherwise, the curve shifted lower c.4-5 basis points in the front end helped by the central bank’s repo auction.

Money Market

The National Bank of Romania injected RON 10.2 billion in the one week repo which finally calmed the market and triggered selling interest across the FX swap curve. Together with tomorrow’s RON 8.08 billion redemption, the liquidity situation should become a bit more comfortable as the year ends, though we don’t believe the central bank will allow a significant structural surplus in the market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RomaniaDownload

Download snap