The Commodities Feed

Your daily roundup of commodities news and ING views

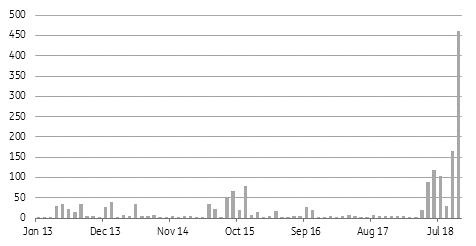

Chinese alumina exports (k tonnes)

Energy

ICE Brent speculative positioning: Speculators continued to reduce their net long in ICE Brent over the last reporting week, selling 32,263 lots, leaving them with a net long of 182,569 lots as of last Tuesday. This is the smallest net long specs have held in Brent since the end of 2015. These numbers do not reflect the sell-off seen in the market on Friday, so the actual position is likely even smaller. There is plenty of uncertainty over whether OPEC+ will announce production cuts at a meeting in early December, especially given the pressure coming from President Trump. As a result, speculators will likely remain hesitant to enter the market until there is further clarity on cuts.

WTI-Brent discount: The WTI-Brent discount has narrowed in recent days, moving from a US$10/bbl discount in mid-November to less than a US$8.40/bbl discount on Friday. The narrowing appears to be a result of uncertainty over whether OPEC will cut production at the December meeting, whilst the weakening price environment also starts to bring into question whether US production growth in 2019 will be as strong as initially expected. Thanksgiving last week would have also distorted the spread, with much of the US off for the latter part of the week.

Metals

China alumina exports: Alumina exports from China increased to 460kt in October 2018- a record high and nearly three times the previous record of 166kt seen in September 2018. Supply disruptions from the Alunorte refinery in Brazil and uncertainty around Rusal alumina supply continues to pull Chinese alumina onto the world market. However, Chinese alumina output has been largely flat, suggesting that exports have tightened the domestic market- Shanxi alumina prices strengthened from CNY3,065/t at the start of the month to CNY3,115/t. Among other trade, copper concentrate imports increased 14.9% year-on-year to 1.57mt with year-to-date imports up 19% YoY to 16.6mt. Coking coal import also increased 15.7% YoY to 6.1mt, though YTD imports are still down 1.6% YoY to 56.9mt.

Japanese steel imports: Japanese steel imports increased 25.7% YoY to 812kt in October 2018 due to lower domestic production over the month, after a typhoon and earthquake impacted some operations in September. JFE steel closed one of its furnaces in October and plans to restart it by end-November, resulting in production losses of c.400kt. Meanwhile, the World Steel Association reported that global crude steel output increased 5.8% YoY to 156.6mt in October 2018, with Chinese and US output increasing 9.1% YoY and 10.5% YoY to 82.6mt and 7.6mt, respectively.

Agriculture

Chinese soybean imports: China’s National Grain and Oils Information Center thinks that soybean import demand for the country will fall for the first time since 2011 as a result of African swine fever, while trade tariffs on US soybeans certainly haven’t helped. The Center estimates that imports will total about 90mt in 2018, down from 96mt last year. Latest Customs data from China shows that the country imported 6.92mt of soybeans over the month of October, down 14% MoM, while YTD imports stand at 76.93mt, down just 0.5% YoY.

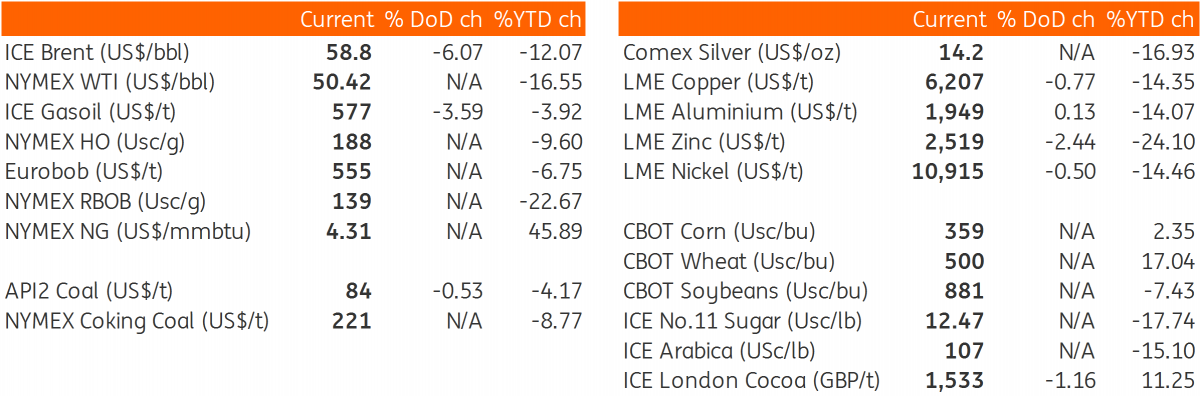

Daily price update