The Commodities Feed

Your daily roundup of commodities news and ING views

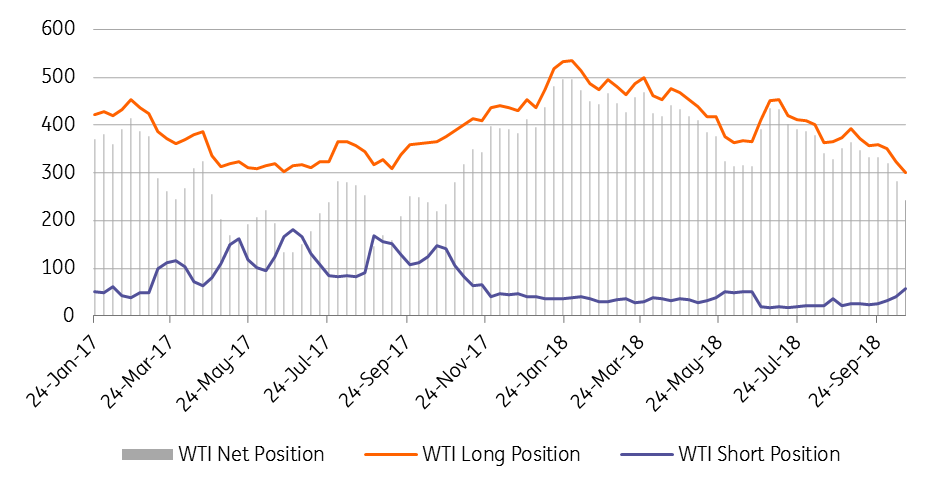

Speculators reduce their net long in NYMEX WTI (000 lots)

Energy

Upcoming IMO regulations and the US: The Wall Street Journal reported on Friday that the US government is concerned over the impact that IMO sulphur regulations, which are set to come into force in January 2020, will have on prices. The US is reportedly suggesting that the new regulations are introduced gradually over time. Any easing or delay in these regulations would likely mean a recovery in fuel oil cracks, and weakness in middle distillate cracks further down the forward curve. An IMO conference gets underway in London this week, so expect some noise around this topic.

Oil speculative positioning: Latest data shows that speculators reduced their net long in ICE Brent by 66,403 lots over the last reporting week, to leave them with a net long of 409,118 lots. Meanwhile, in NYMEX WTI, speculators sold 38,977 lots to leave them with a net long of 242,855 lots. This is the smallest net long speculators have held in WTI since October last year. WTI has come under relatively more pressure recently, with consistent stock builds in both Cushing and the US in general.

Metals

Further LME inventory withdrawals: The majority of base metals saw inventories at LME warehouses decline further over the last week, suggesting further tightening in the physical market. LME zinc stockpiles fell 10% to 171,250 tonnes, while copper stocks dropped by almost 8% to 153,950 tonnes. Nickel and lead stocks were also down 1.9% and 1.0% to 219,978 tonnes and 115,225 tonnes respectively.

Gold short covering: Speculators covered a significant amount of their shorts in gold over the last reporting week, with them reducing their net short in gold by 65,637 lots to leave them with a net short of 37,372 lots. However looking at the gross short position suggests that there is still the potential for a significant amount of short covering. The gross short stood at 144,773 lots as of last Tuesday, compared to around 20,000 lots at the start of the year.

Agriculture

Speculators go long sugar: It has been a while, but over the last reporting week, speculators switched from holding a net short to a net long in No.11 sugar, for the first time since December. Since early September, speculators have moved from holding a net short of 157,481 lots to a net long of 11,012 lots as of last week. A stronger Brazilian Real, crop downgrades in CS Brazil and the EU, and now also worries over a grub infestation in India has been supportive for prices. However, India will still have a significant domestic surplus to export to the world market, which should cap prices.

Asian cocoa grindings: Latest data from the Cocoa Association of Asia shows that cocoa grindings over the third quarter increased 3.7% YoY to total 196,418 tonnes. This, however, was below market expectations for a 5.1% increase, according to a Bloomberg survey. These numbers follow a 2.5% YoY increase in North American processing for the quarter, while in Europe grindings increased by 2.7% YoY.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap