The Commodities Feed

Your daily roundup of commodities news and ING views

March 2019 white sugar premium edges higher (US$/t)

Energy

How much will OPEC cut? The next OPEC meeting is just three weeks away, and until then we are likely to hear plenty of noise around potential OPEC+ production cuts in 2019. Reuters reports that OPEC+ is looking at potentially cutting production by 1.4MMbbls/d, larger than the 1MMbbls/d that was previously mentioned. We are of the view that OPEC+ would likely cut production by at least 1MMbbls/d for an initial period of six months.

US crude oil inventories: Yesterday the API released its weekly US inventory numbers, reporting that US crude oil inventories increased by 8.78MMbbls, significantly higher than the 3.2MMbbls build that the market was expecting. On the products side, the divergence between gasoline and heating oil continues. Gasoline inventories increased by 188Mbbls, whilst heating oil saw a drawdown of 3.2MMbbls. Stubbornly high gasoline stocks have weighed heavily on gasoline cracks, whilst persistent distillate fuel oil drawdowns continue to support the heating oil crack. The EIA releases its weekly numbers later today.

Metals

Base metals find support: The latest economic data out of China has offered some support to the base metals complex. Both infrastructure investment and industrial production numbers came in ahead of market expectations. The National Bureau of Statistics reported that industrial production expanded by 5.9% and fixed asset investment rose by 5.7%, exceeding expectations of 5.8% and 5.5% respectively. However, it wasn’t all good news, with weaker retail sales and home sales growing at the slowest pace in six months.

Pollution sees larger lead smelter cuts: According to SMM, lead smelters in Henan province made further production cuts as a result of worsening pollution levels. Producers in the province previously were facing cuts of 10%, however this has increased to 30% now, which is expected to impact 300-400 tonnes of production per day.

Agriculture

White sugar premium: The March 2019 whites premium has strengthened in recent days, having rallied from a little over US$62/t to almost US$67/t currently. Continued concerns over the EU beet crop have been supportive for the premium, with the French agriculture ministry cutting its sugar beet production estimate for the current season by a further 3.2% to 39.2mt. Drought over the summer has hit yields, and in fact, the ministry expects yields to reach the lowest levels since 2016. Meanwhile, recent reports suggest that there could be further downside in Indian sugar production, with most mills reporting lower yields.

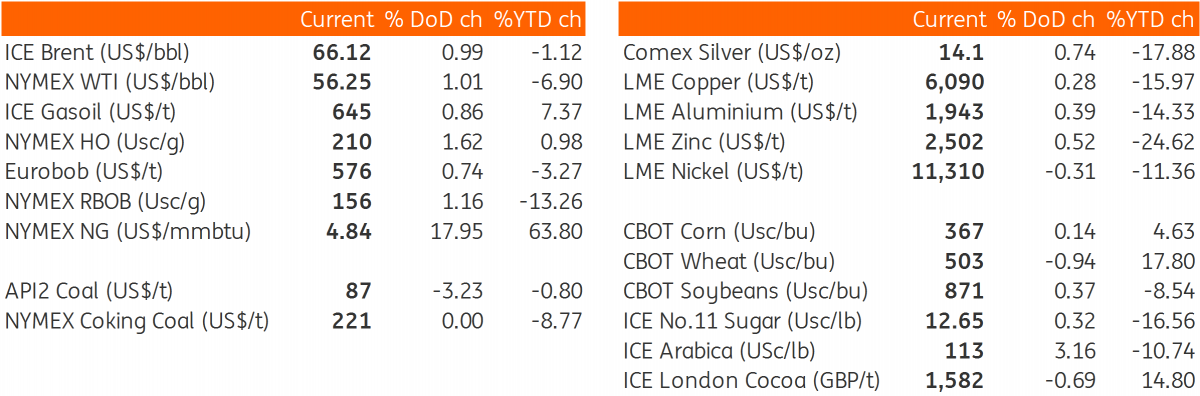

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap