Briefing Romania

The governor of the National Bank of Romania suggests a possible cap on repo auctions at some point

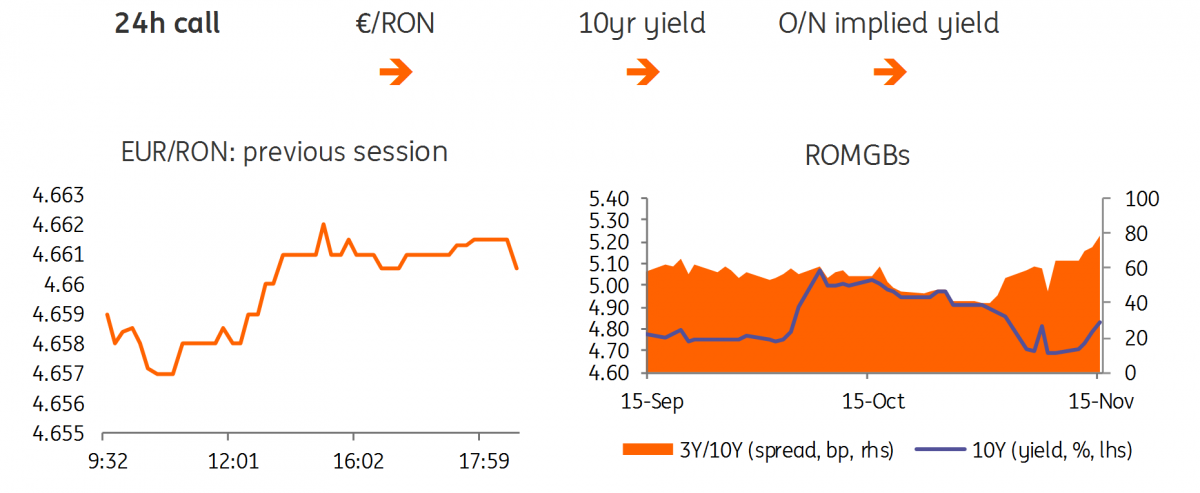

EUR/RON

Stability is the name of the game for the EUR/RON these days as the pair floats in a tight range around 4.6600. Despite fundamentals pointing to a weaker leu, a break above 4.6700 will likely be allowed only after headline inflation consolidates at lower levels.

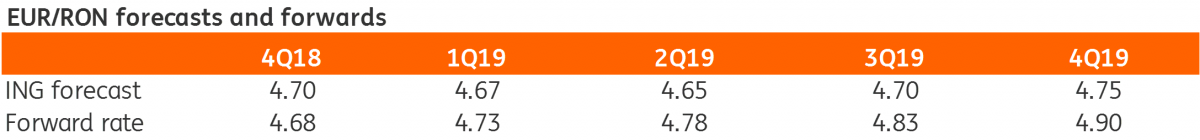

Government bonds

ROMGBs had a less positive day yesterday as yields shifted higher by anywhere from 5 to 13 basis points. The better-than-expected third quarter GDP print didn’t seem to have much impact, but a later statement of NBR Governor Mugur Isarescu about a potential cap on future repo auctions triggered some re-pricing across the curve, initially in the front-end, but later in the day, across the yield curve. Today, the Ministry of Finance plans to sell RON600 million in a June-2023 auction. Usually this is a tenor in good demand from a broad range of investors and filling the target amount should not be a problem. It remains to be seen though if the Ministry of Finance would pay up in terms of yield. We look for a cut-off yield around 4.55%.

Money Market

Funding rates remained stable just above the key rate while in longer tenors some paying interest emerged, pushing the yields 5-10 basis points higher, with the 1Y now trading around 3.75%, likely due to fears of higher funding rates in the future on limited repo auctions. In the past, the central bank seemed comfortable to keep overnight rates close to the Lombard rate for more than just a few days. We believe that this will only happen when weakening pressures on the leu intensify, which we expect towards the end of the year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap