Taiwan: Trade disappoints as Apple pulls order

November trade data shows that Taiwan depends heavily on Apple and when they cancelled orders in November, exports shrunk 3.4% in November after growing 7.3% in October. And we expect this contraction to continue in December and January

Taiwan overly dependent on one single company

Import, manufacturing and export activities in Taiwan are heavily dependent on a single smartphone company. When Apple cancelled orders in November, Taiwan's economy was considerably impacted.

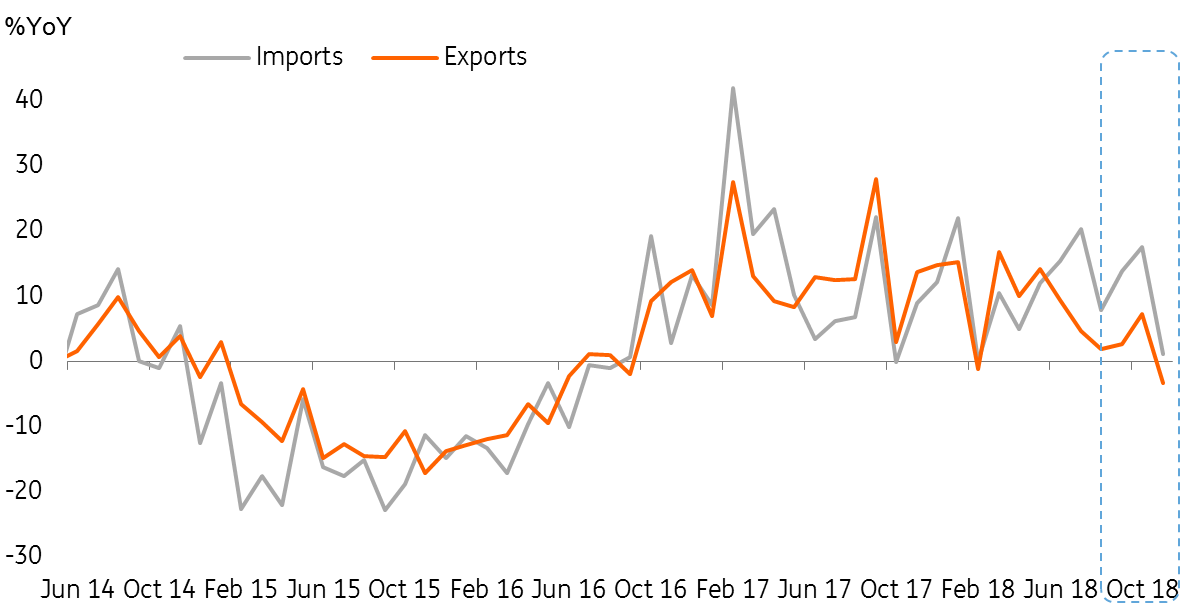

Exports contracted 3.4% year on year in November from 7.3% YoY in October. And because the production of smartphones will continue to slow, import growth also slowed sharply to 1.1% YoY from 17.6% in October.

These numbers could be worse because of the front-loading export activities in November to escape the increase of tariffs from 10% to 25% on Chinese products, which should, in theory, have a positive impact on Taiwan's trade.

Taiwan trade sector in winter

Exports will contract next quarter

As orders were cancelled, Taiwan's export growth will continue to shrink in December and January. Then there is the Chinese New Year holiday for Mainland factories in February, which also means holidays for Taiwan factories and trade.

We will see if smartphone orders return in 2Q19. Otherwise, Taiwan's trade may continue to shrink next year until November to bounce back from this year's low base effect.

If the tit-for-tat trade war between China and the US continues in 2019, then Taiwan trade will suffer even more than what the November data has shown.

Central bank can only wait-and-see

Even the market has talked about a rate hike from Taiwan's central bank in 2019 - to have more room for a rate cut when required, but it may have missed the opportunity as exports are progressively worsening.

We expect the central bank to stay put in 2019 unless there is a large drag from exports, which will then deserve a rate cut.