Taiwan: GDP growth edges lower amid shrinking exports

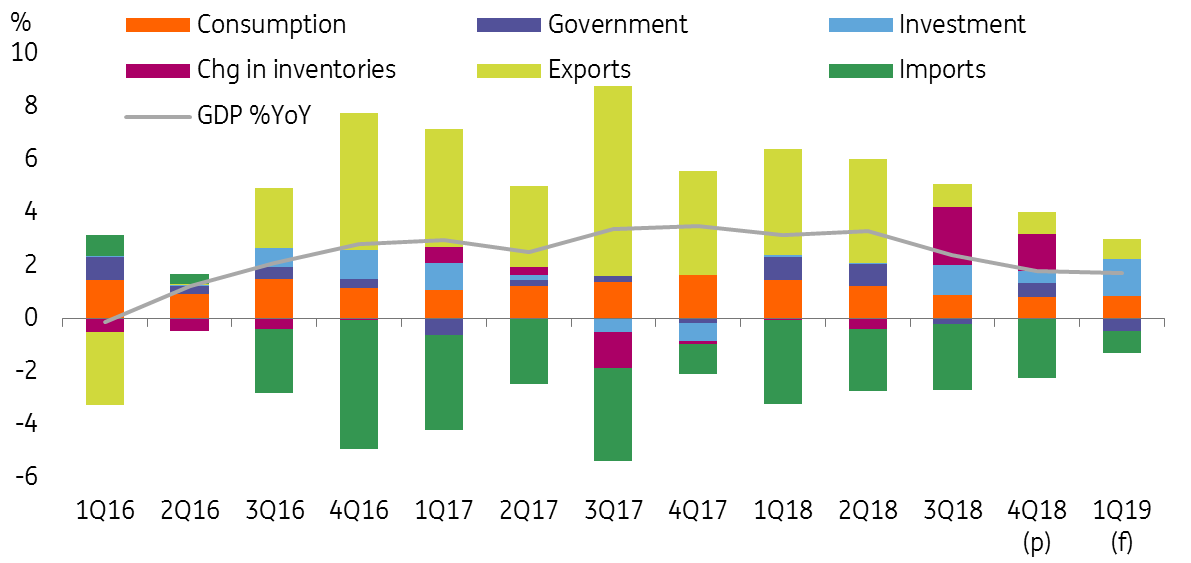

Taiwan 1Q19 GDP growth was 1.7% year-on-year, down from 1.8% in 4Q18. Most of the growth engines contracted. Looking forward, producing 5G equipment could be a new source of growth but it can't lift the whole economy alone. And the government's proposal to relocate factories from Mainland China to Taiwan will only provide limited support to GDP

Can government spending and 5G support the whole economy?

GDP growth was 1.7% YoY in 1Q19, edging down from 1.8% in 4Q18. Exports, industrial production, and retail sales exhibited negative growth in the first quarter.

- Export growth dropped to -4.2% in 1Q19 in comparison to 0.0% in 4Q18.

- Industrial production fell 9.88% YoY in March.

- Retail sales edged up only by 0.62% YoY in the same month.

This activity data demonstrates that most engines on the private side of the economy have been a drag on growth.

The government is trying to stabilise the economy, with plans to spend nearly TWD 2 trillion in 2019, or around 11% of nominal GDP. This spending has taken the form of investment, which contributed almost 1.4 percentage points to GDP growth of 1.7% YoY. Unlike in big economies, it is difficult to rely on government spending to support growth in smaller economies for an extended period of time.

There will be a technical recovery in 2H19 because of the lower base of last year. But there won't be a fundamental recovery in 2019 unless there are many new smart-devices going to market or a popular device that needs parts from Taiwan.

Though 5G equipment manufacturing is growing, this is unlikely to boost industrial production, let alone the whole economy this year. Instead, we see 5G manufacturing as a long term growth prospect for Taiwan because 5G will create demand, from parts to final products, in the coming few years.

Moderate impact even if factory owners move production back to Taiwan from Mainland

The Taiwan government has proposed that factory owners who have production lines in Mainland China move production back to Taiwan. This is one result of the China-US trade war; if Taiwan manufacturers affected by tariffs continue to stay in Mainland China, it will increase the cost of doing business. Taiwan media has reported that the amount of approved investment so far is TWD200 billion, which is around 1% of GDP. But we don’t expect all the approved amount to be invested.

Still, we believe that the upside of this policy is limited for the economy as a whole:

- First, "tariff-saving" applies to Taiwan manufacturers affected by US tariffs imposed on China. If they are not affected, there is little reason for them to move back to Taiwan.

- These manufacturers are also limited by Taiwan's smaller supply of factory workers. If there is a big labour requirement, wage growth will increase, which will offset the attractiveness of moving production back to Taiwan. Still, some companies could add production capacity in Taiwan whilst continuing to produce in the Mainland to please the Taiwan government though we believe these activities are unlikely to be large enough to move the GDP needle significantly.

We are watching the pre-election

The current government's stance of going against the Mainland Chinese government has created a growth hurdle to the economy. For example, the number of Mainland China visitors to Taiwan has fallen by more than 35% from 2015- the year before Tsai took office- to 2018.

Currently, some political parties are starting to prepare for the 2020 presidential election. If the KMT party takes office in 2020, Taiwan's economy is very likely to receive "economic gifts" from the Mainland, which could help GDP growth return to the 10-year average of 2.92%.

Forecasts on GDP, policy rate and exchange rate

We expect 1.4% YoY, 2.0% YoY and 2.2% YoY GDP growth for 2Q, 3Q and 4Q, respectively. The whole year GDP forecast remains at 1.8%. As mentioned above, higher GDP growth in 2H19 should be due to a technical recovery from a low base last year.

According to our GDP forecasts, we do not expect any recession in 2019, which means the central bank can sit back and refrain from cutting the policy interest rate, which is now at 1.375%. As we don't expect a strong fundamental rebound in the economy or accompanying increase in inflation, there will be no need for rate increases either.

The currency is sensitive to corporate earnings because there is a substantial flow of foreign investments into the stock market. We are concerned that any missing sales targets of smart devices could put downward pressure on the Taiwan dollar against the US dollar. As such, we've revised our TWD forecast in March from 30.40 to 30.95 by the end of 2019.

Download

Download snap

2 May 2019

Good MornING Asia - 2 May 2019 This bundle contains {bundle_entries}{/bundle_entries} articles