Taiwan: Export outlook dims

Taiwan exports slowed more than expected and import growth accelerated in July due to higher crude and metal prices. We are not particularly optimistic about Taiwan trade as tensions between the US and China escalate

Slower export growth is an early sign of trade war impact

Export growth grew 4.7% year-on-year to $28.36 billion in July, down from 9.4% in June, while import growth unexpectedly accelerated to 26.12% YoY from 15.4% in June. July's import value, $26.12 billion, was the highest since February 2014.

This accelerated import growth was due to higher crude oil and metal prices. Imports of crude oil, basic metals and plastic-related products rose 46.8% YoY, 23.7% YoY and 20.1% YoY, respectively.

Exports of integrated circuits grew 7.0% YoY in July, up from -3.0% YoY in June, which is a relief for Taiwan manufacturers. However, we suspect that negative growth in this sector could reappear in later months if the US imposes tariffs on $200 billion worth of goods and China retaliates. This is because the tariff list would include electronic products, including earphones and other peripheral products for smart devices even though smartphones may be excluded.

Could Taiwan gain from the trade war? We are less optimistic than before

However, Taiwanese products could also become substitutes for Chinese electronic products. The question is whether Taiwan's exporters could expand their capacity fast enough to catch this opportunity. We are less optimistic than before. Even though there is such an opportunity, Taiwan's manufacturers may be reluctant to make this decision quickly because a trade war could reduce global demand. As such, they may be hesitant to take this risk.

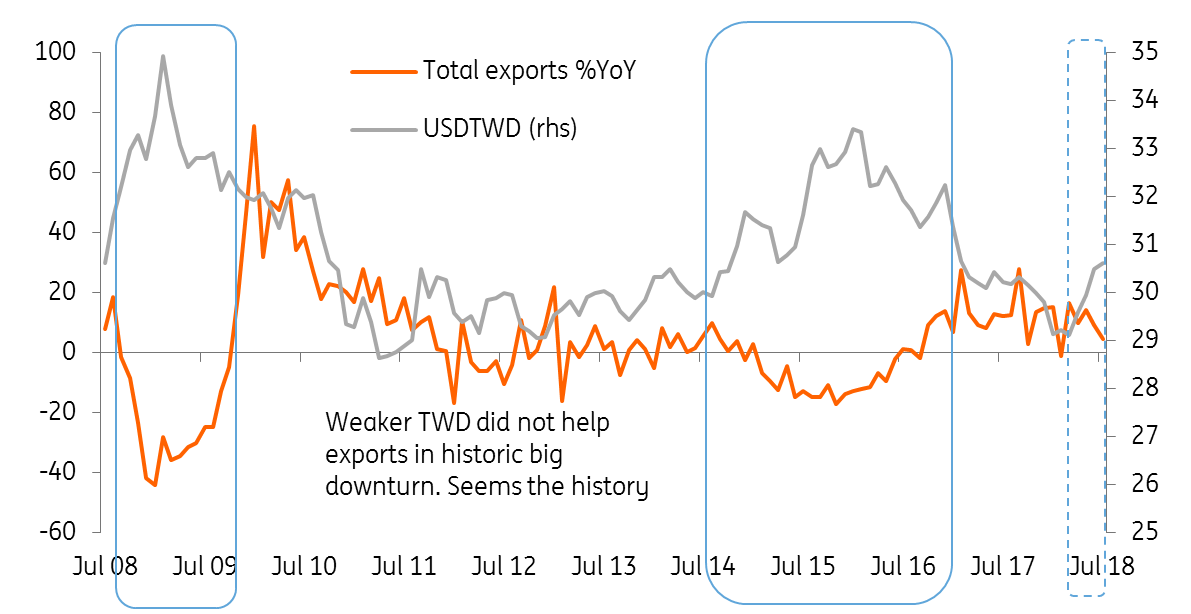

History tells us that a weaker TWD won't help exports

From the chart, we can see that when Taiwan saw a big downward trend in exports, a weaker Taiwan dollar against the US dollar did not help exports to recover. For example, between September 2008 to January 2009, the Taiwan dollar depreciated but Taiwan's export growth contracted even faster. The same can be said for the period of December 2014 to November 2015.

If Taiwanese goods aren't substituted for some Chinese exports, then a weaker TWD may not be a solution.

We have previously noted that Taiwan has fewer bullets this time to prevent an economic downturn.

Taiwan export growth and USDTWD

The Taiwan economy is likely to be weaker during a trade war

Overall, we believe Taiwan is more prone to risk than opportunity as a result of rising trade tensions. We maintain our GDP growth forecast at 2.4% in 2018, and expect USDTWD to weaken to 31.0 by the end of this year.

Download

Download snap

8 August 2018

Good MornING Asia - 8 August 2018 This bundle contains {bundle_entries}{/bundle_entries} articles