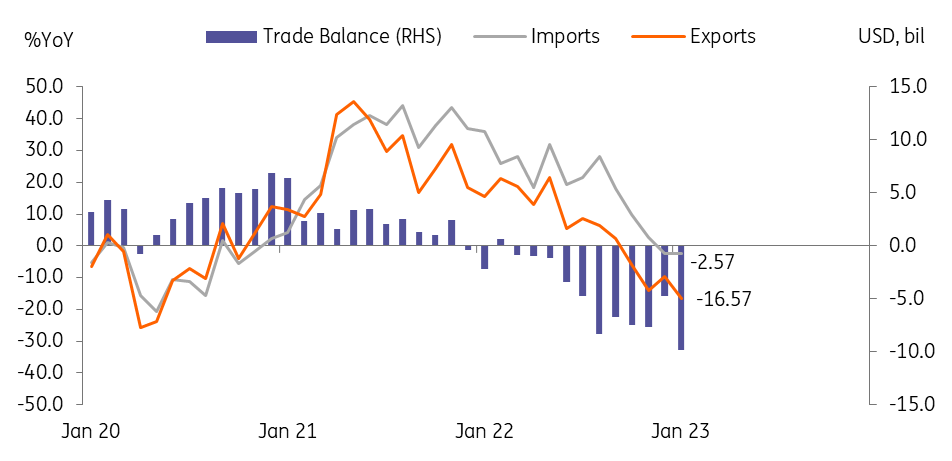

South Korea: trade deficit hit record in January

Exports fell for a fourth straight month in January due to weak global demand for semiconductors and petrochemicals, with little hope for a meaningful improvement in Korea's trade performance in the first half of this year. Today's data supports our view that 1Q23 GDP will deliver a second consecutive quarter of contraction

| -16.6% |

Exports% YoY |

| Lower than expected | |

Exports fell 16.6% YoY in January

Looking at the details of the export data just released, weak performances were even more broadly based and semiconductor exports deteriorated even further compared with the previous month. Among major export items, displays (-36%), steel (-25.9%), and petrochemicals (-25.0%) all declined while semiconductor exports fell the most (-44.5% vs -27.8% in December).

On the other hand, vessels (86.3%), automobiles (21.9%) and batteries (9.9%) all rose in January. We believe that automobiles and E-vehicle-related exports continue to outperform, but the momentum will slow in the coming months as the US and Europe's demand will soften. By export destination, exports to China dropped the most, falling 31.4%YoY, while exports to the ASEAN region (-19.8%) and the US (-6.1%) also slid.

Trade deficit hit record high in January

The semiconductor downcycle will last at least another six months

According to various industry reports, several major memory chipmakers including Hynix have cut their capex spending compared to last year and will focus on inventory management. But market leader, Samsung Electronics, announced that it will maintain its capital expenditure at the same pace as last year. This means that the large imbalance between supply and demand is unlikely to be corrected anytime soon and sector-wide inventory levels will continue to rise, resulting in further declines in unit memory chip prices. Memory prices have fallen more than 50% since their 2022 peak, and further unfavourable price effects look likely to weigh on Korean exports for a while longer. The market will eventually improve on the back of China's reopening and a recovery in mobile phone demand, but Korean chipmakers will face another geopolitical challenge from tightening US sanctions against tech exports to China. Thus, we expect the positive spill-over from the reopening of China to the Korean economy to be limited.

Growth outlook and BoK Watch

Sluggish exports were one of the main reasons for the GDP contraction last quarter and we expect this to continue for several more months. Yesterday's industrial production data also suggest that domestic demand growth will remain sluggish in the current quarter. The manufacturing PMI edged up to 48.5 in January from 48.2 in December, but still remained below the neutral level. Thus we maintain our view that 1Q23 GDP will contract by 0.2% QoQ (seasonally adjusted rate). As external and domestic growth conditions worsen and utility prices rise, the main opposition party has urged the government to draw up a supplementary budget. However, we believe that the likelihood of this is still low at the moment. The government will expand energy subsidy programs for low-income households and ask local governments to refrain from raising public utility charges as much as possible. Meanwhile, the Bank of Korea will pause its tightening policy from February although it will maintain its hawkish stance for the time being.

Download

Download snap