South Korea: Industrial production rebounded in November but details were disappointing

In November, all industry IP rebounded slightly for the first time in five months as manufacturing and public administration activities rose. Yet, service and retail sales continued to fall for the third consecutive month

| 0.4% |

Industrial Production% MoM, sa |

| Higher than expected | |

Industrial production rose slightly in November

Manufacturing output rebounded 0.4% month-on-month seasonally adjusted mainly due to strong gains in auto production (9.0%) and general machinery (6.4%) while semiconductor output plunged (-11.0%). The global supply conditions for the auto industry improved while unmet pre-ordered vehicle shipments increased. However, IT-related output – semiconductor and other electrical equiment – continued to decline with weakening global and China demand. Even though production rebounded, shipments dropped -2.3% for the second month, resulting in inventory rising 1.4%. Semiconductors, basic metals, and chemical inventory remain at an elevated level, meaning that the inventory cycle is likely to work unfavourably for near-term production activity.

IP rebounded, but shipments fell even more, thus inventory accumulation continued

Services and retail sales declined for three months in a row, but a temporary rebound is expected in December

Service activity reduced in November with hotels/restaurants and information/communications down the most. After the tragic accident in late October, the national mourning period in early November appeared to have a negative impact on hospitality/leisure-related service activities. In the latter case, overall IT activities such as software development, programming, and system maintenance slowed, reflecting a slowdown in global IT demand and suggesting employment cuts in the IT sector. We think that Black Friday shopping promotions have probably boosted consumption from late November to early December, thus services and retail sales are likely to rebound temporarily, at least in December.

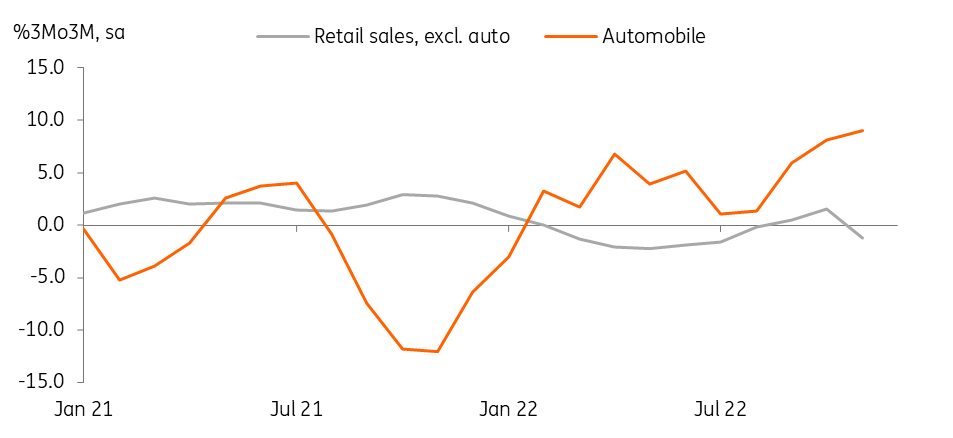

Retails sales excluding automobile were sluggish

Investment is likely to weaken in the future

Construction orders rebounded quite smartly in November, but considering high monthly volatility, three-month sequential growth deepened its contraction to -27.0% 3Mo3M sa in November (vs -19.3% in October). Also, looking at the previous construction ordered data, construction completion is likely to decelerate quite sharply in the near future. Meanwhile, semiconductor investment has been on the rise despite the recent industry slowdown, but only because it takes three to four quarters for equipment that is ordered to be installed. Yet, machinery orders, a better indicator of the current business cycle, declined in November.

We think that investment components should remain positive in fourth quarter GDP but the outlook for next year is quite bleak.

Construction is likely to decline in coming months

GDP outlook

In sequential terms, all industry IP tumbled to -1.6% 3Mo3M sa in November from 0.4% in September, meaning GDP growth for manufacturing and services is likely to contract this quarter. On top of that, as exports have declined over the past three months, the external demand component is also expected to fall. Currently we forecast fourth quarter GDP to contract by -0.1% quarter-on-quarter sa and annual growth of 2.5% YoY, yet the downside risks are growing.

Considering that forward-looking indicators such as business survey, construction orders, and machinery orders are still sluggish, the first quarter growth is unlikely to improve. The continuous price correction in the real estate market and high debt service burden is likely to weigh on private consumption as well. The weak start of the year lowers the base for the annual growth rate, thus we maintain our lower-than-consensus annual growth forecast of 0.6% YoY for 2023. China's reopening is expected to have positive impacts on second half 2023 growth, but in the near term, a surge in Covid cases, the risk of new variants, and health and safety-related problems are likely to add a negative impact on first quarter 2023 GDP.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap