South Korea: CPI inflation unchanged in December

Entering 2023, we expect headline CPI to head down to 4%. Gasoline prices and utility fees are set to rise meaningfully but base effects will anchor headline CPI

| 5.0% |

Consumer Price Inflation% YoY |

| Lower than expected | |

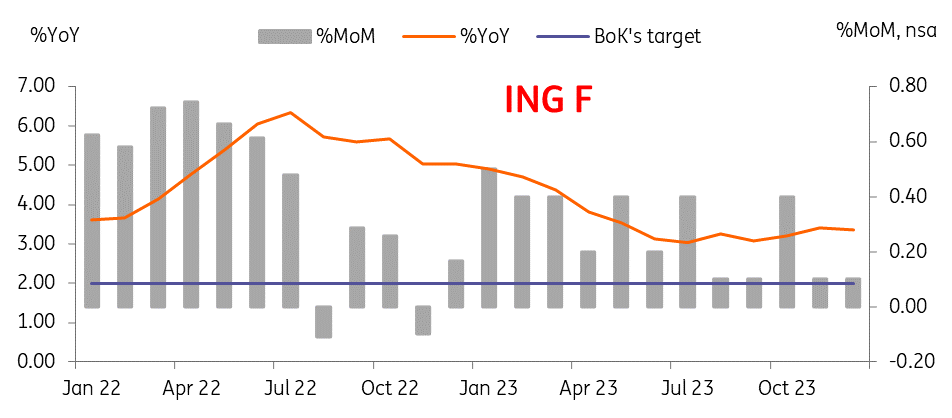

Headline CPI rose by 5% YoY for a second month in December

Both headline and core inflation were unchanged for a second month in December. Headline CPI remained at 5.0% YoY, slightly lower than the market consensus of 5.1%, with core CPI remaining at 4.8%. Electricity, Water and Gas (EWS) rose the most - by 23.17% - while fresh vegetable prices fell (by 2.5%) for the second month. Among services, rent slowed to 1.4% in December (vs 1.6% in November). Given Korea's two-year lease structure, the sharp declines observed haved have only gradually been reflected in CPI. We expect the trend to fall in the coming months.

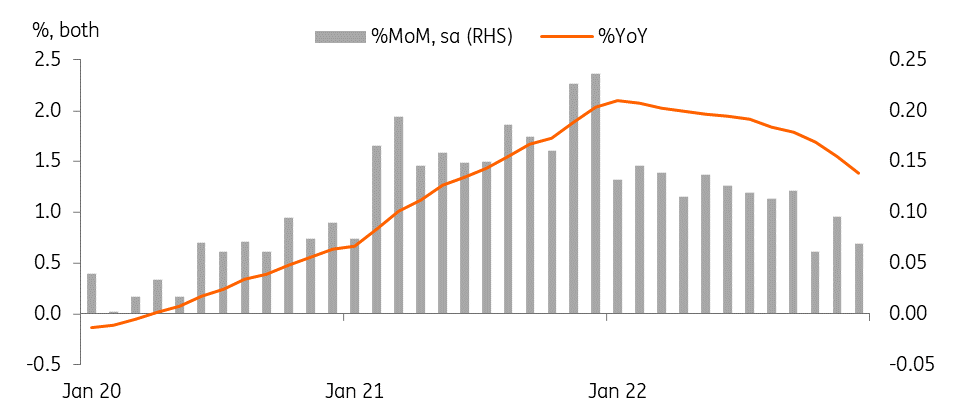

Rents set to decline in the coming months

CPI Outlook

The government and KEPCO announced today that electiricity rates will rise by 11.4 won (9.5%) per KWh from 1 January, pushing up CPI by about 0.15 pt. On top of this, gasoline tax cut will be reduced from 37% to 25% also from 1 January, adding another 0.12 pt. Combined, the two will boost CPI by about 0.3 pt in January.

This will trigger the secondary effect of further price hikes over time, and other public service fees such as public transportation rates are also planned to rise. Thus, headline CPI is set to remain above 2% throughout the year. We still expect downward pressure to grow due to sharp declines in rents and weak demand-side pressures.

Base effects will likely lower headlince CPI early next year, thus we look for a level of 4% for CPI in 1Q23.

CPI inflation set to stabilize in 2023

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap