South Korea: Industrial production contracts more than expected in February

Monthly activity data for February show that manufacturing output slid quite sharply, but services, investment, and retail sales unexpectedly improved. We have revised up our first quarter GDP forecast to -0.1% quarter-on-quarter from -0.2% and annual GDP growth to 0.7% year-on-year from 0.6%

| -3.2% |

Industrial Productionmonth-on-month, seasonally-adjusted |

| Lower than expected | |

Sluggish manufacturing delays economic recovery

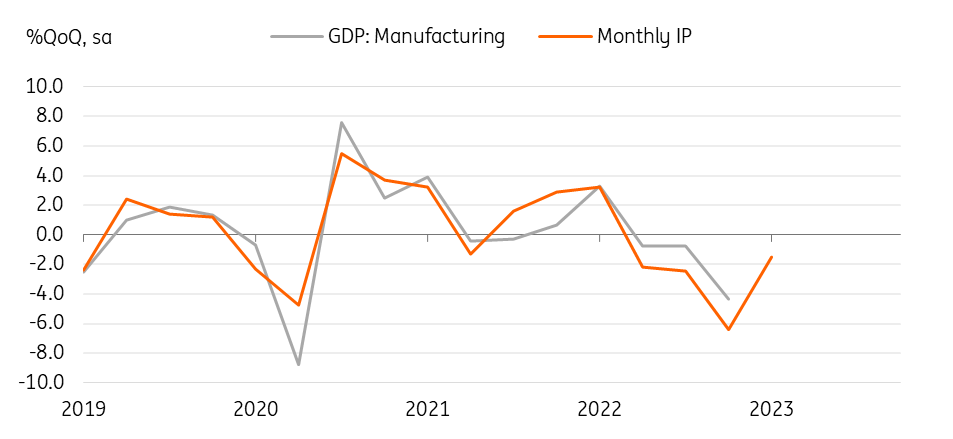

Industrial production declined -3.2% month-on-month seasonally-adjusted in February, which was more than expected (the market consensus was -0.6%), while January’s figure was revised down to 2.4% (vs 2.9% previously). In a three-month sequential comparison, industrial production contracted -4.1% three-month-over-three-month in February (vs -6.43% in December), meaning manufacturing GDP in the current quarter will fall again, but the decline will be smaller.

Manufacturing is expected to drag down GDP

By industry, semiconductors (-17%) and motors (-4.5%) declined while partially offset by an improvement in basic metals (5.1%) and chemicals (3.3%). The decline in semiconductors has been sluggish for more than half a year, recording a decline in seven of the past eight months, and there is no sign of improvement yet. The monthly decline of 17% is the largest since December 2008. Meanwhile, inventories continued to pile up (0.9%), thus our expectations remain the same that the rebound in semiconductor and manufacturing will be delayed to the second half of the year despite China’s reopening.

Semiconductors will stay weak in coming months

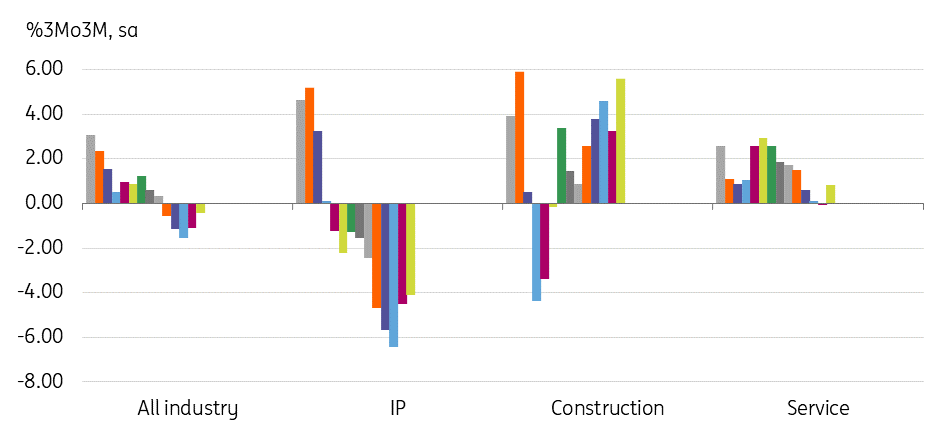

Services, investment, and retail sales improved in February

While IP was worse than expected, services (0.7%), construction (6.1%) and retail sales (5.3%) all showed improvements compared to the previous month. We still believe that some idiosyncratic factors have worked in favour of domestic demand and that consumption and investment will likely turn weak again.

Retail sales rebounded for the first time in four months, mainly due to special sales promotions and the resumption of electric vehicle subsidies. We are not sure if such a big improvement will continue in the coming months, but at least consumer spending has held up well despite high inflation and a weak housing market. Services also improved as weather conditions turned better after the severe cold snap in January.

Construction continued to rise for the second consecutive month, but this is believed to be somewhat misleading to the current construction cycle. Although the housing market has been rapidly deteriorating, monthly construction performance seems to have improved as construction projects that began in previous years have been completed. But, construction orders remain weak, giving a more accurate picture of the current downturn of the construction cycle.

Domestic demand held up well in February

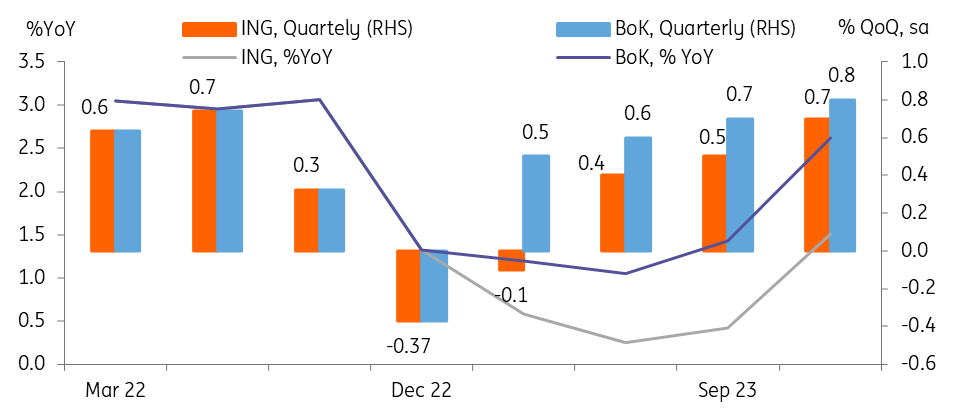

GDP outlook

Based on February’s monthly activity data, we have revised up our first quarter GDP forecast from -0.2% quarter-on-quarter seasonally adjusted to -0.1%, and annual GDP growth from 0.6% year-on-year to 0.7%. We still expect GDP to contract in the first quarter mainly due to weak exports and manufacturing, but consumers and businesses seem to have endured better than expected despite high inflation and high borrowing costs.

Construction investment is expected to rise as the pre-ordered projects come to an end, but the recent sharp drop in construction orders will be reflected in GDP meaningfully from the second half of 2023. In addition, a rapid accumulation of inventory will likely contribute positively to the current quarter's GDP growth.

GDP is expected to contract in 1Q23

The Bank of Korea

We expect the Bank of Korea (BoK) to stand pat at its April meeting. Today's data show that domestic demand has not deteriorated significantly compared to the previous quarter, which is expected to repeat the BoK's hawkish comments. But, sluggish manufacturing, especially the semiconductor sector, is deeper than expected and this will likely continue for a couple of quarters. Investment activity is also expected to turn soft in the coming quarter, thus the BoK's hike in this cycle is done in our view.

Local newswires reported that the electricity bill rise is expected to be less than 10%, which will be lower than the current quarter's fee increase. If so, then the impact on the CPI should be limited and does not meaningfully change the course of deceleration. If the headline CPI slows to the 3% level in the second quarter as we expect, the BoK could deliver a 25bp cut in the fourth quarter of the year.

Download

Download snap