South Korea: GDP growth decelerated in 3Q22

GDP grew 0.3%QoQ (sa) gain in 3Q22. Consumer spending, which had been boosted following reopening, slowed. In contrast, investment was more resilient. Based on the grim outlook for consumption and exports from recently released data, we maintain our view that the economy will experience a moderate recession early next year

| 0.3% |

Real GDP growth in 3Q22%QoQ sa |

| As expected | |

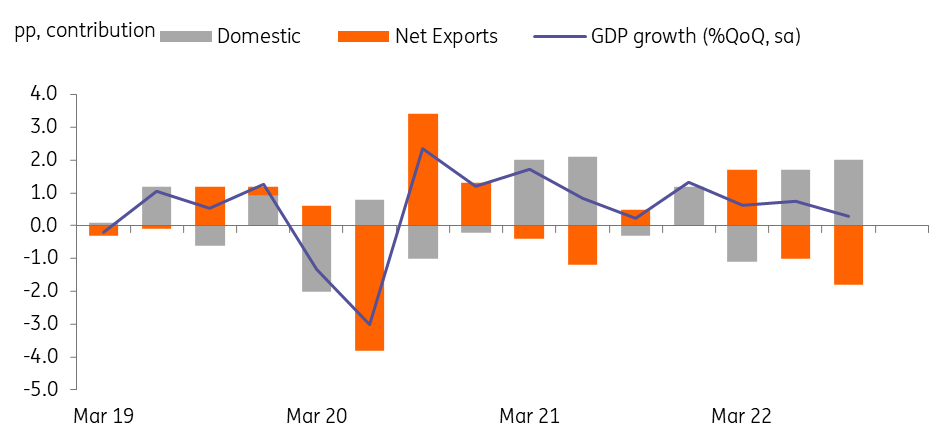

Growth supported by domestic demand while net export contribution contracted even further

In 3Q22, GDP growth was led by domestic demand, as expected. Household consumption rose 1.9% - a slower pace than the previous quarter (2.9% in 2Q22) mainly due to the increased debt service burden and higher inflation. Investment components were particularly strong. Construction and facility investment rose by 0.4% and 5.0% respectively. Investment in the IT sector expanded despite the recent semiconductor downturn cycle, and transportation equipment investment also increased as mobility restrictions were relaxed around the world and supply bottlenecks in the auto industry eased.

Exports rebounded 1.0% in 3Q22 (vs -3.1% in 2Q) on the back of gains in auto and service exports. But, imports rose even faster than exports, rising 5.8% (vs -1.0%) with high commodity prices and increases in capital goods imports. As a result, the net exports contribution to GDP was a drag of 1.8pp more even than the 1.0pp drag in 2Q22.

By industry, manufacturing fell for the second consecutive quarter, while construction and services gained strongly.

3QGDP was led by domestic demand

GDP outlook : 2.6% in 2022, 0.7% in 2023

The latest data show the reopening boost starting to fade, and we expect this trend to accelerate in the current quarter. We think consumer spending will decline in the near term due to debt deleveraging and the debt service burden. Regarding investment, we expect IT equipment investment to continue to rise but other components of investment to weaken. The recent credit market squeeze will likely negatively impact investment due to high funding costs and increased uncertainty, with the construction sector being the hardest hit. Exports are also likely to turn weak again, due to the economic slowdown in major trade partners such as the US, EU, and China and sluggish semiconductor exports. Thus, we maintain our view that the economy will experience a moderate recession early next year.

The Bank of Korea's policy outlook

With consumer price inflation back above 5%, the BoK is expected to raise its policy rate by 25bp in November instead of a 50bp hike. By doing so, the BoK's commitment to price stability can continue to be communicated to the market, while the BoK also needs to calm down the market's anxiety about the recent credit market squeeze to some extent. Although there is still a risk of inflation, an aggressive 50bp hike will probably be avoided as prices are expected to stabilize after a temporary rise in October.

The BoK's MPC will meet today. This is a regular meeting and the BoK will discuss policy response to the recent credit market issue. We believe that the BoK will not inject liquidity directly into the market as this would work against their current tightening policy stance. But, the BoK will likely adjust its micro-policy tools. Thus, we expect that options like reactivating Special Purpose Vehicles (SVPS) to purchase corporate bonds and CP and unlimited RP are not going to be delivered at this time. Instead, it is possible that the BoK will expand its purchases of bonds from commercial banks.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap