Australia: Inflation powers through 7%

3Q22 inflation beat consensus expectations, as did all the core measures. This puts the Reserve Bank under pressure to return to 50bp rate hikes at their next meeting

| 7.3% |

CPI inflation YoY%3Q22 |

| Higher than expected | |

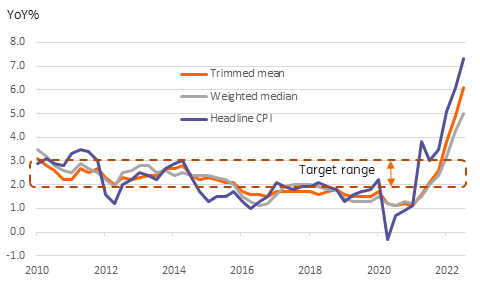

Never a good day when you have to change the axes on your charts...

The chart below tells most of the inflation story quite well, though needed a fair bit of surgery this morning to extend the y-axis high enough to incorporate the latest surge in inflation.

Australia's 3Q22 CPI index rose at a 1.8%QoQ pace, no slowdown from the pace of growth recorded in 2Q22, and this took the headline inflation rate to 7.3%, beating the consensus expectations for a 7.1% inflation rate. But the bad news doesn't end there. Core measures of the inflation rate, which might have tempered any outsize rises in erratic items driving the headline index, also showed larger-than-expected rises. Trimmed mean inflation is now 6.1%YoY, and the weighted median inflation rate is 5.0%. All three measures are considerably above the Reserve Bank of Australia's 2-3% target range.

Australian headline and core inflation

What's driving inflation now?

Within the CPI basket, the biggest drivers for the year-on-year gain were housing and food.

For housing, there are still big year-on-year gains showing for purchase prices of homes. Though these are probably on the verge of turning lower. Rental inflation on the other hand is picking up and probably has some way to rise. But probably doing most of the damage on the housing side this quarter was a steep rise in utilities, driven by a 16.6%YoY increase in gas and other fuel prices.

Within the food index, fruit and vegetables have clearly been hit by floods and adverse weather, though this also seems to have spilt over into a wide range of other food items, including dairy, meat, oils, condiments, cereals and their products including bread. Indeed, there were very few food and beverage items where inflation did not rise.

The good news is that such weather-driven supply shocks tend to come and go, so food prices could pull back next quarter as supplies adjust, though subject to the increasingly important caveat that there are no more adverse weather effects.

Where does this leave the RBA

At their October meeting, the RBA dropped the pace of their tightening to 25bp, hinting that they would prefer to move ahead at a slower pace as they pushed rates into restrictive territory.

Today's inflation data suggest that this moderation may prove short-lived. It is hard to see how the RBA can ignore such an outsized miss on inflation, even though they have been clear in their statements that they didn't think inflation had yet peaked. This inflation data adds pressure on the RBA to revert to a 50bp tightening pace next month. Though if the wage price data out on 16 November remains moderate, they may be able to drop back to a 25bp rate at the December meeting.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap