South Korea: Exports decline on sluggish demand for semiconductor chips

As expected, the exports decline extended through March as global demand for IT weakened, while imports also fell on falling global commodity prices

| -13.6% |

Exports%YoY |

| Higher than expected | |

Exports posted a decline for the sixth consecutive month in March

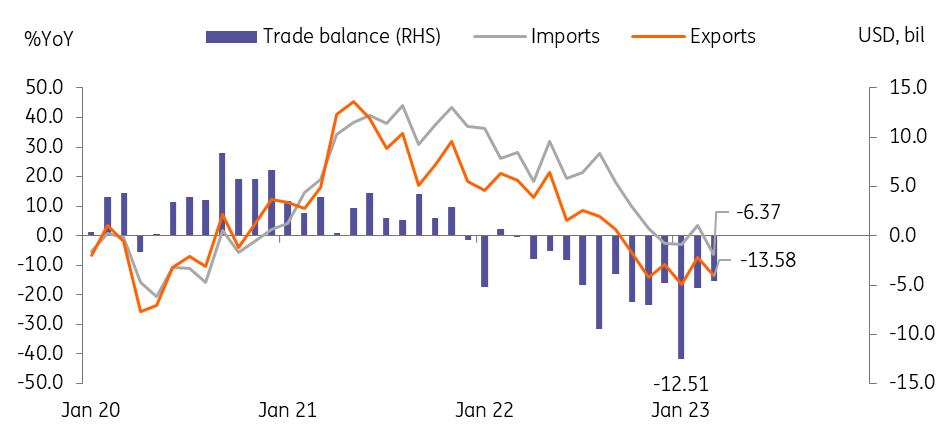

Exports moved down -13.6% year-on-year in March (vs -7.5% in February and -16.0% market consensus). The largest export item, semiconductors, dropped 34.5% in March because prices of memory products, Korea's flagship, are bottoming out, in addition to weak demand for sets such as IT products. Exports of other intermediate goods such as displays (-41.6%), petrochemicals (-25.1%) and steel (-10.7%) were also sluggish, suggesting weak global demand has become more widespread. However, on the other hand, strong export gains continued in auto (64.2%) and batteries (1.0%), mainly due to the improvement in supply chains and new EV/SUV model launches.

Both exports and imports dropped in March

Meanwhile, imports also fell -6.4% YoY in March (vs 3.6% in February and -6.5% market consensus). By item, energy imports (-11.1%) such as crude oil (-6.1%) and gas (-25.0%) declined the most but other major import items such as semiconductors and steel also dropped, meaning that the recent decline in global commodity prices was the main reason for the drop of imports but weak global demand also partly contributed.

As a result, the trade balance posted a deficit of 4.62 billion USD, improving from a record-high deficit of 12.5 billion USD in January. The trade deficit is expected to continue to narrow as the decline in imports is expected to be greater than that of exports going forward, but turning into a surplus is not expected until the end of this year.

Today's data supports our view that sluggish exports are expected to delay the recovery and first quarter 2023 GDP should contract (-0.1% QoQ sa) for the second consecutive quarter.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap